Introduction

Starting up, running, and maintaining a business, in the long run, requires a lot of effort. You may need to infuse capital every time you take a step forward in your business, regardless of its size. Arranging for the necessary working capital could be a financial strain, particularly if your company is bootstrapped and not externally funded. Therefore, if you’re looking to benefit without giving up any control of your profit funds, then a loan is the way to go. You can keep the profits for yourself while still paying the interest on the loan and clearing any debts.

In this blog, we will look at the mistakes you should avoid when applying for a business loan. This will further help you to make sound choices without hurting your credit.

What Is A Business Loan?

No matter if you are starting a business or expanding a business, there is a large amount of funding that goes into making one successful. To pay off the debts, hire a team, purchase inventory, or even gather resources, one needs to be comfortable in meeting the capital requirements of the business as long as they are aiming to achieve prosperity.

This is where banks offer a wide variety of deals to business enthusiasts to bring their venture with the help of financing. Loanz360 is one such place bringing together several bankers, NFBCs, and private financiers together to display their schemes at competitive interest rates against all kinds of property.

Avoid These 8 Mistakes While Applying For a Business Loan

You have a concrete business plan, a strong ownership foundation, and a detailed background as any business should, but now you are planning to put the plan into motion with funds. This is how every business funding for startups story starts or runs to maintain its market presence successfully. So, let us look into those common mistakes you should avoid while getting a business loan:

Falsifying Financial Data

Misinterpretation or falsifying financial data or information can put you at a legal disadvantage. Either your application will be rejected as the procedure unfolds or is caught later on by the lender who will want to take this to court for the manipulation of monetary or fiscal numbers. Either Way, discussing with your lender about your actual financial situation is better because many will want to opt for a transparent relationship with their customer to help them out in ways they can.

If you’ve ever had any issues with loans, bankruptcy, or regulatory bodies in the past, make sure to let your lender know. Although you may be trying to hide your past red flags from lenders, most have a strong structure in place for checking your borrowing history. In these cases, the lender may apply greater scrutiny to your application and charge a higher interest rate to offset your higher risk varying from bank to bank; if not rejected.

