Introduction

There are several reasons why you might want to take out a personal loan for yourself. Whether you are facing a financial crunch or are looking forward to finding a loan to fund your perfect vacation, personal loans come in handy to cater benefits to all personal financial needs of an individual. However, there are some personal loan features that make these personal loans less a burden, and more a profit. If you are a smart investor looking to pay off your debts wisely, using tricks and tips to make your move will help you win a card on your loan.

Even if you are in an emergency to apply for a personal loan, take three minutes out of your busy schedule to avoid a lifetime burden on loans in the future with a haste decision that might pile up more unexpected expenses over your existing debts. While choosing the right lender for any loan is the first and most crucial factor in the borrowal market, it can be challenging with thousands of lenders in the market competing against each other, each with lucrative deals to offer.

9 personal loan features to look for to make your personal loans attractive and affordable

Personal Loan Features # Zero Fee

Zero or low fee facility is when the lender or the lender company offers you deals on the processing fee, foreclosure, prepayments, part payments, etc. Often these are followed by other parts of the agreement where you will be charged more otherwise with the fee. Therefore zero fees should not automatically be celebrated without reading the other clauses of the agreement where these fees might have been compensated with hidden costs.

Discuss your options with the lender, recheck the terms and agreement documents, and ask them about the consequences, risks, and challenges of your loan agreement. Doing so will mean that you have addressed your rights thoroughly and are educated on your benefits and the policies of the bank or the organization associated with the contract.

Personal Loan Features # Fewer Documents

Minimal paperwork or fewer documents is an added advantage in trusting your lender. Your lender does not require all your documents to process the loan. Submitting identity, address, and income proof will do the work. As long as the documentation process is not tiring you and your energy in circling the lender will mean that your time and resources lost are minimal at the benefit of obtaining a loan quicker and easier.

Moreover, as most banks have moved their services online, the online application process will solve several financial crunches sooner than expected. This process is usually processed within a few minutes to hours of applying for the loan, and you can even save time by avoiding moving from bank to bank, offline. Instant approvals and pre-approvals will also make your process easier and hassle-free.

Personal Loan Features # EMIs

There are several tools online to calculate your EMIs before applying for a loan. This will ensure to map out your budget before even signing the contract. Appointing a financial expert who has the equipment to find the best deal in the market will make this process faster. However, if you have the fundamental knowledge on the subject, you can do the market analysis yourself and check a few banks or NBFCs that you think are the right option for your loan, and calculate the EMIs on their market interest rates to forecast your expenses.

Once you have figured out the EMI you have to pay every month, the process is made simple with the knowledge of your repayment capacity. This will help you set the tenure on the loan wisely if you would want to set a long-term repayment tenure with the probability of making part payments when the funds permit or a short-term tenure to avoid racking interest rates.

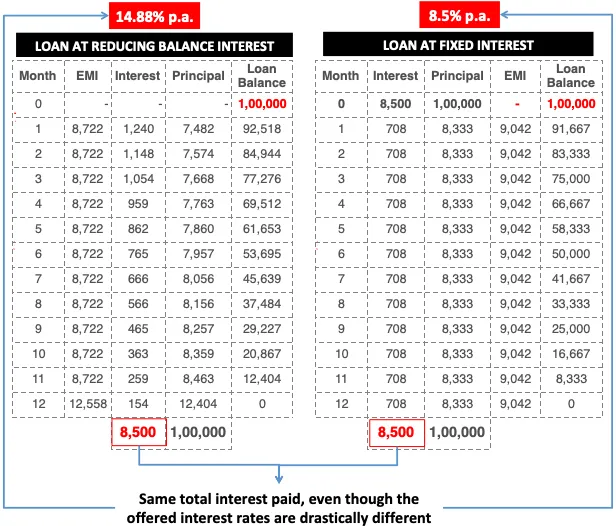

Personal Loan Features # Interest Rate Method

Flat rate interest and diminishing rate interest are two methods that lenders use to calculate your interest on the loan. While flat rate interest will define your interest rate with respect to the principal amount, diminishing rate interest depends on the outstanding balance of your loan, i.e the interest decreases with the loan and is naturally preferable over the flat rate interest.

You can ask your lender before applying for the loan which method they use for the interest rate and save up more money on your loan by making an informed decision. Also deciding whether you should go for a fixed or floating interest is beneficial before signing the contract since it will depend on your requirement and finances at the moment. Most individuals however prefer a floating interest rate on the loan with the probability of interest rates decreasing over the period, compared to fixed loans, that start high and are consistent throughout the tenure of the loan without a probability of reducing interest, even with the market conditions.

