Startup funding or seed capital is one of the most important driving factors in the start of a company’s expansion. In India, with growing entrepreneurship, venture capital as well as angel investing can ultimately determine a startup’s failure or success. This guide discusses key issues of start up through the lenses of investment knowledge and with insights. Also find strategies that will help an entrepreneur understand the rocky terrain of investments.

What is Startup Funding?

Capitalists provide startup funding to support entrepreneurs when they are starting up their businesses. It is important to cover these important cost aspects of the business, regardless of the form of financing chosen. Such as providing funds for product development, marketing, hiring talent, and scaling operations. The Indian startup scenario has grown greatly in recent years and many of the entrepreneurs of the budding startups have even tasted sweet success.

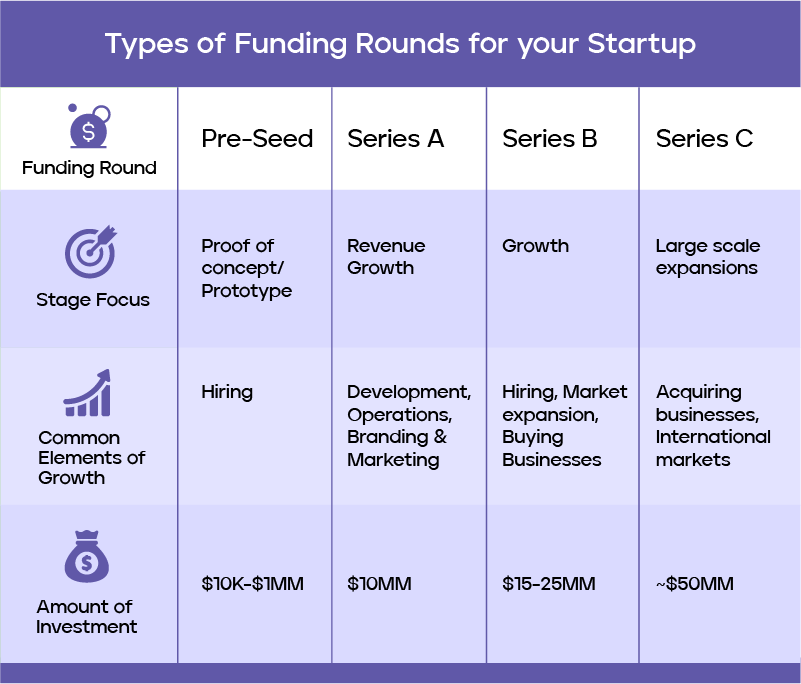

Types of Startup Funding

In India, startup funding primarily seeks from two main sources. Main reputable firms, which operate in this field, and private investors.

Venture Capital

Professional venture capital firms are institutional investors that invest in high-risk startup development and receive shares of these companies as the return on investment. Venture capitalists are usually dedicated towards high-growth-oriented startups. And are considered to be sources of expertise, networks, and resources alongside the capital. Start-ups intending to raise venture capital funds have to show an ability to scale, relatively big market potential, and business plan to attract investors.

Angel Investors

Angels are high-net-worth private stakeholders. They use their own funds to buy into startups on the onset, which may sometimes be a new enterprise. Venture capital investors more generally deal with higher volume and are less directly involved in guiding and development. However, angel investors are more hands-on and may provide a spectrum of services. Such as mentorship and guidance, in addition to funding. Developing friendship with angel investors is a worth-imparting factor for startups. If you are trying to get capital as well as advisory services.

Corporate Venture Capital (CVC):

Corporate venture capital is the name given for a form of venture capital made by established companies as their investment in external startup projects that are strategically relevant. These corporations invest in this startups where they can be able to obtain innovative technology, new markets or just new product/service offerings. CVCs allow startups to work with the collaborations of the parent company’s resources, expertise, and market presence at the same time as it provides the necessary financial backing to grow. Many multinationals and large companies in India that have set up CVC arms look for and invest in startups that perform brilliantly in the sectors like technology, healthcare and e-commerce.

