Buying a home is a huge responsibility. While having one is a necessity in today’s age, it can also boost your confidence. However, navigating the home loan process can be tough.

Here is a home loan checklist that will get you through the home buying process – with only minor changes made to keep it concise. To achieve Your Dream Home – Follow these steps and increase your chances of getting a home loan and making your dream home a reality.

Home Loan Checklist #1. Check Your Credit Score:

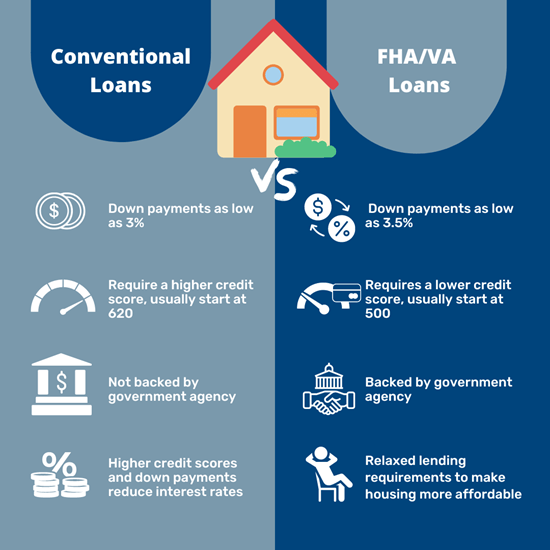

Before you begin the process of securing a home loan, it is fundamental for you to measure your credit score. It is your creditworthiness that flushout the terms and conditions of your home loan including the rates of interest and monthly installments. Aim for a credit score of more than 620 if you are targeting conventional loans and at least 580 for FHA loans to increase your chances of getting favourable loans terms. Keeping a regular eye of your credit report is a crucial step towards spotting inaccuracies and developing your score further. Check here now.

Home Loan Checklist #2. Save for a Down Payment:

Saving up for the down payment is a fundamental stage in the process of buying your dream house. Starting your savings plan now means taking one more step towards accomplishing financial stability. A small amount of equity seems a small price to pay for not having to live with a mortgage for a long time. It has a twofold advantage. It reduces your monthly financial load and eventually results in savings by minimizing interests payments. Take into account utilizing different types of savings approaches, including setting up recurring transfers or trimming the areas of your discretionary spending to speed up the growth of your down payment account.

Home Loan Checklist #3. Get Pre-Approved:

Getting pre-approvals for a home loan will impress sellers and real estate agents which will increase your chances of being selected as a buyer. It indicates a show of commitment and of readiness to go ahead and complete the purchase. This strengthens your position while negotiating for your dream home. Also, pre-approval can clarify your home loan amount and, therefore, help you to concentrate your search in the properties that are in your price category. Through making a smooth process of the mortgage application at the start, you will be in the position to speed up the whole deal and take advantage of that market, which can be competitive.

Home Loan Checklist #4. Compare Home Loan Options:

While borrowing money, do not just quicky grabs the first offer if you want to be smart. Instead take your time and be creative and compare the various options before you make a choice. Research meticulously on the rates on interest, repayment terms as well as lender features. The process of surveying different lenders and their different offers on the market can help you to identify the one that would work best for you considering your current financial circumstances and goals.

It may be a bank, credit union or online lender that emphasize different aspects and under potentially vary terms and conditions that may consequently impact your financial health in the long run. Take time to go through and compare loan options carefully before taking a home loan. It will help you arrive at the correct decision that will suit you best.

Home Loan Checklist #5. Learn more about Loan Terminology:

Before embarking on this home loan journey, it is important to become acquainted with the terminology that falls under the lending of different loan kinds, especially when one is thinking of borrowing a huge sum of money, say a home loan. With mutual funds, for example, investors can choose from a wide variety of funds focusing on different investment strategies, such as growth, value, and income.

Being aware of the distinctions between these choice avenues is an imperative to choosing a plan which would suit your financial goals in the long run. likewise, a fixed-rate mortgage involves standing charges with infinite monthly payments while a variable rate mortgage implicates that you have to deal with changing interest rates in the future. When you gain a knowledge of the words related to loans then you can make a decision with confidence about the home loan term that is the best for your financial situation and future plans.

Home Loan Checklist #6. Gather Documentation:

Gathering various documentation is a key step to the loan application process, as it optimizes the approval process and leads to an easier time moving forward. As a general rule, lenders demand an array of files from, say, tax returns, relevant pay slips, bank statements, to your employment proof, so that your asset stability can be evaluated along with your capability to repay the home loan with interest. These documents must be collected beforehand and one makes it sure that they are updated can speed up the application process and stop the application being purported.

Proactively sorting out all the documents you will be providing to the lender, you are displaying competence and credibility which might be one of the factors that would make the decision go in your favor and may leverage you favorable loan terms. With the proper documentation readily available, your ability to respond promptly to any requests from the lender can also help you advance your financial objectives because receiving the home loan faster could mean the difference between being able to carry out projects or not.

Home Loan Checklist #7. Factor in Closing Costs:

During the home buying process, it is important to include closing costs or head for financial shocks that come from nowhere. Begin by asking for a rate from your lender, but you need to keep in mind that closing costs do not end with just the home loan itself. Factor in origination fees for borrowers, appraisal costs, title insurance as well as escrow fees. Being equipped with a true grasp of all the aforementioned expenses at the time of settlement will enable you to budget in an effective way and there is no room for financial surprises.