Personal Loan Features # Flexi Loan Facility

Term loan and Flexi loan are 2 types of loans that you can avail of on any loan type. Term loan as we know is when the lenders offer the loan for a fixed term over which you will repay the loan with interest on the principal amount sanctioned. On the other hand, a Flexi loan, also known as a flexible loan, is an overdraft method in which the individual is offered a limit, and he can use ANY amount on the limit, and only repay for the amount utilized rather than the amount obtained. This is useful especially when the individual does not know how much money he would require for the event of his need.

In such cases, the Flexi loan option will allow you to use up funds generously. Even if you have only used a quarter of the amount sanctioned, you will be only paying for that quarter than the whole. Opting for a loan that is flexible is definitely beneficial in cases such as weddings, vacations, medical purposes, etc, so that the person can have a cash reserve without worrying about exhausting funds obtained.

Personal Loan Features # Collateral

Collateral or security is another aspect of the loan. Most personal loans are short-term loans and loans that do not require higher funding. In such cases, remember that you will not be required to submit collateral for the loan. However, this will depend on your credit score and other factors of your employment and financial status. However, looking for a loan with lower interest rates even without submitting collateral is advisable, if you would want to keep your assets remain on the safe side of the spectrum.

This is a sure hit if you do not have any assets to spare. However, not everyone who takes out a secured loan loses their assets until they have been warned multiple times or have defaulted on their loan. But, one should know that there is no pressure or demand on submitting collateral when they have qualified for the loan and have met the eligibility set by the lender.

Personal Loan Features # Tax Benefits

Check out the tax benefits on your personal loan to make the most of your investment. However, the tax benefits will depend on the end-use of your loan when you have submitted adequate documentation to show the designated authorities the utilization of the funds. This feature though is not controllable depending on the end use of the individual, it can be of benefit when informed.

Personal Loan Features # Customized Loan Benefits

Applicants have different purposes and different economic backgrounds, therefore different requirements and benefits on the loan. Free size or one-fits-all is not applicable to personal loans. Whether you are using the loan for a wedding, debt consolidation, home improvement, medical emergency, or you are a doctor or CA by profession, or even a woman, you have different benefits on your loan, each customized to the purpose of the loan. Though you do not have any end-use restrictions on the loan, discussing your benefits will get you a better loan with better deals, rather than being just one of many.

These are also called special loans and are tailor-made to your purpose. Therefore explaining your situation might get you the deals you wouldn’t have gotten otherwise.

Personal Loan Features # Penalties & Hidden Costs

This is one of the most important features of your loan. Penalties are not fully dismissible considering that the penalties on the loan will depend on your repayment habits. Although they are not totally avoidable, they will also depend on your credit history and relationship with the lender. Therefore choosing a lender who you have made a good relationship with or a lender who you can share a mutual trust with is important. This will ensure you that the lender is not immediately threatened by your missed EMIs and is willing to get in touch with you first to hear out your story and decide the aftermath.

On the other hand, hidden costs should also be a criterion when looking for a loan. Hidden costs are something you are not informed about. Most of us who do not have knowledge on the subject can often end up paying more than we should due to these hidden costs.

But asking your lender when the interest rates have increased, discussing options, or even reconsidering when you cannot get into a mutual agreement is advisable. If you are facing higher interest rates on your loan even when you have qualified and are eligible for the loan, you should definitely reach out to your lender and ask them to refinance your loan, if not prepare for a balance transfer for a better deal.

Advice #1

Most borrowers or applicants might not know about certified marketplace services that help them get loans with the best deals and offers. Similar to real estate agents or brokers who help get the best deals on commercial spaces, these third-party marketplaces help customers to get benefits on their loans with their in-house financial partners by pulling strings and benefiting from connections. However, unlike brokers or agents, these are not costly or tiring affairs. You will get research-backed-up information on the lenders and unbiased advice to help make an informed decision.

Appointing a financial expert will save you more in the long run if you are not sure where to start, this is a better place to start.

Final Word

Knowing personal loan features can only take you so far. If you are looking for capital assistance and need help, contact Loanz360 to get the loan at the best prices and deals instantly. Check out the eligibility criteria and documents required in the services section under a personal loan.

Your loan need not be a burden with Loanz360. Loanz360 is such a third-party supermarket for all-inclusive financial solutions, from management to protection of assets, we provide all financial services to our local and international customers alike with the help of our in-house financial partners.

If you are still not sure how, give us a call at Loanz360 and schedule a meeting with our representative, who will take you through the process of buying and financing a loan, along with comparing the market rates and finding the best deals that fit your pocket with discounted offers and flexible services.