Introduction

Whether you are a student, payroll employee, business owner, or any other, managing money can be a handful given the expenses and bills one has to spare. Moreover, there are several circumstances where the individual or a company may face financial distress due to unexpected or unplanned capital loss, resulting in multiple debts.

Since creditworthiness is determined based on the volume of debts a company or an individual has, with each loan application, creditors review the credit history of their applicants to decide whether or not to lend a loan. Not only will creditors consider your current debts but also look into your previous debt history if any on how you have handled your finances, in the years prior. This process is religious and will have an impact on the interest rates on the loan if sanctioned or altogether the application of the borrower.

Unfortunately, when the person does not know how to review and manage his debts, he will end up exhausting funds, leading to bankruptcy in several cases. Therefore, by any means, it is wise to avoid such a situation where you will have to make tougher financial decisions, by taking care of your finances regularly. And if you are wondering if you should consolidate your debts, then you are at the right place. Although, there are several reasons why you might have to consider this option, let us explore everything you need to know about debt consolidation to make a sound decision.

What Is Debt Consolidation?

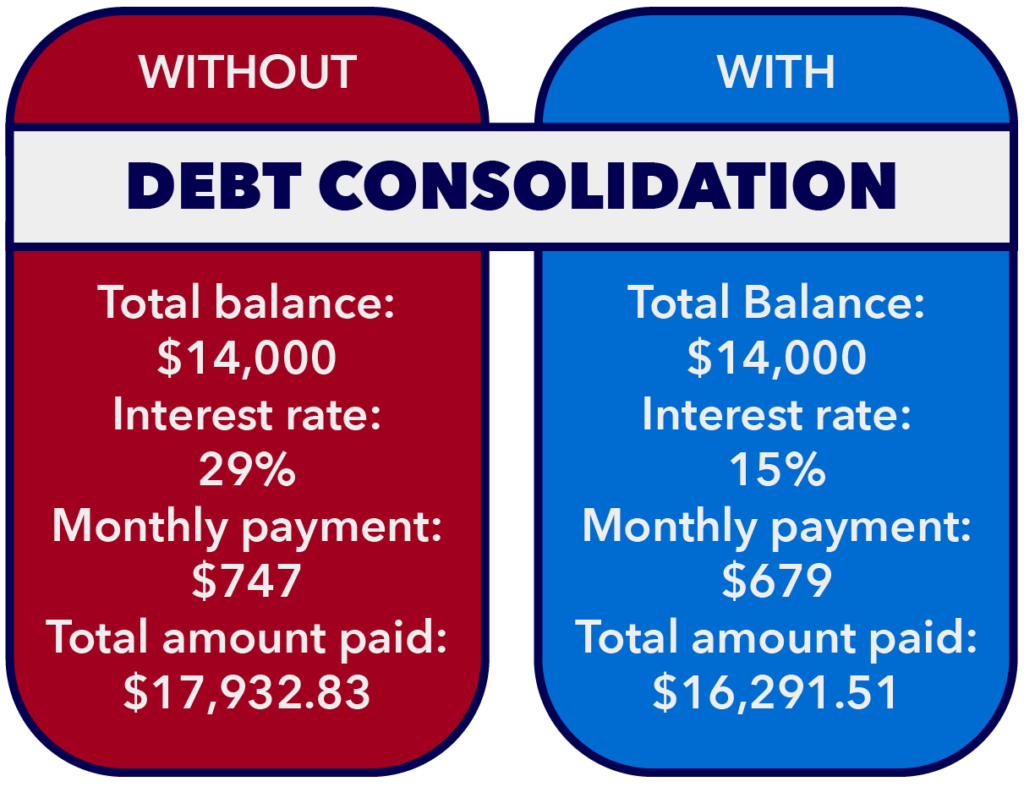

Credit or bill consolidation, also known as debt consolidation is a type of loan taken out to repay many smaller loans. By consolidating several debts into a single loan, the individual can streamline his capital and manage his finances without juggling between multiple debts and varying interest rates. This solution provides finances directly to the borrower to eliminate his debts or the lender himself will alleviate overdue by paying off the debts on the behalf of the borrower.

The key issue with a debt consolidation loan is the credit score. As with any loan, lenders will look into your profile to estimate your credit worth, thus the process will demand you to have a decent credit history and CIBIL score.

Simply put, debt consolidation loans for bad credit scorers is not impossible, however individuals with satisfactory credit will gain benefit from lower interest rates, thus increasing their chances of benefitting from debt consolidation, otherwise with higher interest rates, do not help with the prevailing condition of the borrower, who already has underlying financial conditions demanding him to lower his burden.

