Introduction

A personal loan is a type of loan that can be used for varied purposes, from closing debts to taking a vacation. One of the widely used loan types has a preferential rate of interest depending on the terms of the lender and your negotiating skills. Therefore, anyone planning to get an instant personal loan online or offers on their personal loan interest rates should first know the terms involved and the tricks that help them to get better deals and offers from potential lenders.

The process is not as straightforward as it seems, while you might be profiting under certain conditions, you still might be tied to leverage to compensate for the losses with another clause added. However, knowing beforehand the parlor tricks can ensure you greater success at getting the deals you want and also might create a good rapport and relationship with your lender for your future endeavors.

Factors Influencing Personal Loan Interest Rates

Lender Type & Reputation

Lender reputation in the market is one of the most important aspects of the personal loan where the basic parameters of the personal loan or eligibility parameters of the loan highly focus on the borrower’s repayment history, source of income, employment stability, and other aspects of the loan including personal loan amount, subtype, and LTV ratio will depend on the type of lender or the financier itself.

That being said, there are clear differences in how banks and NBFCs operate, and their flexibility regarding these terms. While banks are good with stable income employers, to lend a personal loan with low interest, NBFCs on the other hand look for a different structure in their borrowers, since most of the borrowers that apply for a personal loan to an NBFC are either low credit scores or loaners looking for flexibility on proof submissions.

That is when these are the generic parameters any loan financier will look for when supplying capital reserves to the applicants.

For suppose, a credit score between 650 to 750 is considered satisfactory and is likely to bring more offers to the table without any added efforts on the borrower’s end. Likewise, an applicant with a clean repayment record and no existing debts will be at an advantage compared to another applicant who has several outstanding debts or had in the recent past.

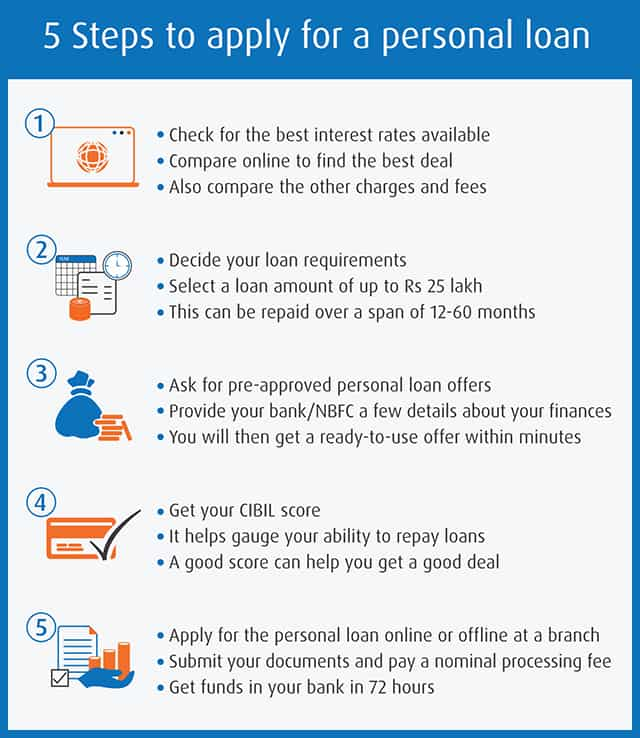

On the other hand, loan type, which includes the end user will more likely affect the processing time than the interest rates themselves. For suppose, if you are applying for the loan for personal purposes, it is not mandatory to disclose your reason for the loan, however, in some cases, the applicant might be in a hurry or an emergency to get the personal loan approved, therefore can mention his reason for emergency funds and get the personal loan in a faster fashion than following up with the lengthier process.

Similarly, with higher LTV, the process gets a bit complex, since higher LTV attracts longer tenures, and thus market fluctuations. However, these will largely depend on the capacity of the applicant since they would be having prepayment, foreclosure, or other options where the borrower can close the personal loan when they have accumulated sufficient funds thus reducing their interest burden.

Therefore it is essential to research the lender and their lending history to make informed decisions on their authenticity and credibility along with the lender that will best suit your needs. Finally, discuss with your lender their processing, prepayment, or foreclosure terms beforehand, and choose a lender with a low or no fee policy, thus ensuring a neat way out.

