A credit score comes up as a significant factor in our financial life. They determine whether we get capital for our loans or credit cards and even whether we can get a rental house or not. The CIBIL score in India is one of the most prominent metrics for financial institution’s estimation of the borrower’s credit quality. This is what implies that to gain access to the profitable financial opportunities one should keep the most of the positive credit record possible. The ability to stay more steady financially can cause problems as well.

What is a Credit Score?

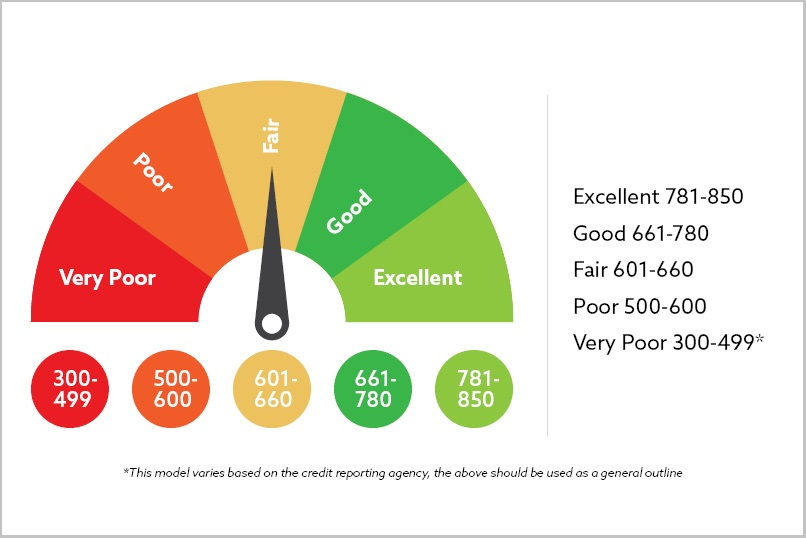

A credit or CIBIL score is a three-digit figure. Which reflects on one’s credibility based on his/her credit behavior. It generally encompasses within the range of 300 to 900, where highest scores mean the creditworthiness. The credit score is a measure that lenders use to determine among other factors the high or low risk in providing someone with credit.

Factors Influencing CIBIL/Credit Scores

The credit scoring system is impacted by a lot of factors the combined effect being the creation of a credit risk assessment which reflects on the overall credit status of an individual. Important factors are settled customer’s payment history, credit utilization ratio, variety of credit facilities, total number of credit accounts held and recent credit inquiries. These variables aim at gaining a better understanding of the methods applied in financial management and protecting the credit commitments.

Payments due (payment history) form the leading bloc of the credit score what demonstrates the person’s reliability in debt fulfillment and regularity of payments. Timely payments therefore are a sign that someone is committed to responsible financial decisions, and such factors reflect well on their credit rating. On one hand, consistent payments can be rewarding while, on the other hand, missed or late payments can lead to bad consequences that are reflected in credit scores and are sign of potential risk to lenders.

The credit utilization ratio, a further key element, shows the extent of the credit which an individual is currently using against the available credit. Hence, low credit utilization ratio equals using only a small percentage of available credit, which in fact bears a good sign of a creditworthy and thus boosts the credit score. However, the same coincidence is conceivable when a high credit utilization ratio raises the worries that a particular person is poor in handling debts.

The variety of credit accounts will amass as well as, inter alia, the formation of people’s credit scores. A combination of different types of credit including installment loans, credit cards, and buying accounts shows adaptability in the matter of meeting different credit payments. Indeed this diversity is a contributor to the positive values of credit scores showing that the credit profile of the individual is good and well balanced.

An ongoing credit inquiry, commonly triggered by credit application, also plays into the credit scoring formula. While an inquiry that occurs once in awhile might function without much harm, constant inquiries or multiple inquiries within a short period may result in scrutiny, and consequently, lower credit scores. Thus, performing due diligence and weighing carefully before going for credit is essential in having a good credit score.

Importance of Credit Checks

Constant checking one’s credit report becomes essential for staying financially conscious and avoiding any misrepresentations or mismanagement of information that can lower the credit score. People can discover and work on inaccuracies and inconsistencies in their credit reports timely by reviewing the report periodically. This will help them to ensure the correctness and fairness of their credit information.

In India, one can get a free CIBIL report upon login by using the credit bureau’s website which in turn enhances the ease of accessibility of credit information. I.e., you can also check now here. At least once a year, credit scores should be equated with an individual´s credit health, probable areas for improvement, and active measures to improve creditworthiness.

Some of the Tips for the Healthy Crediting Profile Maintenance as follows:

- Pay Bills on Time: Regular payment of credit card debts, loans, EMIs, finances, and others in a timely manner reflects well on your credit report. It improves your finance and boosts your CIBIL score for sure.

- Maintain Low Credit Utilization: Ensure that you’re always maintaining the ratio of credit balance to credit limit below 30%. It will reflect well on you that you’re not addicted to credit and you’re capable of managing your finances responsibly.

- Diversify Credit Accounts: The rules for revolving credit, as well as others such as loans, retail installment agreements, and mortgages- can positively affect your credit score. As long as you demonstrate a history of sensible utilization of each financing line.

- Limit Credit Inquiries: Stay away from triggering many credit inquiries in a short period. This can make other lenders think that you are financially distressed and thus your CIBIL score can fall.

- Monitor Your Credit Report: Keep an eye on your CIBIL score by checking it regularly. Check at least once every quarter and report any errors or suspicious activities. Make sure to dispute any errors immediately so they cannot lower your credit rating.

Maintaining a Good Credit Score:

A good credit or CIBIL score will give you access to many financial opportunities. For instance, taking a loan with low-interest rates may be stress-free and so is a higher credit limit. Lower premiums may be your gain for better credit. Not only does it indicate your fiscal ability and discipline but it also plays a part in calculating your creditworthiness for lenders and landlords.

The most prevalent misconceptions about credit ratings are the following:

- Closing Credit Accounts Improves Your Score: Actually, shutting down your credit accounts can negatively affect your credit score. This is because it does not only narrow the limit of your credit, but it also shortens your credit history.

- Checking Your Credit Score Lowers It: A hard inquiry has the potential to lower and harm your credit scores. On the other hand, an inquiry for your own score is simply a soft pull and does not affect your credit score in a not-so-good way.

- Good Income Equals Good Credit Score: A fixed income does not give an immediate ROOF to your credit score. Underwriters give credit to your credit score and the ability to repay.

Conclusion

Understanding CIBIL/Credit score and reforming one’s credit habits as a core requirement to financial prosperity is essential. Practice responsible financial habits and do regular credit report monitoring on your part. This is to address any issues in a timely manner while your creditworthiness will be improved. Also, this will open up the world of financial services to you. Contact Loanz360 for more information.