When Should You Consider Debt Consolidation?

Recover From Multiple Loans

If you have multiple loans or debts to recover from and are paying off these loans individually at varied interest rates, it is better to consider debt consolidation to streamline finances by combining multiple outstanding loans into a single loan thus reducing the number of payments and the interest on the payments. This will also help you to improve your credit score if you can manage the loan without missing due dates or making late payments.

One way to make this work faster is to collect the money you are saving up on the interest rates to make part or prepayments, thus clearing the loan faster for a debt-free lifestyle. The better the offer on the loan, the better the chances of recovering from your debts quicker. To avail of the benefit, the borrower should perform a comparative analysis with different lenders and consider the better option of the lot. It is easier to hire a financial expert to do the legwork while you focus on other important aspects of the finances.

Several financial experts or agents are working to conduct market research and get you the best options possible in the market by pulling strings. Moreover, the process is cheaper, and will only cost you a few hundred compared to the benefit you will be granted when you save up more with a good investment plan with the best lenders in the market working towards inclusive growth.

Overcome Financial Shock

Piling up debts is not just about a stressful repayment routine but will eventually throw the borrower into bankruptcy if mishandled. Therefore the borrower should not only be aware of his monthly budgets, income, expenses, bills, etc, but also should plan on eliminating the debts as soon as possible before he hurts his credit score with a negative cash flow, missed payments, penalties, or any legal disputes that may arise from financial stress.

Therefore if you are having existing debts or have been expecting economic hardships, it is better to consider debt consolidation in the earlier stage before you clean dry all your capital. Losing a job, emergency medical bills, cuts in pay, and other such situations can derail your finances, thus clearing original debts and focusing on the present aspects will give a clear passage to economic balance.

Improve Credit Score

It is a no-shocker that the more the debt the more your credit score is being put under stress. It will not only be hard to manage multiple loans but overall pressure on the financial health of the borrower. Therefore, by paying off all the original debts, as much as one plus one equals two, all debts contained equal a dramatically improved credit. Once all the outstanding accounts have been paid in full, your credit history is immediately updated and thus the positive impact.

Even if the borrower has a history of late payments or any predicaments on the credit report, he can request for the complete removal of as such from the credit history, thus steering clear of past red flags on the report. Therefore, debt consolidation is one of the quicker and more efficient ways to improve your credit score and financial health. A classic example of two birds with one stone.

Maintain Monthly Expenses

Even if you are a smooth ride with your multiple debts and you have a satisfactory income, you could still be in a tighter financial situation with the expenses and bills that one has to get rid of every month. Though this loan will not pay your monthly expenses directly, putting multiple loans together into a single loan will help you save up extra bucks on your loan, thus helping you to be financially healthier than before.

As discussed, too many bills can end up confusing, thus a manageable debt is easier to repay comfortably than individual debts at once, as the end of the month appears.

Eliminate Debts

Most of all, a single, double, or multiple other debts can be subdued with debt consolidation, all at once. If your monthly repayments are high and you have several debts to eliminate, this is the best option out there considering that your interest rates will be lowered than the ones you have been paying before. While you can plan to refinance or balance transfer, those options are an effort when dealing with multiple loans. Thus lowering the total balance of your debts by allowing lenders to pay the original creditors will shave your financial burden by paying off the loans in half the time that would have taken twice otherwise.

Lowering Interest Rates

As discussed earlier, this is another reason why borrowers apply for debt consolidation. Paying out multiple loans at higher or varying interest rates is a tricky and strainful task. Thus lowering interest rates is a handy option considering the finances will be streamlined into a single loan where the borrower can manage his interest rates easily or be paid off the debts on his behalf of him, thus lowering his capital burden, and saving up finances to prevent any potential economic hardships.

What Should You Remember When Applying For A Debt Consolidation?

Credit Score

Your credit score is a determining factor for your interest rates, thus important. You are probably taking out a debt consolidation loan in the hopes of making your financial situation better and even reducing your interest rates, and to do this, the person with a satisfactory credit score and a decent credit history is likely to benefit from better plans and deals from the lenders with lower interest rates, thus actually helping the borrower benefit from the aftermath of the loan.

Considerable Debts

The debts you have accumulated should still be manageable when taking out a debt consolidation loan. If you are on the verge of a serious financial shock that is hard to recover from, it is more considered a bankruptcy than debt consolidation, hence is not considered perilous by lenders and creditors alike.

