Introduction

Instant personal loans are easier to acquire and can provide the funds you need for a medical procedure, travel, or other personal uses quicker. Today, many financial institutions offer hassle-free loans at attractive deals. To get a personal loan, simply evaluate your requirements, decide on the loan amount required, and then pay fixed EMIs decided at the time of application throughout the tenure in due.

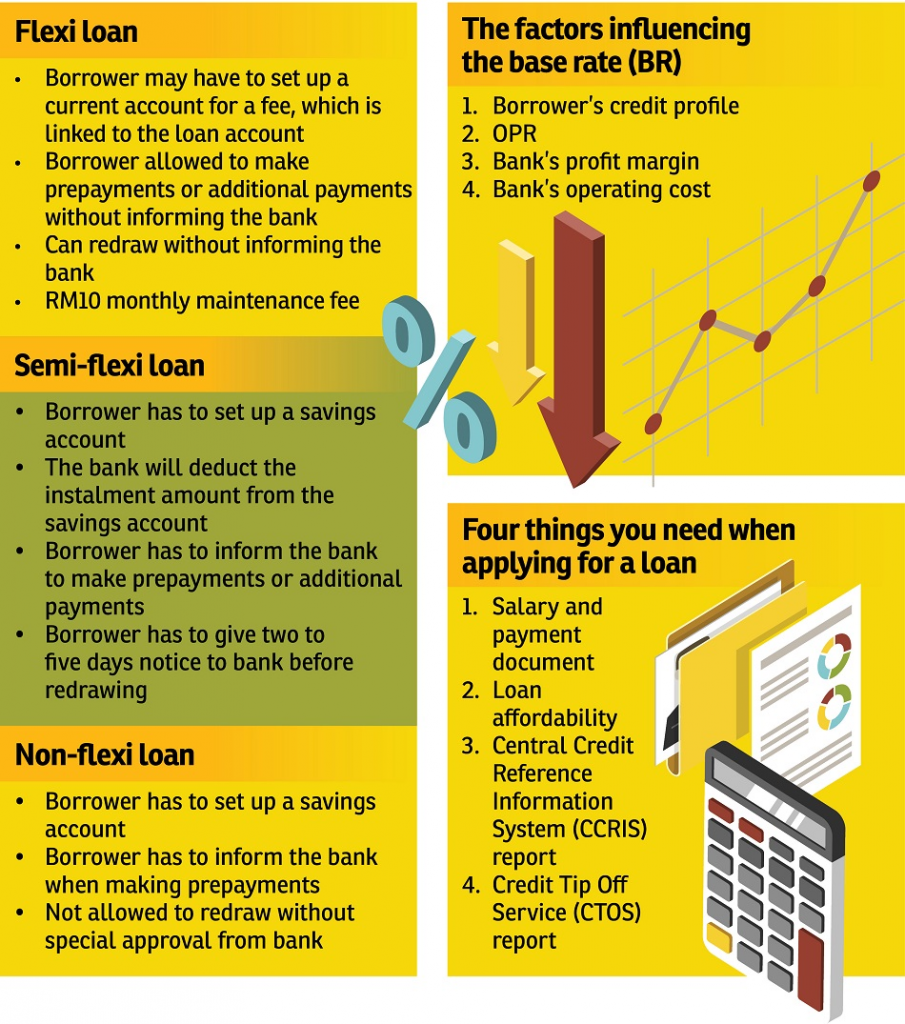

Even more, if you don’t use the entire amount you borrowed, you will end up paying hefty monthly installments (EMIs) for the full amount borrowed on the loan. This is where the “Flexi loans” enter the game. These are loans that offer flexible repayment options and overdraft facilities without customers having to stress over the lock-in periods or loan restrictions by financiers.

What Is A Flexi Loan?

A Flexible (Flexi) loan is relatively a new term in the Indian market. Financiers providing Flexi loans will grant their customers looking for regular working cash a pre-approved cash limit to use whenever they need funds. Most lenders offer affordable Flexi loan interest rates and flexible repayment arrangements to cater to the financial flexibility of their customers.

One of the best things about Flexi loans is that you only have to pay interest on the money you use, not the whole amount you’re approved for. This can save you a lot of money in interest payments, making Flexi loans a great option for savvy investors.

In an instance where the financier offers the customer a cash limit of Rs 15 lakh as a Flexi loan, and the customer has only used 2 lakhs to his requirement, then the customer will only have to pay for the amount he has used rather than the amount he has been sanctioned by the lender. This puts the customer at an advantage of accessing loans whenever he wants to without having to apply for multiple loans on multiple occasions because he has used out the cash he has applied for.

What Is A Term Loan?

