Introduction

There are several reasons why your credit score might be declining, but that shouldn’t stop you from pursuing dreams and even getting better in the process. Though borrowers with a low credit score might be at a disadvantage to increased interest rates and EMIs, knowing your options is always the best place to start your research at.

We are here to help you apply for bad credit car loans and find the best deals on instant car loan approval that you might benefit from in the long run of improving your credit score.

Bad Credit Car Loans Overview

To know how to make your credit better, you need to know what makes it worse. Bad credit is defined as the inability to make timely payments on your previous EMIs, thus giving your future lender a benefit of the doubt on your repayment capabilities in the future. Anything around 550 or lower is considered a low credit score that will likely hurt your loan eligibility, hence making bad credit car loans a thing!

The tables below show average interest rates for new and used cars, according to Experian’s State of the Automotive Finance Market Q1 2022 report.

Average Auto Loan Rates for New and Used Cars

| CIBIL Score | Avg New Car APR | Avg Used Car APR |

| 781-850 | 2.40% | 3.71 % |

| 661-780 | 3.56% | 5.58% |

| 601-660 | 6.70% | 10.48% |

| 501-600 | 10.87% | 17.29% |

| 300-500 | 14.76% | 20.99% |

In the above table, you can see the rates increasing with a decreasing CIBIL score. This also affects your down payments and what you pack in monthly installments. However, remember that bad credit car loans do not alone depend on your credit score – professional stability, income, type of vehicle, and credibility also plays a larger role in availing a loan at a good deal.

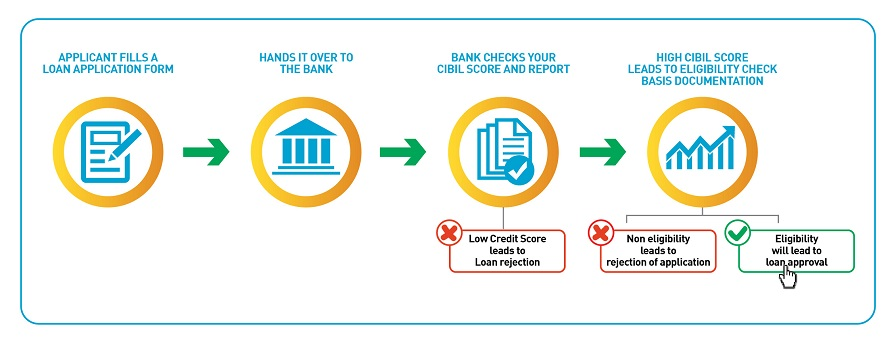

How To Apply For Bad Credit Car Loans?

The steps involved in getting bad credit car loans are similar to applying for a car loan with a good credit score. You choose the car, make, and model – compare your lenders and approach the lender. However, it will be advisable to remember that most banks will cost you more with a low credit score. So, what should you do to get bad credit car loans?

For Bad Credit Car Loans Find The Right Lender For Your Requirement

Though all lenders may look approachable at first, you should know what you are getting into before choosing a lender who has a good understanding of your situation and is willing to work along to make your credit scores better. However, there are 4 types of lenders you can reach out to

Banks: Most banks offer in-house financing to their customers. But the interest rates at banks keep soaring depending on your credit report. If you have a very low credit score, it is beneficial if you avoid looking into banks with credit score requirements.

NBFCs/Credit Unions: Most NBFCs or credit unions offer attractive interest rates to their borrowers. Moreover, they do not look into your credit report, nor is it mandatory for them. Yet, a membership at these unions will be important for you to get a loan from them depending on your relationship with the lender and your current repayment capabilities unlike with an NBFC where you do not need one.

Private Financiers: Online lenders or private financiers are the least reliable and most convenient of both the options above. The reliability is because of their authenticity or credibility, and the convenience is of their instant loan approvals. Also, if you are looking for lower interest rates, these lenders may provide you with a good bargain as they have to deal with lower overhead costs. But doing a background check and looking at their customer history is advisable before talking to them about your requirements.

Car dealers: Many dealers have their own financing options for car buyers. Although they charge you higher interest rates, you can always negotiate a better deal with them if you know your deals and offers in the market.

If you are not sure where to start, there are several third-party companies that mediate between the lenders and the borrowers, do the research for you, find the best deal in your budget, and stay reliable through the process of getting an instant car loan approval. They even charge you only hundreds for the service you are offered. This is the most reliable and easy process out there that can get you bad credit car loans without having to spend a lot of time searching for your options.

For Bad Credit Car Loans Offer To Pay A Large Down Payment

This is not the best part of your loan payment but is the most beneficial. Offering to pay a larger down payment will attract you a lower interest rate in the future and the trust of the lender. Although many banks provide a 100% on the on-road price, if you have a bad credit score, it is advisable to create trust within your lender of your repayment capabilities and better financial situation with a 20% down payment on the loan amount.

This will not only give you instant eligibility for the loan but also reduces LTV (Loan-to-value) ratio and lender’s risk. Therefore if you have a good amount saved for/on your purchase, you will have an upper hand on the terms of the loan with a higher down payment.

For Bad Credit Car Loans Take Smaller Loans That Have Greater Benefits

If the amount of loan you are looking for is small, the lender is more than happy to assist or trust in you even with a bad credit score. Why? Because – not only the cost is shortened but also the repayment tenure. Therefore, a lower budget on your car will benefit you in the long run by improving your credit score and saving more for any future purchase. This is one of the best options out there because you will not only get your car, if not a dream high-end car but can actually improve your credit score for any future loan.

For Bad Credit Car Loans Find A Guarantor

Do not panic. The guarantor is not mandatory. But if you are looking forward to your lender trusting you on your repayment capabilities, having a guarantor will benefit you on the eligibility, lower interest rates, and EMIs. You can either ask your family, friends, guardians, or even colleagues to co-sign the loan. However, make sure, your guarantor knows the risk and trusts you on the deal, because; at any given time – in any given circumstance if you fail to pay the loan, your guarantor will be responsible for it.

Keeping these in mind, you can also look for several other options if you have a bigger budget and have the capacity to repay your EMIs timely. You could for in-house financing if you think that higher interest rates wouldn’t be a problem for you as long as you are getting your dream car.

The Bottom Line

Bad credit car loans are not an impossible task anymore. Anything below 4% is an excellent interest rate on your auto loan. However, look into your credit history, budget, interest rates, and EMIs before putting your trust in the lender. Because at the end of the day, if you are unable to repay your lender on time, there will be consequences for your present and future purchases. To not face any legal issues and notices, remember to chart out a plan, choose wisely, and budget accordingly.

If you are still unsure how, give us a call at Loanz360 to get an instant car loan approval by scheduling a free consultation with our representative, who will take you through the process of buying a car at the best rates possible, even with a poor credit score, thus saving your time, money, and sweat. Apply for bad credit car loans today and enjoy your benefits with our financial partners. You can also check out another source here, who can help you with your car loans even with a bad credit!