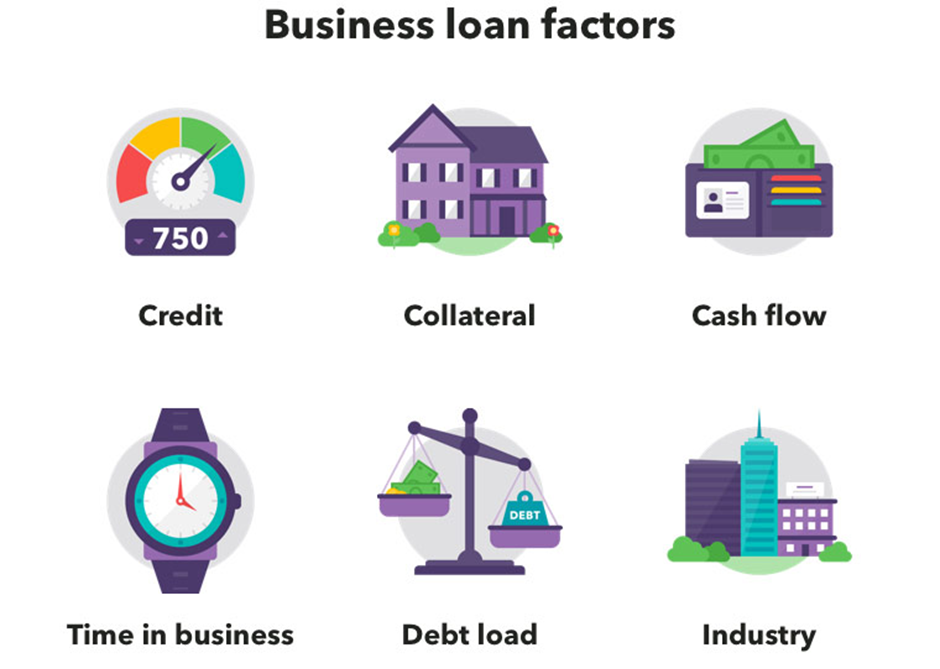

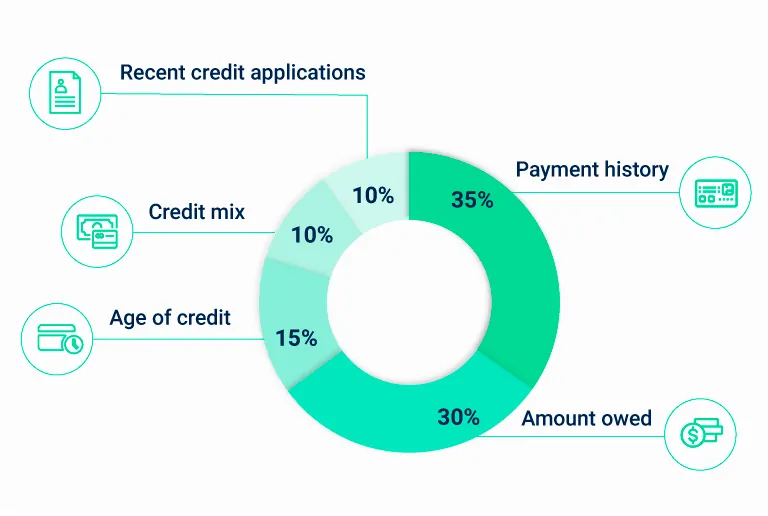

Low Credit Rating

Low credit ratings are usually not a problem. Many lenders are willing to work with individuals with poor credit with alternative deals such as asking for collateral, guarantor, etc. However, a low credit rating will put you at a disadvantage in dealing with higher interest rates on loans. A good credit score usually ranging from 750 or above will benefit you from negotiating deals with your lender at better terms.

Building a credit history is easy! To build a healthy credit rating, you can take out a credit card with no annual fee and use it carefully for your expenses. Remember to make your payments on time and in full to maintain your credit history and keep your credit score high. Therefore, if you want to get a business loan with suitable terms, an individual needs to have a clean credit history. This will show lenders that you’re a responsible borrower and help you get better terms on your business loan.

Unregistered Business And Inadequate Documents

It is a no-shocker that lenders will want to work with customers who are trustworthy in submitting appropriate documents and repaying their loans in time. However, lenders will find it shady if the individual has an unregistered business for which he/she wants a loan. This will put off a lender from considering your loan together or you at several credit facility disadvantages with the lender.

Formally registering the business with the relevant authorities is a must whether or not you are taking a business loan. A registered business is likely to enhance identity, avoid liabilities, and manage the owner’s reputation in the market. Therefore, if you have an unregistered business, you should take an action to register your business legally to win over clients and improve the legal dealings of the entity.

Similarly, get all the appropriate documents ready for the business to submit while taking out a business loan. These documents will help the lender to gain trust over you to lend a good deal of amount with lower interest rates.

Choosing The Wrong Lender/Loan

There is no RIGHT lender. However, with several lenders growing every day in the market, making infinite promises to/her customer, it is almost not easy to make the RIGHT choice. But, with the appropriate help and research, the borrower may avail of his business loan at the best prices in the market within his limitations.

Suppose, the borrower who may not have collateral may benefit from finding a lender who may not require collateral and will also have a lower interest rate if the funding amount is not high. Likewise, the borrower is not limited to banks. They may avail of a loan for business without security with credit unions, NBFCs, or a private financier under certain conditions, and may get better deals on their requirements at any of these lots.

There it is not only important for a borrower to choose the RIGHT lender but the RIGHT loan. Depending on his requirement, the borrower may choose a loan for the right loan product such as a machinery loan, working capital loan, loan for women, etc.

To achieve your financial goals while taking out a business loan, you must consult a professional before making any decisions – your friends and family may mean well, but they may not be aware of your specific goals and needs.