In a term loan, the financier will have sanctioned a loan to the borrower that he has to repay over a definitive period of time agreed by both parties involved in the exchange at the time of application, typically a term spanning between one and seven years at the most.

While the borrower of a term loan makes regular payments in EMIs (monthly installments) until the loan has matured over its tenor, this type of loan is perfect for those who need a little help getting back on their feet financially. There are two types of term loans:

Unsecured Term Loan

An unsecured or collateral-free loan is a loan without the need for a mortgage as a security or collateral for the financier to lend the loan to the borrower. Usually, these loans are short-term or less funding loans where the lender will be able to trust the borrower with his repayment abilities depending on key factors such as his creditworthiness, employment stability, and even the relationship with the individual involved in the loan process.

However enticing may sound, sometimes they come with higher interest rates than secured loans as for the lender to compensate his trust on the repayment ability of the borrower.

Secured Term Loan

Secured loan is an instant personal loan seeking a collateral or security on the loan amount sanctioned which will make the lender a lien holder of the asset pledged or acquired during the loan process. Meaning when a bank or financier is pledged a property by the borrower, the loan is exchanged for the property acquired and will be seized or be legally held responsible until the borrower clears the debt or the loan amount in full. When the customer fails to meet the lender’s repayment requirements in due time, the property pledged can be sold by the lender to compensate for the loss acquired.

However unsecure this may sound, the interest rates and tenors on secured loans are flexible with most lenders offering longer tenures to clear the loan at lower interest rates. This is because a lender will likely trust the customer’s ability to clear the loan in the fear of their property being seized. Therefore, more benefits and offers are put on the table in terms of a secured loan.

Flexi Loan Vs Term Loan: A Comparison

| Key Factor | Flexi Loan | Term Loan |

| Purpose Of Borrowing | Weddings, Travel, Emergencies, Medical Procedures, or Other Personal Usages. | Working Capital Requirements, Small Business Loan, Purchasing Fixed Assets, Etc. |

| Disbursed Loan Amount | The loan amount credited has a cash limit and can be withdrawn whenever you want in full or limited as required. | The entire approved loan amount is disbursed to the bank account of the borrower once the loan is sanctioned. |

| Interest Charged | On the amount utilized on the total sanctioned credit limit. | On the entire loan sanctioned. (Whether the amount is used or not by the borrower) |

| EMI Amount | EMIs vary in the amount utilized depending on the terms of the loan, prepayment, and tenure of the loan. | Fixed EMI with interest rates (fixed or variable) added to the principal amount that can be calculated in advance with an EMI calculator. |

| Accessibility | Easy to manage with quick and fast disbursal with a hassle-free documentation process. | Typically have a longer processing time compared to flexi loans. |

| Collateral | No | Yes (Depending on the loan type) |

| Prepayment | Zero Prepayment Charges and Flexible Repayment Opportunities | There may be Prepayment Charges. (Varying from bank to bank) |

| Repayment | Flexible repayment options and overdraft facility. | Fixed repayment schedule. |

Which Is Better: Flexi Loan Or Term Loan

Depending on the purpose and requirements of your loan, Flexi and term loans are both advantageous and have different benefits with short term and long term financing options. However Flexi loans offer better liquidity, low EMIs, quick disbursals, and zero prepayment charges compared to term loans that may or may not offer such deals on their fixed repayment schedules. However, term loans are also beneficial for those customers looking for a standard and reliable loan that they can use on fixed assets or capital payments with a lump sum of cash upfront in exchange for definitive borrowing terms agreed upon by both parties involved in the financial or monetary exchange.

It is up to you to decide whether you would benefit from a Flexi loan or a term loan depending on your end goals and requirements at the moment of your loan application. However, with Flexi loans becoming an instant trend in the market among borrowers who wish to save money on their interest with the user-friendly policy of the Flexi loan, these will stay up in the game for a long time if used in association with the right lender.

Final Word

Depending on if you have a specific amount you want to avail of a loan for or not, you can choose between the Flexi and term loan without having to worry about the advantages or disadvantages of each. Because each loan is beneficial for investors depending only on your requirement. Several banks and financiers offer benefits to both types equally. However, at the end of the day, the customer needs to know and have knowledge on which among these two will be beneficial for him to satisfy his goals. A fixed EMI or surplus liquidity?

If you are still not sure how, give us a call at Loanz360 and schedule a meeting with our representative for both short term and long term financing. The dedicated relationship manager will take you through the process of financing a instant personal loan, along with comparing the market rates and finding the best option that fits your monthly budgets without breaking a sweat.

We are partnered with leading financial banks and NBFCs, such as, HDFC, IDBI, Shiriram, PNB, ICICI, SBI, and more with interest rates as low as 7.25%! Check out our services now!