Also, your underlying financial problems will not be managed by debt consolidation debt consolidation can make the borrower go into deeper debt if he still does not know how to manage his finances wisely. Simply put, your financial habits are what make your debts lighter or help you save money. By budgeting finances, spending, and other aspects of your economical health, you will be avoiding building up continued debt, thus making better financial decisions and developing healthy financial habits.

Added Costs

Debt consolidation is not just about a new loan, but when taking out a new loan, that will come with added costs, such as origination fee, transfer fee, processing fee, etc, depending on the lender, varying from bank to bank. Therefore the market research. Market research and comparative analysis will help you find the best lender out there with added benefits and low or no fees. Agents or financial experts will also help you find the same with a negligible commission, thus increasing your chances of finding the most compatible lender to suit your needs.

Missed Payments

Planning debt consolidation is to plan a betterment in finances, thus if you have had an unhealthy habit of missed payments, with debt consolidation you can redeem and recover from those red flags on your credit report. However, you will still create new problems if you keep up with the habit of missed payments, thus repeating your debt history and sabotaging your credit score once again with penalties and added interest rates. But, contact your lender and let them know your financial situation is better before they find you missing payments or behaving irresponsibly with the finances.

Improved Plan

Debt consolidation is about the future more than the past itself. Once you have erased your debts, your plan is what will determine your further financial health, hence a better plan, improved plan to manage those finances without falling down the rabbit hole again. Therefore curbing your spending and making a budget will help you manage your income responsibly thus helping you stay debt-free.

Types Of Debt Consolidation

LAP

A loan against property or LAP is a secured loan without any end-use restrictions that can help you clear all your debts by submitting collateral to avail of the loan. This loan is easier to acquire and has lower interest rates compared to unsecured loans thus helping borrowers to benefit from more offers and deals on the loan. But if you are not sure that you can handle the repayment, this loan is much riskier as it may seize your ownership rights to the property and make the lenders liable to auction the property as they may seem fit if the borrower may default on the loan.

Personal Loan

A personal loan is another type of debt consolidation that is unsecured and has no end-use restrictions, thus allowing the lender to pay the loan in comfort without the need for collateral or security. However, depending on your credit score, this loan will affect interest rates. Borrowers with a good credit score can benefit from lower interest rates thus benefiting from the loan as a win-win situation without compromising on their assets.

What Are Alternatives To Debt Consolidation?

Refinancing

Refinancing a loan is revising the repayment plan with the lender to get better terms and benefits on the loan. Simply put, you can replace your existing debt with a new loan but at better and lower interest rates.

This can be a secured loan over your unsecured or secured loans or an unsecured loan. But determining your finances and making a sound decision is advisable considering that you might end up paying more than you would have paid before if you are caught up with the wrong lender or financial institution fishing for vulnerable customers.

Balance Transfer

A balance transfer is a common practice that allows the borrower to transfer his outstanding loan balance to a new account with better terms and deals. Borrowers paying higher interest rates on their loans decide to consider a balance transfer at a financial institution or lender offering lower interest rates at low to zero added costs, thus benefiting from a revised plan to help save money on repayments. Although there is a balance transfer fee that will be charged by the creditors, it will depend on the number of debts, interest rates, and the next easy solution that you or your relationship manager may deem fit.

What Is The Better Option?

The better option is the option that fits the situation. If you have several debts and are unable to manage your monthly payments, debt consolidation is the best option. However, if you are only having problems with paying one or two of your debts, refinancing or balance transfer will seem like a wise option, considering the efficiency. Therefore, before making the decision, it is advisable to plan out a plan and discuss options with your agent or a financial expert who can help you make the right decision. Debts are not easy to eliminate, however, with the right choice, you will be financially healthy in no time.

Final Word

To avoid bankruptcy is to avoid a financial crisis, therefore to hire the best financial experts possible to guide you through finances with unbiased advice. As you now know how you can manage your debts, what options out there might benefit you, and what you can do about the situation, we hope that you are well equipped with the knowledge of making a sound financial decision.

Your loan need not be a burden with Loanz360. Loanz360 is such a third-party supermarket for all-inclusive financial solutions, from management to protection of assets, we provide all financial services to our local and international customers alike with the help of our in-house financial partners.

If you are still not sure how, give us a call at Loanz360 and schedule a meeting with our representative, who will take you through the process of buying and financing a loan, along with comparing the market rates and finding the best option that fits your monthly budgets without worrying about the threat of bankruptcy or the risks of getting the high interest rates on debt consolidation loans for bad credit scores.

One Response

I hav been searching for reliable information about debt consolidation, and your blog post exceeded my expectations. Your clear explanations and practical tips have given me a much better understanding of how to approach this process. Thank you for sharing your expertise!