Introduction

If you have been seeking a loan and do not know which option is better for your financial luck, you just might be at the right place. With emerging loan options, though conventional, personal loans are still popular among borrowers, and might even be the favorite option among many. This is largely because most people who acquire a loan on a regular basis are looking to fund their personal needs rather than emergency requirements.

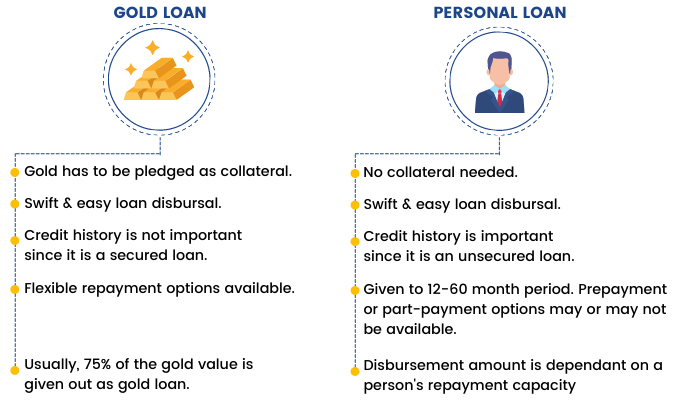

Therefore, personal loans are considered to be one of the most affordable and easy options for both lenders and borrowers alike, more convenient to borrowers as there is only less funding requirement religiously with zero collateral options. However, everything aside, why gold loans?

Though gold loans are a branch of personal loans, they are still a loan against security, popularly deposited in the form of gold, jewelry, or coins. So, there is still a risk of losing your asset, if you default on the loan. However, you are not at any greater advantage with personal loans or loans without collateral, you still might be at risk of court trial if you do not meet the contractual requirements or default on the loan. Therefore, the loss might be more of an emotional than physical damage.

In this blog, let us see why gold loans are better than personal loans. Does it depend on your requirement or any other parameters, and if so, which? Keep reading to know more.

Interest Rates

Interest rates on gold loans are preferential and will largely depend on the type of gold pledged and its purity. On the other hand, though personal loan interest rates are not relatively higher and will depend on the creditworthiness of the borrowers, there is little to no negotiation on the loan amount and interest rates. Therefore, you are at a higher benefit on a gold loan with attractive interest rates depending on the loan tenor and LTV ratios.

Since the nature of the loan is largely short-term and emergency funding, usually the loan is easier considered the short tenor, usually ranging from 3 to 12 months. You can still extend your tenor, but it will depend on the lender and their policy, therefore it is advisable to discuss your options with the lender before signing the contract.

Loan Amount

Loan amounts on gold loans are higher than personal loans depending on the quantity of the gold provided. The higher the gold, the higher the loans sanctioned. Though on a personal loan you are not pledging any collateral, you might be requested for one if you are taking a loan of higher value. However, in such a case, both the scenarios are alike and will require collateral of higher value to sanction the loan. However, the benefit of the gold loan is when your asset is safeguarded under high-security surveillance and can be obtained up to 75% of the market value easily without income or employment-related proof documents required.

Flexible Repayment Options

Personal loans have largely limited to EMI and Flexi repayment options. On the bright side, gold loans have larger options, based on the lender’s terms and conditions. The borrower may visit the bank and pay in cash his EMIs, make payment on the bank website(credit/debit/fund transfer), submit DD(demand draft), or present in cheques. Moreover, Overdrafts, balloon payments, and term loans are available options.

Widely applied gold loans are for their balloon payment options. That is, the borrower can repay relatively smaller amounts during the course of the loan term and by a large amount at the end of the term, i.e maturity of the balloon loan. Therefore, if you are tight with funds, this type of option is feasible for you to make convenient payments at the beginning at full interest at the end of the loan term when you have ample funds.

Processing Time

Processing time for gold loans is lower than on personal loans since gold loans are paperless and can be processed online with doorstep evaluation services available. Also, the documentation evaluation on the gold loan is minimal compared to a personal loan, therefore is processed instantly within a few minutes to hours of the application.

Loan Tenor

Personal loans can be acquired for a variety of tenures, however, borrowers on gold loans know that the funds are either for emergency or an urgent capital requirement. Therefore they know that gold is a highly short-term to mid-term loan which can be repaid faster thus resulting in lower interest rates over the course of the loan. Personal loan on the other hand has long-term loans that might vary in interest rates with market fluctuations. Therefore the longer the loan tenor, the higher the interest on the loan the borrower will be paying.

Extra Fees

Prepayment, foreclosure, and processing charges on gold loans have low to no fees compared to personal loans. Though these charges are not higher and are usually between 1% to 2% depending on the bank or the financier, it is still a burden to those who are already spending a good amount of money on interest rates and other minimal fees. Therefore skipping these fees or charges might be the cherry on the top for those who are looking to lessen their loan burden even if by little.

Credit History Evaluation

Most banks and lenders will not evaluate your credit score, this means there is a loan, unbiased and exact, for all profiles, depending only on the type of gold deposited, and its purity. Whether you have a low credit score and are struggling to get a loan with decent interest rates with banks or NBFCs, this is not the case with gold loans.

Therefore, if you have gold readily available, it can bring you best deals on your loan with negligible fees or charges. It is a win-win situation for you as you can easily raise funds on your inactive gold and also keep it secure (think of it as your safe locker with high-security surveillance) until the loan is repaid in full.

Documentation

As discussed earlier, lenders do not look for income proof or credit score. And since we have eliminated the requirement of two main processes that may take time, we are at an advantage of availing a loan quicker than a personal loan. Therefore, for instant approvals, faster processing, emergency funding, and secure evaluations, you can opt for a gold loan rather than personal loan depending on your tenor and flexibility.

Summary

Final Word

Personal loans though a popular and convenient option, gold loans are highly beneficial if you have gold readily available to deposit. This option will get you secure and better deals. Therefore, rather than keeping your gold idle or inactive in a locker that hasn’t been dusted for a while, you can do it readily for the reasons above and more.

Loanz360 is such a store for all-inclusive financial solutions, from management to protection of assets, we provide all financial services to our local and international customers alike. Apply for loan at Loanz360.

We are partnered with leading financial banks and NBFCs, such as, HDFC, IDBI, Manapurram, Muthoot, Shiriram, PNB, and more with interest rates as low as 9.25%! Check out our services now!

If you are still not sure how, give us a call at Loanz360 and schedule a meeting with our representative, who will take you through the process of buying and financing a loan, along with comparing the market rates and finding the best deals that fit your pocket with discounted offers and flexible services.