Introduction

A mortgage loan, also known as loan against property is a popular type of loan among several investors. While investors have several reasons why they might want to take out a mortgage loan instead of a home loan, with a budget in mind, the process becomes easier. Mortgage prequalification and mortgage pre approval provide the necessary support to avail of added benefits when serious about purchasing a home. But first to know the terms involved the homebuyers should know the difference between a home loan and a mortgage loan. Therefore, this blog.

In this blog, we will teach you everything you should know about mortgage loans; from preapprovals to their process.

Home Loan vs Mortgage Loan

While both loans aim at larger expenses and are secured assets, there are several visible differences and end-purpose variations between both the loan types.

Purpose of the loan

A home loan is a type of loan taken out by homebuyers to build or construct a new house or a move-in property. On the other hand, a mortgage loan has no end-use restrictions on the amount borrowed and can be used to meet both personal and business requirements. This type of loan is typically taken out against an already owned property.

Loan To Value (LTV)

LTV ratios for both loans may differ from lender to lender. However, home loans offer a higher LTV ratio of 90% property market value compared to mortgage loans with up to 80%.

Interest & Repayment

Interest rates and repayment tenors for both types of loans are also independent of each with home loans having better interest rates and flexible tenors of up to 30 years and mortgage loans of up to 15 to 20 years.

Top-up Facility

Top-up loan varieties and flexibility over mortgage loans are relatively higher than home loans.

Tax Benefits

There are several tax benefits to a home loan, offered under section 80C, section 80EE, section 80EEA, section 24, etc. However, mortgage loan tax exemptions are limited and highly dependent on the end use of the loan. On a general-purpose mortgage loan, there are no tax benefits, but if the loan obtained is used for business expenditure, the investor can claim benefits under section 37(1) ITA. Similarly, if the investor borrowed the funds to finance or purchase a house property, he may avail of benefits under section 24(b) on the interest repaid, unlike home loans that can also claim on principal repayment.

What Is Mortgage Prequalification?

Mortgage prequalification and mortgage preapproval are not interchangeable terms, since they both serve different meanings and purposes. Mortgage prequalification is when the investor gains an estimate for the amount he can borrow from the lender based on his creditworthiness, employment stability, income, debt, and bank account information.

This is the process typically done before preapproval is obtained by the borrower. This can be carried out by the investor himself, online, for free; with the help of several tools online.

What Is Mortgage Pre Approval?