Home Loan Checklist #8. Maintain Financial Stability:

As you enter the path of home buying, the following advice is necessary to help you stay financially stable and give trust to the lenders. Do not make any financially significant changes in your life like changing the jobs or taking any loans during the period of home loans. Lenders will want to see your financial record is consistent to ensure you can pay for mortgage. The stability of your financial past is an indicator of responsibility, which enhances the probability of your getting favorable terms.

Home Loan Checklist #9. Get a Home Inspection:

Prior to buying any property, make sure to consult a full-fledged home inspection. The appropriate inspector has to be chosen because they will determine the real condition of the property by detecting any hidden flaws. Early on you can get to the problems and the parties in negotiations will be in your favor and you can either push for a reduced price or some repairs. Paying attention to a professional home inspection will not only assure you against hidden repair activities that may arise after the purchase but also provides value for your money.

Home Loan Checklist #10. Stay Organized:

Handling an application for a home loan also means processing a ton of paperwork such as income statements, credit reports, and appraisals. Having an orderly record of these documents is not only a matter of convenience but also crucial to you having a smooth process . Designate a particular folder in hard-copy or digital modes where you can keep all documents of importance to you, so as to have them always at hand whenever they are needed. Labeling each document with the purpose assigned to it and grouping them according to goals such as income proof or properties details is a great idea.

Besides administrative tasks, staying organized also depends on keeping your banker or your home loan officer fully informed. Act swiftly in case they ask for additional documents or clarifications. Through this initiative, you demonstrate your willingness to work productively with all parties which ensures that the application process doesn’t suffer from unnecessary delays as well as other hassles that may arise.

An effective communication strategy should include correspondence tracking, which may also be useful. Keep a record of all bank conversations with writing emails, talking on the phone, and communicating in person. Besides, keep in mind what was underlined and follow up on any further action items without delay. This proves helpful for both keeping you informed and for the purposes of maintaining a record, in a case where reference is needed.

Home Loan Checklist #11. Attend Loan Counseling:

First-time homebuyers take part in home loan counseling sessions, where they gain a new insight and direction by hearing all the helpful information and advice. These meetings, usually imposed by financial organizations, are set up to help buyers understand the major components of the home buying process and the obligations that come with being a home owner.

Under the home loan counseling, the participants get to know about different loan types as well as the respective time payment, interest and repayment measures. In this way, a borrower is able to make a well thought-out decision on the right loan that will most adequately serve his or her current needs and future aspirations.

Along with the home loan specifics, in order to complete a full counseling, workshops will also cover budgeting, credit management as well as how to avoid common home buying errors. The participants have the opportunity to gain such vital knowledge on preparing their credit, paying their debts properly, and attaining good financial standing.

In addition to advice, home loan counseling opens a way to acquire resource material and tools necessary for loan management. These materials can be a good source of references and aid the homebuyers during the process of buying a house.

Mortgage counselling helps prospective borrowers to understand what is required to achieve their home ownership goal and to develop the confidence needed to go through the rigours of buying a home. As for the buyers, whether you’re a first-time buyer or not, these sessions play a key role at each step of the proceeding thus empowering you to make the right decisions.

Home Loan Checklist #12. Review Loan Estimates:

Carefully going through the loan estimate and comprehending its clause details will save you from being taken aback by issues that you originally thought you had been fully briefed on at the beginning of your loan application. Loan estimate presents the complete features which are associated with the loan like interest rates, loan monthly payment, and the closing fees.

Start the table by taking a look at the interest rate as it will greatly affect the total loan amount. If you compare the rate, offered by other similar institutions, you will see whether it matches your financial targets. It is worth knowing that variation in interest rates by a single basis point can eventually lead to the almost worth of entire home loan.

With that in mind, let’s then explore the amount that you need to save up for this once a month. Is this amount that you will pay up for this kind of monthly basis something that you manage to budget in your personal expenses? Remember that your credit score will be affected by making payment each month. Think over whether you will afford it long-term. It also should involve about the possible future variations of the amount of payment, the alterations including interest rates in case of a variable-rate mortgages.

Moreover, look carefully at the closing fees listed in the loan estimate so that you can be certain that everything is up-to-date. Such expenses could be the payment for the appraisal, expenses for the title insurance, and the loan origination fee, among the others. Take time to comprehend each fee. If the lender fails to explain a certain charge make sure to ask for clarification if it seems unknown or over the top.

By closely reviewing the home loan estimate, you can avoid surprises and make sure you’re getting the best home loan deal. Unsurprisingly, you will be able to find out all the key information if you do a thorough research. Never be afraid to speak up, ask questions, or feel for explanations just to make sure that you have totally understood the terms of the loan and any other process before you proceed.

Conclusion

Their journey won’t be so flustering as they will possess all necessary documents at their disposal along with their conveniences. Research besides teaching should be always viewed.

Having a knowledgeable advisor by your side will ease you on the paperwork and let you achieve results faster. While the process is not enjoyable alone, Loanz360 advisors can guide you on path to get quicker home loan approvals. Contact us today to avail benefits.