Paying a mortgage is a part of the process to a dream of becoming a homeowner. However, instant access is one privilege that requires you to go through a never-ending paperwork. It is essential to know exactly the type of documents they will need and that they have them in order will save you time. This will also in turn even give you an upper hand in the repairs. This blog will take you through the major documents, which are important for any home loan applicant in India.

Home Loan Requirement #Identification Proof:

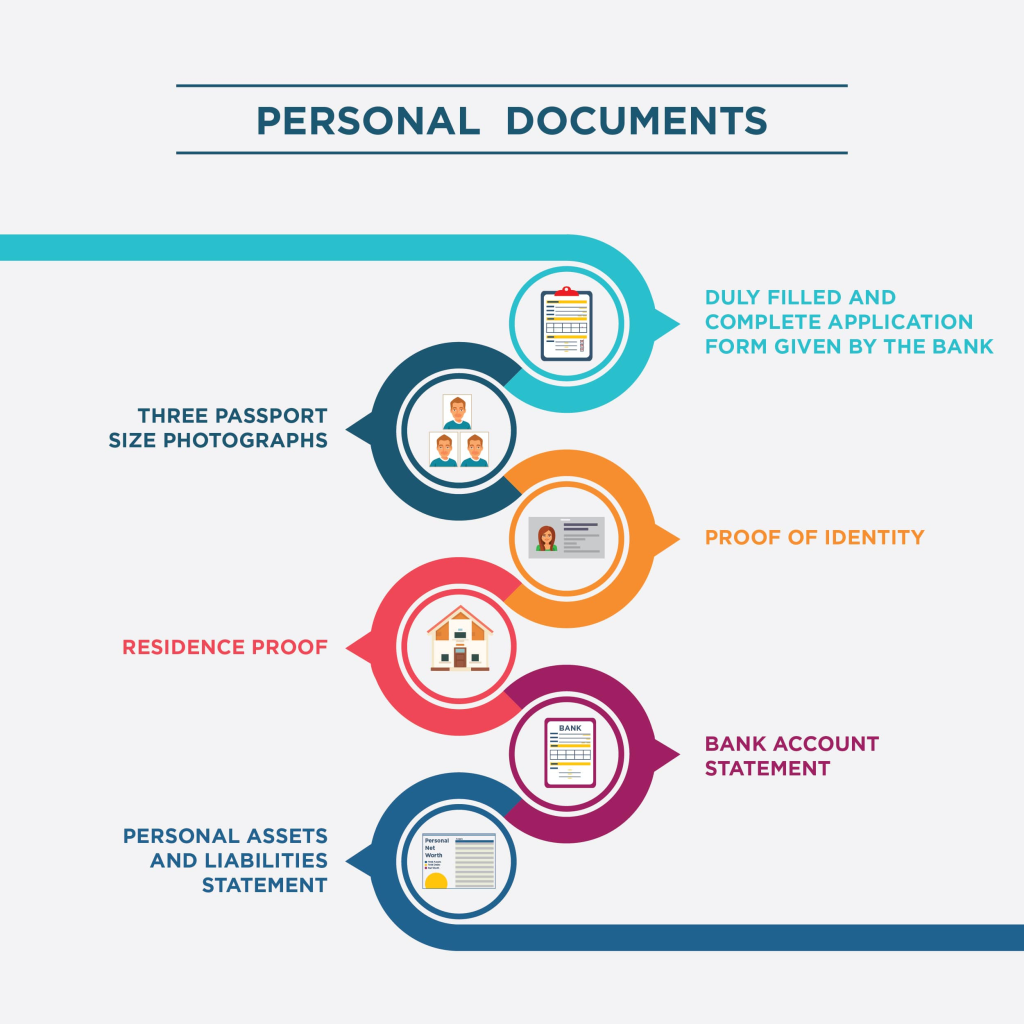

Before doing any formal procedures, it is recommended to identify yourself which is usually done with recognized identification documents. Usually, such documents consist of Aadhaar cards, passports, or driving licenses. The identity verification that your ID provides becomes the first step of major transactions, such as the homebuying process, where it lays the foundation for further documentations like pre-approval for a home loan. This first step is one of the most important points for the development of trust and legitimacy of different deals.