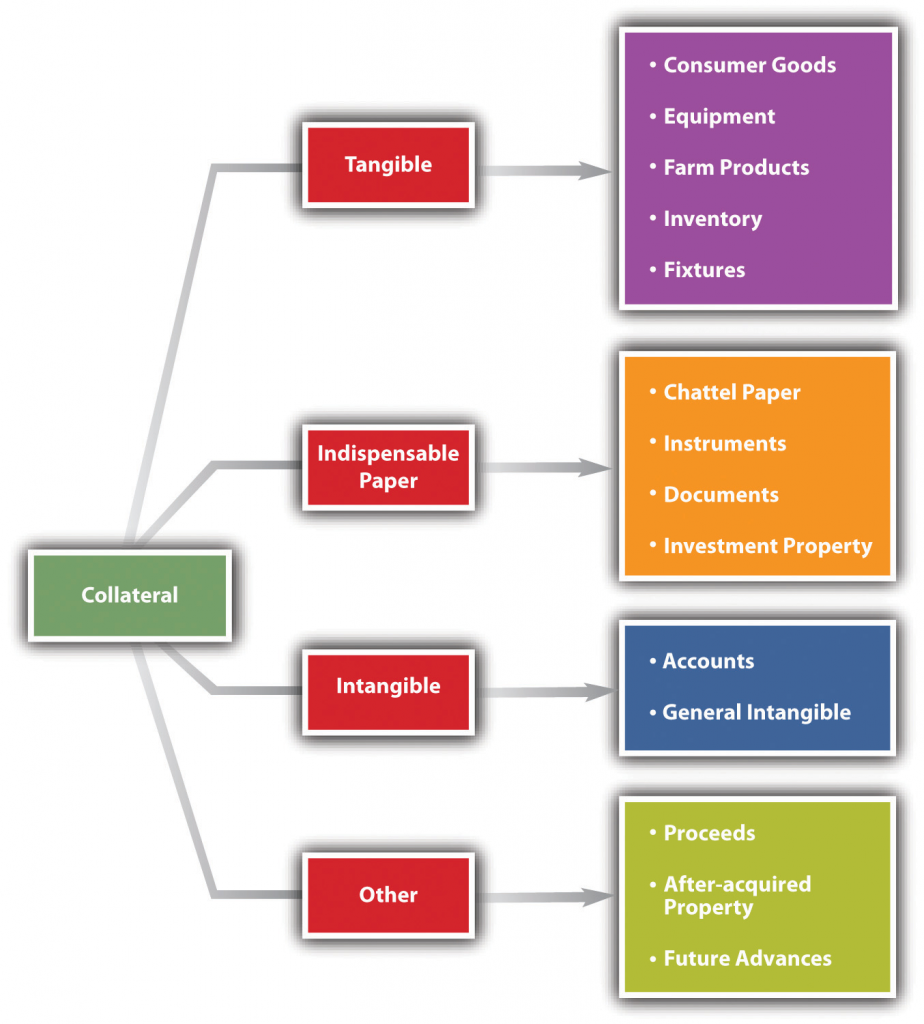

Unable To Provide A Collateral

The need for collateral depends on the requested funding amount. Most banks will need collateral or security for larger funds to be able to trust the borrower. Therefore, while deciding to apply a loan for business without security, it is important to discuss with your lender about their bank policy. If you do not have collateral, weigh your options with different lenders and seek out the best financier that will be able to help you with your requirements at your comfort.

A convenient lender however is not someone who will say yes to your requirements. Check with their interest rates, fees, penalties, clauses, and market trust to bet your reliance on the financier.

Rushing The Paperwork/Ignoring The Fine Print

Application process if one of the important procedures for your loan to get sanctioned. While providing appropriate documents is important, you should not rush the paperwork when there is money and your time to repay the money involved. Take time to read the documents before you sign an agreement with the lender. Check with the terms and conditions of the lender and ask them the appropriate questions you have on their policies. This way you can make sure that you are not being scammed with lower interest rates and higher fees in the future.

Refinancing is always an option if you are not satisfied with the terms of your existing financier, however, be careful to read everything and know your rights before signing the deal. Contact a professional if you are unable to understand the jargon, a third-party dealer or an expert financier who is not affiliated with the credit borrower will bring you the required research and knowledge on the loan process with a very minimal fee.

Loan Stacking

Applying for multiple business loans may seem like a better idea to steer clear of existing debts. However, the more loans you have to clear, the more the burden you will be shouldering to repay the loans on time. And the more the burden, the harder it is to maintain a good credit history or clear your debts on time.

Therefore, having to take out one loan to repay other loans can make it difficult to keep up with payments, and can ultimately lead to financial difficulties. However, you might want to consider business debt refinancing. It’s basically when you get a new loan to replace an existing one because the new financier is offering better terms on the loan compared to your previous conditions. This can help lower your monthly payments without adding to your overall loan list.

Avoid Negative Cash Flow

Businesses aim to make profits and reinvest a portion of those profits back into the company for growth initiatives such as purchasing equipment and inventory, hiring additional staff, etc. It’s important to maintain a healthy balance between the money being pumped into the business and the revenue it generates.

If expenses exceed revenue, it indicates negative cash flow, which is not favorable to lenders. The impression that you are more likely to default on the loan repayment may deter some lenders from approving your loan. Be aware that applying a loan for business without security when your business is not doing well can send the wrong message to lenders, who may see you as more likely to default on repayment. Only apply for a loan when your business funding for startups is healthy and has a strong cash flow.

Final Word

As you can see, these are some of the most common mistakes that individuals applying for a business loan tend to make. Avoiding these mistakes can significantly increase the chances of your loan getting approved. When considering taking out a business loan, always use an EMI calculator to determine your monthly repayments. This way, you can budget effectively and make informed decisions.

If you are looking for business funding for startups and are still not sure how, give us a call at Loanz360 and schedule a meeting with our representative, who will take you through the process of buying and financing a business loan, along with comparing the market rates and finding the best option that fits your monthly budgets without breaking a sweat.

Find a loan for business without security at Loanz360 with our best financial partners (HDFC, Kotak, SBI, ICICI, and more!). Get a free consultation today.