Financing is one of the important concerns in today’s dynamic real estate sector while tenants figure out means to become homeowners. One of the typical choices has been the adjustable interest rate mortgage loan. It is commonly termed as an adjustable rate home loan, adjustable rate mortgage or an ARM. Learning the intricacies of adjustable rate mortgages will empower borrowers to make informed decisions that resonate with their financial goals.

What are Adjustable Rate Mortgages (or) Home Loans?

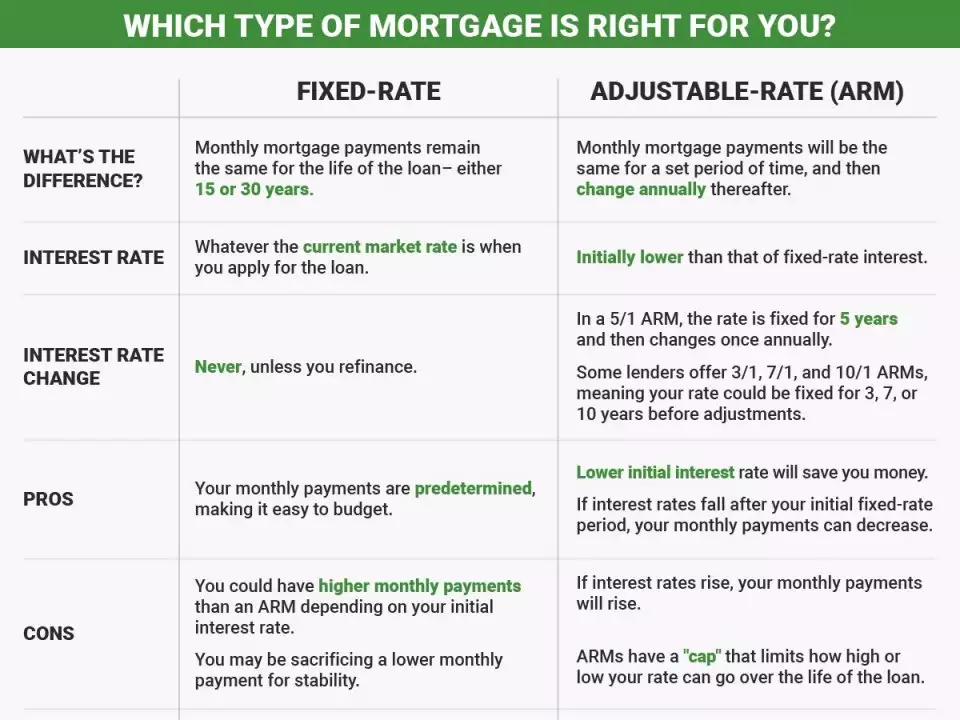

Adjustable rate mortgages refer to a loan concerned with the changing, rather than the stable, instated interest rates. In contrast, ARMs have fixed interest rates that remain the same throughout the period of the loan. Whereas initial rates of the variable rate mortgage are on the lower end which gets adjusted at specific times. Such adjustment, calculated on the basis of index value which may be Prime Rate or the London Interbank Offered Rate, is added to a lender’s margin.

What Factors will Influence Adjustable Rate Mortgages?

First, the loan means that you get smaller obligations every month. That is, reduced payments, but the initial term of these loans is often from a year to a decade. The period of the initial fixed rate is known as the “fixed-rate period”. It is due to the fact that a constant rate is applied for that period. After this maturity, interest rates change from time to time, commonly annually. The actual rate is a collective quantity of the index rate along with the margin. Which is specified in the Loan Agreement.

Adjustable Rate Mortgages – Pros & Cons:

Pros:

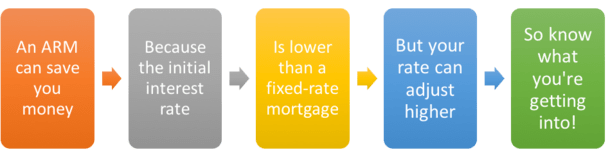

- Lower Initial Rates: Adjustable rate home loans most often begin with a lower interest rate than fixed rate mortgages. This may be a quick draw for borrowers looking to reduce monthly expenditures in the first place.

- Potential for Savings: If interest rates remain unvaried and in a steady line, individuals with debt obligations can achieve payments with lower costs over time.

- Flexibility: Borrowers can adjust either the rate terms or the duration of some adjustable-rate mortgages. This borrower-centered flexibility helps cater to various financial circumstances.

Cons:

- Rate Fluctuations: The first risky aspect of the adjustable-rate mortgage is the flexibility of the rates to be changeable. With potentially sharp increases, the consumer would be paying higher monthly payments, and so affordability would be part of the equation.

- Uncertainty: In contrast with fixed-rate mortgages where payments are always the same, after modifications there is a doubt that arises because the rates may change.

- Budgeting Challenges: Rate corrections necessitate working with fluctuating payments in mind, hence result in mostly inadequate budget plan.

Elements Deciding The Best Adjustable Rate Mortgages

1. Market Trends

The awareness of the market trends implies we have to observe a number of economic indicators directed at interest rates. Such indicators, among others, will consist of numbers such as GDP growth rate, inflation rate, unemployment figures and central bank policy decisions. One of the ways how financial experts and borrowers could gain such insight is by examining the potential moving direction of the interest rates based on some given economic indicators.

As an example, if the economic indicators like inflation are pointing up, the central banks can take a decision of increasing the interest rates to keep the inflation in check. On the one hand, when the economy slows down, central banks lower the interest rates to push people to borrow and spend.