Home Loan Requirement #Address Proof:

The next step after confirming your personal identity is often supplying the residential address proof. Different types of address proof are available, including utility bills for electricity, water or gas, rental receipts and Aadhaar cards. This proves that you are currently living in a particular place and shows that you are a valid beneficiary of any transactions of a financial or legal nature. This data is very carefully put in by the lenders to check for the accuracy and compliance with the regulations.

Home Loan Requirement #Income Proof:

Securing a steady income is crucial when applying for financial aid, especially loans. Lenders analyze your ability to repay a loan by looking into your income evidence, depending on your employment status For instance, for salary-earning individuals, it could include providing payslips, income tax returns and Form 16. The process to be followed by the self-employed individuals is more detailed, include audited statements and tax returns reflecting business income. Through this careful check, borrowers can prove that they have the financial capability to fulfill their debt obligations, thus protecting the interests of all parties.

Home Loan Requirement #Property Documents:

Your documentation details the property being priced as the security in case of default which helps to prove its validity and ownership. Regarding fundamental documents, it is necessary to mention sale deeds that show transfer of ownership from seller to buyer, title deeds that confirm legal ownership rights, and documents of property tax filed by the owner illustrating compliance with local tax regulations. These documents not only serves the purpose of documentation of ownership but also ensure the legitimacy, and the authentic of the property, which helps the various parties involved in the transaction to feel secured.

Home Loan Requirement #Employment Proof:

Along with that, creditors, most of the time, ask for a certified record of your present employment to show them whether you are financially secure and have the ability to pay back the loan amount Normally, it can be in the form of a job letter or appointment letter that is provided by your employer, stating your rank, tenure, and salaries. Through the process of employment certification, lenders reduce risk of loan default, making them sure that borrowers have a reliable source or a job to cover their financial obligations.

Home Loan Requirement #Bank Statements:

The bank statements provide a comprehensive detailed record of your transactions and could therefore be used to see the amount you earned, your spending and your financial health. Lenders scrutinize these statements to see your credibility and the ability for the payback. More often than not, lenders will ask you for your bank statements spanning a few months enabling them to view your financial stability and behavior in a specific period. This set of indicators is basic for creditors to accurately assess your financial position and take well-considered loan issuing decisions. Having proceeded to the application stage, the bank can request updated statements to make sure that the financial viability is there.

Home Loan Requirement #Credit History:

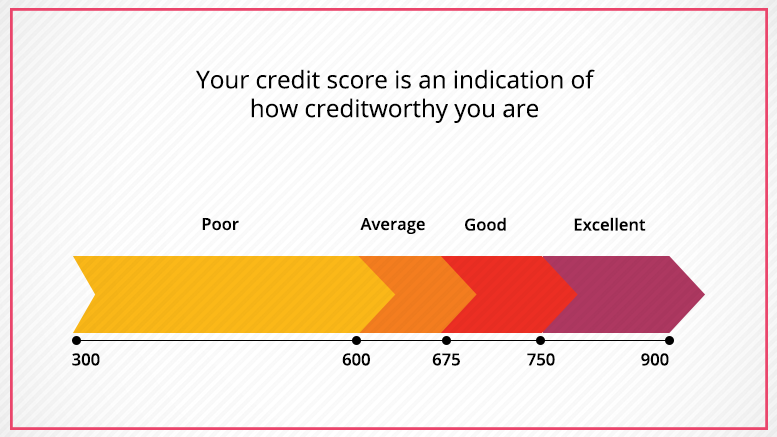

Your credit history acts as the centerpiece around which everything else is determined, whether or not you will be eligible for borrowing, and the conditions under which you can acquire a loan. Creditors use credit reports prepared by the sound agencies as a telling evidence of your creditability. These reports sum up your entire history of credit related activities ranging from repayment history, the existing debts, to level of debt utilization.