DTI Ratio

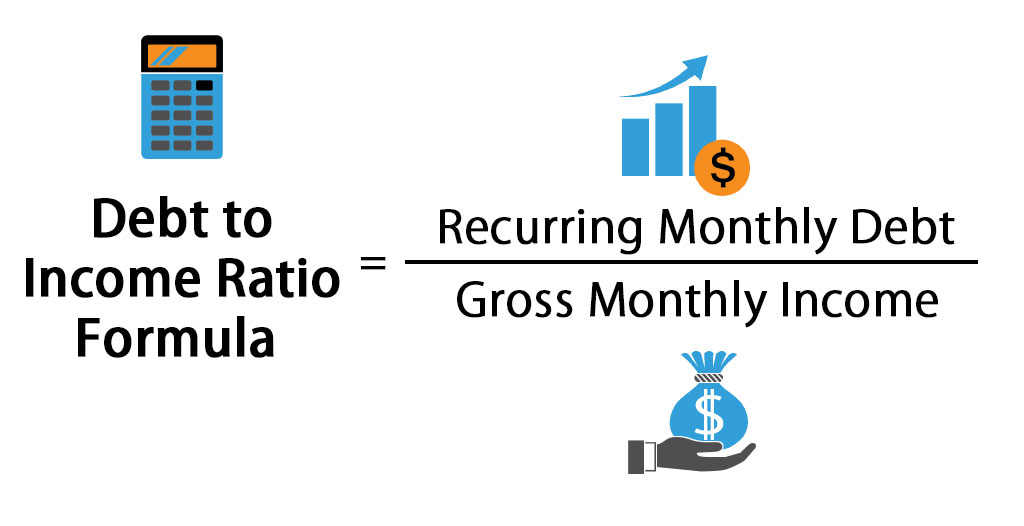

DTI or debt-to-income ratio is a substitution of your monthly debts from your monthly gross income. This ratio is expressed in percentage and will determine your potential to pay debts. While an ideal DTI is usually reported from anywhere between 20% to 35%, this might well vary from lender to lender. Therefore, if you are someone with a DTI ranging between the ideal spectrum, you might as well attract lower interest rates with the lender by negotiating terms.

For example, if your monthly gross income is Rs. 1,00,000INR and you have 1 existing personal loan with INR 35,000 as your EMI, your DTI will be (35,000/1,00,000)x100, which equals 35%. This will make you an ideal applicant for the personal loan and may benefit you with several lenders if you have a satisfactory eligibility record. And if your DTI is high, it is advisable to close loans sooner, at the earliest, to avoid negative cash flow or tight cash situations where you might look like a riskier customer to deal with for several lenders.

Interest Rate Calculation

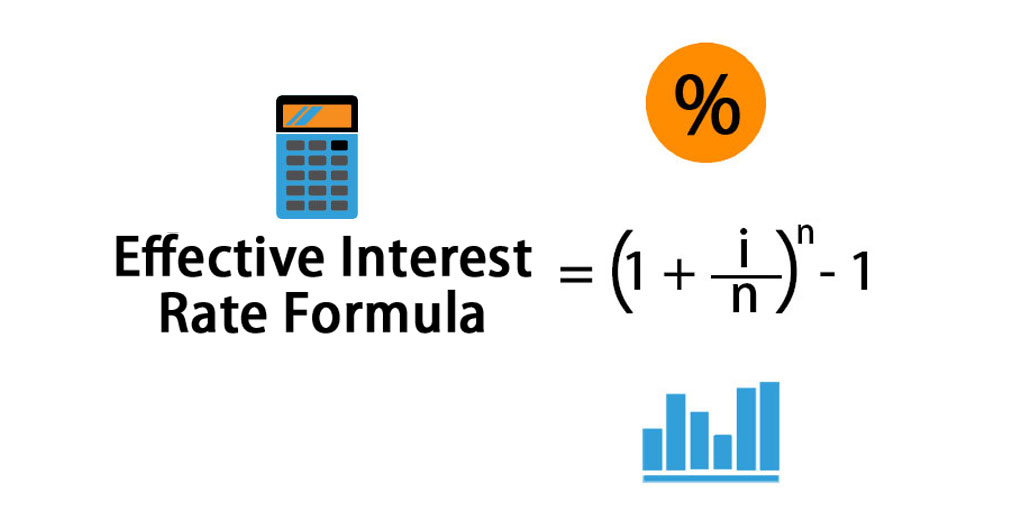

There is a method that every lender or financier follows to calculate interest rates called flat or diminishing ROI. Check out our blog “Everything You Need To Know About Flat Rate Of Interest Vs Diminishing Rate Of Interest” to learn more about these two types of balance methods.

However, in the flat ROI or balance method, the interest rates are calculated on the entirety of the principal amount, unlike the reducing or diminishing balance method where the interest rates are calculated on the outstanding principal(not the entirety of the principal). Thus rationally, the EMIs on the flat is a bit higher compared to the EMIs on the diminishing ROI method, therefore looking for lenders with a reducing ROI policy is more desirable considering the reduced loan burden even if by a little.

