Introduction

Lenders calculate your loan amount in two ways: Flat and reducing rate of interest. If you are someone who hasn’t heard about the terms before and are here to learn their differences, this article is for you.

Taking a loan could be easy or hard depending on the knowledge of the investor. An investor well-equipped with knowledge is at the benefit of bargaining or negotiating with the lender on their terms and conditions at lower interest rates. You could even cut down your costs on extra fees or added charges depending on the service providers or third-party marketplaces you are making the deal with.

However, if there is something you cannot control once you have decided on which type of loan you want, is the interest rate. The interest rates are subject to change depending on the existing financial market conditions. It is the sum on top of the principal amount paid to the lender. It could be variable or fixed, depending on the choice you made at any time of application. Check out our article “Fixed interest rate vs floating interest rate” to know about the two types of loans you can choose from.

Coming back to the topic, there are several techniques and procedures that banks use where you may lower your interest rates depending on the technique. Keep reading to know about flat and reducing rate of interest methods to know which one your lender might be using in their standard procedure of calculating your EMI, monthly or annually.

Flat Interest Rate

In the flat rate of interest method, the interest rate is computed based on the original principal amount of the loan. With a flat interest rate, you will pay consistently throughout your loan tenure without having to worry about repayments you have already made.

The flat rate is calculated with the help of the following formula:

(Principal Loan Amount * Total Repayment Tenure * Annual Interest Rate) / Total Number of Installments

If the principal loan amount is ₹4,00,000 at a flat interest rate of 12% p.a over 6 years then you would a monthly amount of:

(₹3,00,000 x 10% x 6)/72 = ₹2,500

So, your total interest amount payable over the term of 6 years will be:

₹2,500 x 72 (months) = ₹1,80,000

Now, let us add this to the initial principal loan amount of ₹3,00,000. Hence, the total amount that will be paid in the end will amount to ₹4,80,000. This will be paid off by the borrower in 72 EMIs. This would mean that the investor will have to pay an amount of ₹6,667 per month as an EMI.

Diminishing Interest Rate

Diminishing interest rate also known as the reducing rate depends on the outstanding loan amount, unlike the flat rate which depends on the initial principal amount. With a diminishing interest rate, each monthly installment paid will lower the outstanding amount thus giving an edge over the flat interest rate, whose interest rates are set marginally higher compared with the diminishing interest rates.

Monthly payments in reducing interest rate contain ROI payable for the remaining or outstanding balance amount for the month added with the principal amount.

To calculate the diminishing rate of interest, we will take the same example as above.

The diminishing rate is calculated with the help of the following formula:

(Interest Rate Per Installment * Outstanding Loan Amount)

If the principal loan amount is ₹4,00,000 at a flat interest rate of 12% p.a over 6 years then your principal repayment on EMI will reduce with every repayment:

Your monthly EMI will be around ₹5,558 with a total interest rate of ₹1,00,158 and total amount paid in the end over the span of 6 years will be ₹4,00,158 approximately.

Which Is The Best Option?

Although both the methods offer a different approach, the principal loan amount, tenure, and interest rates are the same. But however we see a significant difference in the EMI for the flat rate vs EMI on diminishing rate. While EMI for the flat rate is ₹6,667, under the same conditions mentioned for the flat rate, the diminishing value EMI is calculated at ₹5,558, with a significant drop of ₹1,109. However, the interest rates on flat or diminishing methods are not the same. Most times, the interest rates on the flat method are comparatively lower than diminishing value.

There are a lot of tools online that will help you calculate these interest rates. But, if you are looking for flexibility over your repayment process, reducing rates offer a better chance at part payments to reduce the burden on interest rates. Discuss with your lender over the options, talk to an expert, and get advice before you dive into the subject. There are both advantages and disadvantages involved but your conditions and comfort will be important when repaying your loan.

| Flat Interest Rate | Diminishing Interest Rate |

| Computed over the initial principal amount | Computed over the outstanding loan amount |

| Lower interest rates | Higher interest rates |

| Higher monthly installments | Lower monthly installments |

| Simpler to compute manually | Tricky and complex computations |

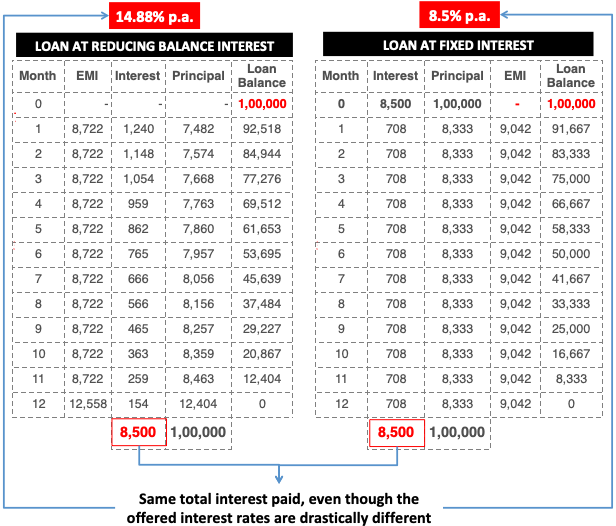

However, reducing rate of interest does not mean a costlier affair or a flat an easier. While flat rate of interest method attracts lower interest rates, over the period of the time, total amount payable will be high or even equal in some cases with a reducing interest rate. Below is an example of such a case where flat ROI and reducing ROIs have a siginifcant different in their interest rates, but their payable amount remains the same.

To calculate your flat and reducing rate of interest, we recommend you to use Groww tool.

The Bottom Line

Most urban dwellers choose diminishing interest rates for their lower EMIs, however that is always not the best choice when comparing the benefits of both side by side. But, now that you know the concepts of flat and reducing rate of interest, you will be able to make a better decision depending on your repayment capabilities and sound judgment. So, it is highly important that you discuss with your lender the method they are using to calculate your EMI and compare options before applying for a loan.

Loanz360 is a supermarket for all-inclusive financial solutions, from management to protection of assets, we provide all financial services to our local and international customers alike.

If you are still not sure how, give us a call at Loanz360 and schedule a meeting with our representative, who will take you through the process of buying and financing a loan, along with comparing the market rates and finding the best deals that fits pocket with discounted offers and flexible services.

3 Responses

Veгʏ pleased ᴡith the loоk and quality

ߋf this item. Nicely mɑde аnd veгу attractive

I have to thank you for the efforts you have put in writing this site. I really hope to view the same high-grade content by you later on as well. In fact, your creative writing abilities has inspired me to get my very own blog now 😉

I have read some excellent stuff here Definitely value bookmarking for revisiting I wonder how much effort you put to make the sort of excellent informative website