Through analysis of this information, lenders would consider the risk factor related with lending to you and therefore set loan terms accordingly. healthy credit history may be a ticket for preferable terms while unhealthy one could make interest rate to be high or even deny for credits. Therefore, having a credit record in good standing is a must for a person to benefit from a favorable financial services. Check your credit score here.

Home Loan Requirement #Legal Clearances:

Before closing on any property deals it is mandatory to ascertain that the asset has acquired all the permits and clearances and that the granting of these has come from the proper authorities only. This includes administrative authorizations from municipal corporations, development authorities, environmental institutions, and different other authorities. Going by these rules not only affirms the legitimacy of our property but also protects us from any probable legal disputes or liabilities in the future. Lenders as well as buyers may use these title clearances to lessen risks around the property investments and support conducting the deals in a lawful and smooth way.

Home Loan Requirement #Insurance Documents:

Furthermore, for certain lenders, there will be a need to obtain insurance for the property being financed. This is protective fence for the borrower and lender which provide a barrier from any kind of risks such as damage, loss, or liability. As borrower, you could be subjected to the requirement to avail a proof of insurance policy as a condition of the loan contract. Usually, this means presenting insurance documents that exhibit proof that the property is properly insured for the respective hazards. By providing insurance companies, lenders minimize their risk of losing money because of unforeseen events, and borrowers become at ease as the safety of the investment is ensured.

Home Loan Requirement #Declaration Forms & Additional Documents:

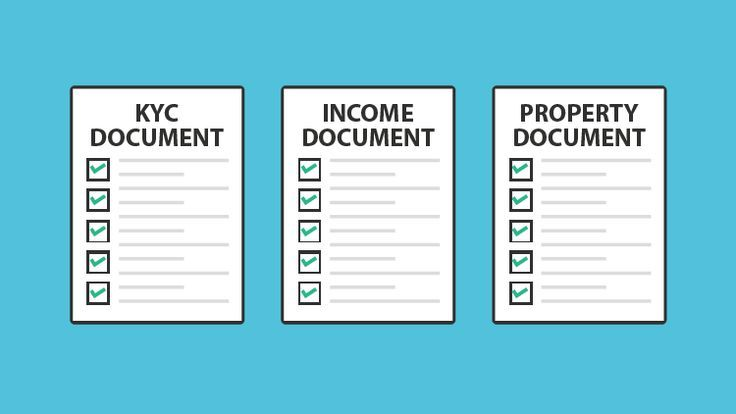

Declaration forms like Loan Application form and the KYC (Know Your Customer) form are mandatory for processing the application for a home loan. You must accurately and properly submit the form and make the invoice payment. Such as indicating the correct register for crediting the money and signing the slip.

The lender’s approval or rejection of an application will depend on additional documents. I.e., if they have special requirements, such as a power of attorney (POA), a No Objection Certificate (NOC) from the relevant authorities, or an income certificate.

Conclusion

Maintaining the documents you used to apply for the home loan and having them in order could help the lender go through their task faster. This reduces the chances of delays or rejection of the loan. You’d better go through your documents thoroughly before submitting them. This is to ensure that they do not have any mistakes and are also complete.

Please note that the discrepancies may result from such lack of attention to details. Recognize the fact that document filing in home loans has a vital role in attaining house ownership which is the dream of many people in the country.

To sum up, you can certainly handle the home loan documentation process. Even though it might look intimidating, with the required papers in hand it makes you feel more confident and in control. A structured and timely approach can help you go through the paperwork comfortably. As well as could grant you the financing to purchase your desired home. Contact Loanz360 for more information.