Inflation or Benchmark ROI

Marketing inflation or deflation is a common science among loans and lenders. As the saying goes, the variable interest rates may rise or fall depending on the existing market conditions is true to the nature of the loan. However, if you are a fixed-interest borrower, the interest rates are consistent throughout the tenure of your loan without being dependent on the market conditions, but this is trickier than it sounds. Since there is a risk of loss involved in such loans where the interest is fixed, the lenders will increase your interest rates more than those on variable interest rates.

Therefore, throughout the tenure of the loan, you are paying a higher interest regardless of the deflation of the interest rates, if any.

This is the reason why most applicants go for variable interest rates, however, will consider their tenure and LTV for that matter. This means, as we discussed, the higher the LTV, the higher the tenure, and the more the chances of market fluctuation, and interest accumulated. Therefore, the borrower should be aware of the market conditions when applying for a personal loan, and should ideally borrow for a shorter or medium-term loan, so that he can repay with ease, and make foreclosures or part payments when his finances allow.

Collateral

Collateral has a large impact on the interest rates of the loan. When a borrower submits collateral on the loan, the lender is more at ease with giving out the loan and can trust the borrower with his repaying capabilities since there is a risk involved for the borrower of losing the collateral if he may default on the loan. But if you are a religious tax or loan payee, you might not even consider this as a threat, given the stable cash flow income, and other aspects of your earnings.

This means that you can easily get lower interest rates when pledged collateral compared to times when you don’t. And if you do not have collateral to pledge, you might as well get a guarantor or co-applicant, who will also give you the same benefits as pledging collateral or security. However, the guarantor should be an immediate family member and should be able to repay your loan to the lender if you may fail to do so. As with a co-applicant, the same rules follow, but the co-applicant can split with you the burden of your loan and other terms equally.

Consider your options, requirements, and the urgency of your loan. That way you can decide on the best way possible to get the loan without being liable for high-risk conditions.

Loan Purpose

Though this might not directly impact interest rates, the purpose of the loan is still important sometimes when taking out a personal loan. Since there are several sub-loan types in the personal loan, the end-use of the loan solely depends on the applicant, however, when in medical emergencies or other emergencies, the borrower should discuss with the bank the urgency of the loan and his financial conditions to get the loan faster without going through multiple states of checks.

Relationship With The Lender

If you have an existing account with the lender, there is no need for you to go through the selection process or documentation process twice when taking out a loan again. Therefore, the processing time of the loan will be reduced and the lender is likely to trust your repayment capacity depending on your repayment history with the lender.

If you had smooth transactions before, you might as well get the benefits without blinking twice, however, if you have a rough or patchy or even no relationship with the lender, this applies to a friendship where you should have to gain trust again to get the benefits of the loan.

Third-Party Assistance

Most borrowers or applicants might not know yet about third-party services that help them get loans at the best deals and offers. Similar to real estate agents or brokers who help get the best deals on commercial spaces, these third-party marketplaces help customers to get benefits on their loans with their in-house financial partners by pulling strings and benefiting from connections. However, unlike brokers or agents, these are not costly or tiring affairs.

Through the entirety of your loan process, you will be assigned a dedicated relationship manager who is a professional ex-banker and an expert in finances, assisting you with your needs and requirements. This relationship manager will discuss with you the requirements and conduct market research to bring out to the table the best deals on your profile. This will save you time on the research and will also let you make the best possible decision without having to fall hard for the sales trick. The data provided by these third parties is highly researched and backed up by proof, thus is authentic and detailed.

Also, getting a third party involved will help you avoid potential legal complications in the future by being equipped with the knowledge of the market and also save time with commuting between banks, hard inquiries, and other aspects of the loan by allowing you to view, manage, withdraw, everything at the comfort of your home.

Final Word

If you are looking for an instant personal loan online and need help, contact Loanz360 to get the loan at the best prices and deals instantly. Check out the eligibility criteria and documents required in the services section under a personal loan.

You can also check out your CIBIL score here

Your personal loan interest rate percentages need not be a burden with Loanz360. Loanz360 is such a third-party supermarket for all-inclusive financial solutions, from management to protection of assets, we provide all financial services to our local and international customers alike with the help of our in-house financial partners.

If you are still not sure how, give us a call at Loanz360 and schedule a meeting with our representative, who will take you through the process of buying and financing a loan, along with comparing the market rates and finding the best deals that fit your pocket with discounted offers and flexible services.

One Response

I appreciate the detailed explanation of loan terms and interest rates. It’s so important to be informed when considering borrowing money, and your blog post has definitely helped me grasp the key concepts…