Mutual funds are one of the preferred investment avenues in India now. For the same reasons they are reputed across the globe for, that is the diverse underlying investment securities and the skilled management. Although you might be starting as an investing newcomer, you may be aiming to increase your present asset value. This calls for ample financial understanding, including understanding mutual funds. In this beginner’s guide, we’re gonna travel around the fundamental topics of mutual funds. So be confident and seize the moment – navigate the dynamic investment landscape!

What are Mutual Funds?

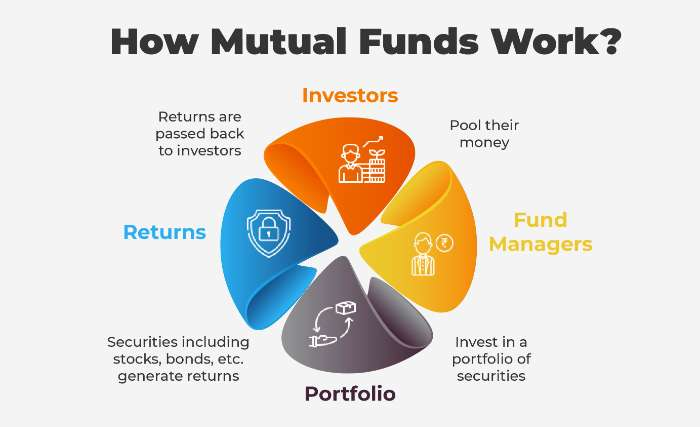

Mutual funds work as a means of gathering money from different people and putting it all in the same basket for diversifying the holdings in a way that would include stocks, bonds, and other investment vehicles. A team that has the knowledge and technical know-how to either manage the pool fund directly or acts as a trustee or guardian is responsible for investments in line with the objectives and the prevailing market conditions.

This integrated strategy not only minimizes the risk to the investors, but also provides them with access to a broad collection of investments empowering them with the ability to manage them directly. Mutual funds distribute their risk among several securities, so investors benefit from potential long-term growth and activities which generate solid income.

Types of Mutual Funds

There are several types of mutual funds tailored to different risk profiles and investment goals:

- Equity Funds: These money resources hold to the point of investments in stocks. Thus, it looks for a capital value that is long-term. They are perfect for investors who are high risk affinity desiring higher benefits that face market disarray.

- Debt Funds: Funds of the debt nature put the money mainly in such financial products as government bonds and corporate debentures. Such funds generally entail a smaller risk than equity funds, and are thus targeted primarily at those seeking stable income who still have a cautious nature.

- Hybrid Funds: Often termed balanced funds, hybrid funds allocate their assets to both equity and debt instruments. With the main goal of reaching an optimal risk to reward balance. These intend to be quite attractive to those savers who seek a moderate level of risk.

- Index Funds: Such shares are called “ETFs” because they replicate the index in multiple stocks and are available at a comparatively low price. They are espoused to just those passive investors interested in replicating index performance.

Advantages of Mutual Funds

Investing in mutual funds offers several advantages:

- Diversification: Mutual funds diversify the portfolio by putting money to work in various assets. This way reduces the chances of poor performance by a single security.

- Professional Management: Investment managers have professional knowledge of market analysis and trading techniques as well as organization of the portfolio of investments. Thus, they can generate profits from investments in line with market trends.

- Liquidity: This flexibility provided by the pooled investments of all fund participants. Whereas in stocks or real estate direct investment usually takes more time to liquidate.

- Affordability: Investors with small money can also have exposure to diversified portfolios. That only previously was exclusive to the people who had large amounts of capital.

How To Invest In Mutual Funds?

To start investing in mutual funds, follow these steps:

- Set Financial Goals: Establish your investment objectives – financial growth, retirement planning or saving for the short term.

- Risk Assessment: Assess your risk appetite to match your asset classes. Depending on your risk attitude, select funds that balance risk with return.

- Choose the Right Fund: Choose mutual funds depending on your investment level, financial goals, and also on your willingness to spend either conservatively or riskily. Are the financial consultants and advisors if you need to do the research or seek for the consultation.

- Open an Account: Establish a mutual fund account which you can set up by yourself. With the company managing the funds or by going to a registered broker like a bank or online platform.

- Invest Regularly: Consequently, dedicated SIP (Systematic Investment Plans) keep you from rupee cost averaging and multiple disciplined purchasing.

Tips for Investing Wisely

1. Diversify Your Portfolio: Have your money invested in different assets classes such as stocks, bonds, real estate, and precious metals among others. As for the asset class, look to diversify the portfolio even further than before by investing in a variety of industries or sectors. The main portfolio risk mitigating intervention is the diversification of your investment that reduces the effect from the bad performance of your single deposit. It has become like having multiple egg holders instead of a single one.

2. Regularly Review Your Investments: Take out time to look at the investments’ performance regularly and make sure that these investments are as far meeting your investment objectives as possible. Putting together a general picture about your portfolio and analysis of it enables you to make the required adjustments, for instance, rebalancing or the reallocation of assets, to have the optimum amount of diversification and stay on track towards accomplishing your targeted objectives.

3. Stay Informed About the Market: Stay updated to market trends, economic indicators, and general news related to your investment in order not to miss out on timely information. Digging deeper into the economy and how it affects different asset class varieties allows you to obtain an informed frame of mind and prevent responding to shifts based on momentary changes.

4. Educate Yourself: By all means, continually enhance your knowledge about investment principles and strategies. Regardless whether by reading a book, using online resources, or seeking professional advice, the financial side of the markets and investment vehicles is bound to improve your execution ability as well as to minimize errors.

5. Maintain a Long-Term Perspective: Withstand the irrational desire to respond impulsively to market instability or swings in the trends. Patience and discipline are the primary keys to success; one must be focused on long-term goals as short-term fluctuations should be not be used as a measure of the success of an investment. You have higher chances of overcoming stock markets ups and downs if you approach this path with commitment to your investment strategy. This increases your likelihood of achieving long-term growth.

6. Manage Your Emotions: Some of the emotions such as fear, greed, panic are irrational hence, they blur the vision and make it hard to make wise investment decisions. Strengthen your emotional hardiness by being level-headed and rational when investing. Maintaining a clear plan in difficult times and not letting yourself be controlled by emotional reactions that might lead you astray is something that will help you stay away from risks. Don’t forget that investing is a race rather than a short-term sprint.

7. Seek Professional Guidance When Needed: Although self-education is important, there might be situations when receiving a professional’s advice, like that of a certified financial planner or an investment advisor, will be a true blessing, as these professionals will give you more personalized guidance based on your circumstances. Be careful of the professionals you are working with and make sure they are reputable, trustworthy and act in your behalf.

One way of going about this is by sticking to the aforementioned strategies and practicing discipline. In doing so, the probability of you making savvy investment choices and reaching your financial goals becomes more high.

Conclusion

Mutual funds provide the most convenient and effective tool for investors. They help you to have a stimulating experience of the financial markets, achieve their set investment goals and move further compared to other investment options. With the knowledge of the investment type, qualities, investment techniques, and taxation policies; a beginner can also be confident on this journey.

Remember that learning, diversifying and staying up-to-date will assist you in making the ideal investment choices. At Loanz360, we help you create a healthy portfolio that will result in a long term performance. You can also check your creditworthiness here. Happy investing!