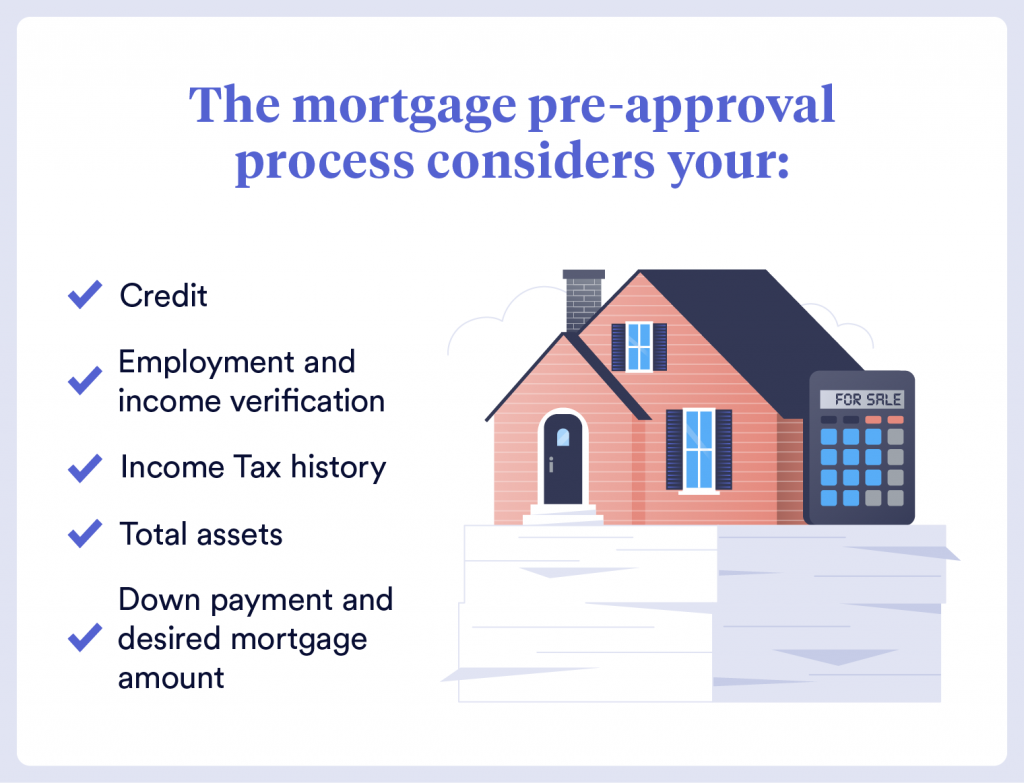

As discussed, preapprovals on the other hand come from a financier or creditor who has analyzed the finances carefully against their policies to give a detailed chart on your borrowal limits and interest rates. Therefore, the process may go something like this.

First, you look for a property or an open house you are interested in, discuss it with your lender on how much budget you are looking forward to being funded, and apply for a preapproval. Then the lender will check your prequalification for the loan based on the deciding factors of the loan, such as your past credit or bank information and repayment capabilities. Once you have passed this stage, the lender will then preapprove the loan before you find a home.

This preapproved loan can be used on the home or property as you have discussed before or can be used differently if you may wish to do so after availing of the loan. However, you should discuss this with your lender and inform them of the changes before asking for more funds depending on your new estimates.

Mortgage Pre Approval Letter

The process is not straightforward, however, not complicated. Most homebuyers go for preapprovals, therefore, consult with the lender to obtain the contract. This means when you are sure that you want a preapproved loan, then the lender will ask you to provide the basic information with which he will perform a hard pull of your financial history.

Hard pull or hard credit pull is when the lender performs a background check on the past credit and bank records of the investor to obtain proof of his repayment capabilities. When done, the hard pull may cost 5 points or less from credit scores, therefore, should not be done frequently with multiple lenders. However, on the upside, you will know if you have any misinterpreted information or red flags on your credit resume with this process. Further is done only when the investor is sure about getting the loan with that lender after he has already checked his prequalifications.

But note that this is nothing to be stressed about since FICO recommends our investors worry about obtaining hard pulls from multiple lenders to get their hard pulls done within a 30-day-window-period since the credit bureaus will consider the hard pulls done in this period as a single hard pull. Knowing this, once the investor obtains the preapproval letter on his loan, setting the budget and hunting for a property will be plain sailing.

Why Should You Get Mortgage Pre Approval?

We all know that when we teach ourselves, kids, siblings, friends, or anyone the rules for saving money, we first tell them to set a monthly budget on their spending habits and spend accordingly. The same words with mortgage preapprovals. Preapprovals will help you save serious cash on your house hunt. Property or assets are tricky to acquire, with larger funding going into several aspects of the construction or purchase process. Therefore, the investor may get confused about where he can or he cannot spend the money thus spending a whole lot without even realizing it.

To save investors the burden of overspending, preapprovals allow them to set a budget for their project, which often can be expanded later in time. Therefore, if you are looking forward to saving burden and cash when you are hunting for a home in real-time, the budget will help you find a desirable home without worrying about breaking the bank.

Final Word

What do you think about mortgage pre approval? Do you think taking a home loan or mortgage loan will benefit your end-use, if so if you haven’t already made a choice, it will be easier now with the extra knowledge you have just gained.

If you are still not sure how, give us a call at Loanz360 and get pre approved for a mortgage by scheduling a meeting with our representative, who will take you through the process of buying and financing a loan, along with comparing the market rates and finding the best option that fits your dream in your pocket. We are partnered with leading financial banks and NBFCs, such as, HDFC, IDBI, ICICI, SBI, Kotak, and more with interest rates as low as 7.25%! Check out our services now!