Highlighting market trends is the foremost important aspect for people and businesses intended to take loans. Interest rate dynamics tend to have a direct effect on the cost of loans, which in turn influences purposes as diverse as mortgage payments and business financing In this way, borrowers can be proactive in distinguishing possible changes in interest rates and clarify the timeliness for loan and type of loan they want to take.

Besides, building a sophisticated brand identity and a user friendly experience using modern web design is a tip that can as well be utilized by any business. A user-friendly website, on one hand, improves customer engagement and on the other, demarcates the firm image as one that is innovative and customer-oriented. The alignment of business with modern design trend provides a basis for businesses to grow their reputation and appeal to many people.

Primarily, elucidating changes in market trends allows upstarts to conceive a plan to put themselves in a favorable position in the future. Adapting strategies like payment models to account for projected interest rate changes is critical, and integrating branding tactics with emerging consumer preferences are also important. With this in mind, a long-term business success can only be achieved by tracking market trends.

2. Loan Terms:

ARMs, i.e, adjustable rate mortgages, are one of the different kinds of home loans where the interest rate may change from time to time, usually following some underlying benchmark interest rate such as the Prime Rate or the LIBOR. Familiarizing with the terms and conditions of an ARM before considering using this product will assist a borrower in choosing it.

The very important elements of an ARM are an initial fixed-rate period, adjustment intervals, rate adjustment caps and lifetime rate caps. The first years of the fixed-rate plan, which can be anywhere from one year to several years, see no fluctuation in the interest rate. The second step involves adjusting the rate, and adjustments occur periodically, usually annually or semi-annually, corresponding to the market rates at that time.In addition to rate adjustment caps that limit the change in interest rates per adjustment period and the absolute change of the interest rate over the lifetime of the loan.

Similarly, 2% is the limit to increase or decrease rate a year hence this is the annual adjustment cap. Just the same, a lifetime rate does not allow the interest rate to be adjusted higher than the limit that is set for the entire loan period. The role these features play in determining the cost and affordability of an ARM cannot be over-emphasized. Borrowers need to assess accurately their level of risk tolerances and their capability to manage the finances as changes in interest rates can have a big result on monthly mortgage payments.

3. Financial Stability:

Consideration of a financial stability is a primary point of thought and especially when borrowers are aware of adjustable rates loans. Before taking on such a mortgage, people need to check if their finances are able to tolerate the up and down interests rates and given mortgage payments.Income stability is another aspect of financial stability. The borrowers need to examine mechanisms in place for mitigating risks associated with the fluctuation of income sources which may cause an increase in the interest rates and subsequently the monthly payments.

For instance, employed people with steady and fixed incomes may get across better fluctuations of rates than workers with recurrent and unpredictable revenues. Reserve funds and savings are the other crucial elements of financial safety. To ensure that enough funds are available can serve as a safety net, which can be used for handling unplanned costs or short-term salary impairments.

It can also stand as a reassurance if rates are adjusted upwards and hence resources to manage rescheduling of monthly repayments are available. Moreover a third factor of financial stability in adjustable rate loans is a level of risk tolerance. Borrowers need to approach any decision of this kind quite carefully and ensure they can handle any possible modifications in the mortgage payments and unexpected costs.

For some people, the predictability of the fixed-rate mortgage might bring more peace of mind than they need to suffer with changeable payments, while the almost immediate bait of the reduced initial interest rates at low-variable rate mortgage could possibly attract the other people. Certainly, debtors should consider their financial safety, susceptibility, and long-term financial objectives before settling for an adjustable rate loan that might best meet their particular needs. Talking with a financier can give a person new insights and help them to make the right choice in the matter of their residential mortgage.

4. Compare Options:

As do borrowers, when taking into account adjustable rate loans tend that they seek from different providers. Each lender may present a different product in form of interest rates, terms and fees. As a result, a borrower is supposed to look for many more loan options than those based on interest rates alone. The borrower should also assess aspects like loan terms, adjustable-rate reasons, rate adjustment caps, unlimited rate caps, and any fees and extra charges connected to the loan.

Also, borrowers should assess the reputation and dependability of likely institutions. Having a reliable lender who is known for impressive client satisfaction and is also transparent during lending; gives hope, no stress as the borrowing process continues.

It is important to know that while traditional mortgages can be through banks and mortgage lenders, you should also access alternative lending sources like credit unions or online lenders. Hence, some other options such as competitive rates and terms of service could maybe be offered together with more individualized customer service.

Adjustable rate loans from different lenders could be compared fully in a manner that allows a borrower to spot the most competitive and proficient loan out of the lot. Setting aside some time to do some research and comparison shopping can help borrowers to find a suitable loan at the best possible rate. Also, this can save them some money and ensure they get a credit that is suitable for their financial goals and needs.

Conclusion

Fixed rate vs adjustable rate mortgages provide flexibility and fee savings at the initial stage yet there is a potential for interest rate changes. Make sure that the given market trends, loan terms and your financial condition, matches your requirements, and also to compare other options from the different lenders. With knowledge of the nature of adjustable-rate mortgage loans and checking through sources of trust, one can suit their financial needs today and in the future.

To conclude, though ARMs are a good move quite often, you should be sure and accurate before going for them because they carry absolute risks. Through knowledge, and comprehension of your financial situation, and help from credible lending agencies, you are able to go on with most of your home owning aspirations and with confidence, overcome the obstacles that come along with adjustable rate mortgages. Contact Loanz360 for more information. You can also check your CIBIL score here now!