Debt Financing:

Debt financing entails raising of money through issuing debt by banks and alternative lenders. Companies may choose the debt financing option through bank loans, lines of credit, or convertible debt securities to fulfil their working capital needs and to finance specific projects. On the other hand, equity financing, which is giving up shares in the company, enables startups to retain control and ownership but with interest accrued over the time of repayment of borrowed funds. On the contrary, debt financing flagged inherent risk of default in that a startup would be unable to generate enough cash flow to pay interest and principal on its debt.

Crowdfunding

Crowdfunding platforms make it possible for startup funding to choose loans from many individual investors mostly from online campaigns or platforms. Startups present their business ideas or products on crowdfunding platforms and ask for monetary contributions in return for the receipt of rewards, pre-orders, or shares of equity stakes. Crowdfunding provides startups with an opportunity to validate the ideas, generate early customer interest, and gain access to capital without giving away the shares or borrowing the money. In India, firms like Ketto, Wishberry and ImpactGuru host crowdfunding campaigns for startups, social enterprises and creative projects on their platforms.

Navigating the Funding Process

The crowdfunding for a startup in India taken into consideration is a meticulous work since it involves a well-thought strategy and careful execution. Here are key steps to consider:

- Prepare a Solid Business Plan: Create a business plan that articulates your startup mission. It should also identify market opportunity, strong value-proposition, and financial project. This is the main ingredient to getting investors behind your business.

- Identify Potential Investors: Carry out research and specify Venture Capitalists and Angel Investors. Those whose spectrum of interests correlating the industry, growth stage and funding needs yours.

- Pitch Your Startup: Your business can have a decently organized pitch deck that covers the main points of your business. For example, your startup’s value proposition, your followers, staff’s level of expertise, and business growth potential. If you want to force a specific investor to pay for your project, it is your task to customize the pitch to every investor’s personal interests and priorities.

- Negotiate Terms: Conversely, investors can express interest and then negotiate on funding terms, equity ownership, valuation, and investor rights to get a fair but mutually beneficial partnership.

- Close the Deal: After signing the terms let go for document finalization, such as term sheet, investment agreement and closing the round of funding.

Challenges and Opportunities

Startups in India consider initial funding as a significant opportunity for growth and innovation. However, entrepreneurs also face serious hurdles such as intense competition and difficulties in understanding changeable market dynamics due to regulations. Nevertheless, government projects, startup-specialized services, and other entities continue to enhance the essence of the Indian startup system.

Discovering the Indian startup world, the optimistic moments can be mixed with the rough ones.

Opportunities:

Initial Funding: Securing startup funding is a key milestone for businesses to scaffold growth and engagement.

Government Initiatives: Initiatives like the Startup India program constitute funds, mentorship, and regulatory support that lead to an improved form of environment for startups.

Startup Ecosystem: Support and networking services that are specialized for startups like co-working spaces and accelerators emerge to avail young business owners such benefits.

Collaborations: A joint venture with an established company increases the startup’s chances of success by giving it access to resources, expertise and large markets.

Investor Interest: The growing involvement of VCs and angel investors indicates risk-taking willingness. This is an obvious sign of the promising startups support.

Challenges:

Intense Competition: Within blazing sectors of “to eat or not to eat”, startups need to differentiate themselves from the rat race and strive for the survival of the fittest approach.

Market Dynamics: The range of fast changing market dynamics, frequently affected by regulatory factors requires agility and responsiveness from entrepreneurs.

Regulatory Hurdles: Complex legal procedures may be very difficult to get the hang of, and founders will have to spend their time and money in order to make sure the company is compliant with the law.

Resource Constraints: Lack of availability to talented people and infrastructure stands in the way of companies’ expansion and development.

Scaling Issues: The perennial battle to scale their operation while dealing with challenges is the utmost difficulty many startups in India face.

Conclusion

To sum up, the role of finance cannot be overlooked in case of reinforcing the success of business launches in fast changing economics of India. To understand how venture capital and angel investors work, startups can seek readily available expertise and networks. So that they can acquire the fuel needed for growth and the achievement of their entrepreneurial vision. Through a well thought out strategic planning, fundraising and pitching, coupled with resilience, Indian startups can succeed. That is they are able to sail through the funding journey and realize the full niche of their own potential. Contact Loanz360 today for more information.