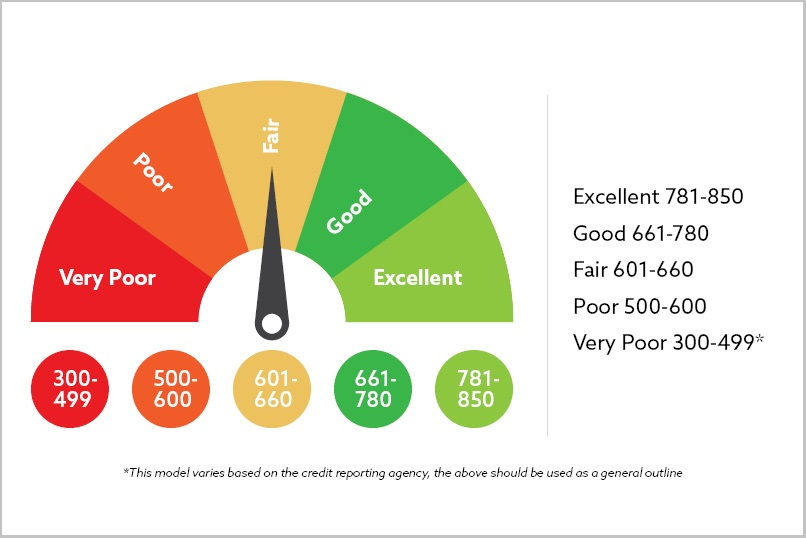

A credit score comes up as a significant factor in our financial life. They determine whether we get capital for our loans or credit cards and even whether we can get a rental house or not. The CIBIL score in India is one of the most prominent metrics for financial institution’s estimation of the borrower’s credit quality. This is what implies that to gain access to the profitable financial opportunities one should keep the most of the positive credit record possible. The ability to stay more steady financially can cause problems as well.