Nowadays, impact investing has shown up to be a huge kick start. Overcoming the contradiction between financial profits and community contributions. This is where the influence of impact investing is making its mark within the Indian investment space. It is by helping prioritize social and environmental welfare together with financial success.

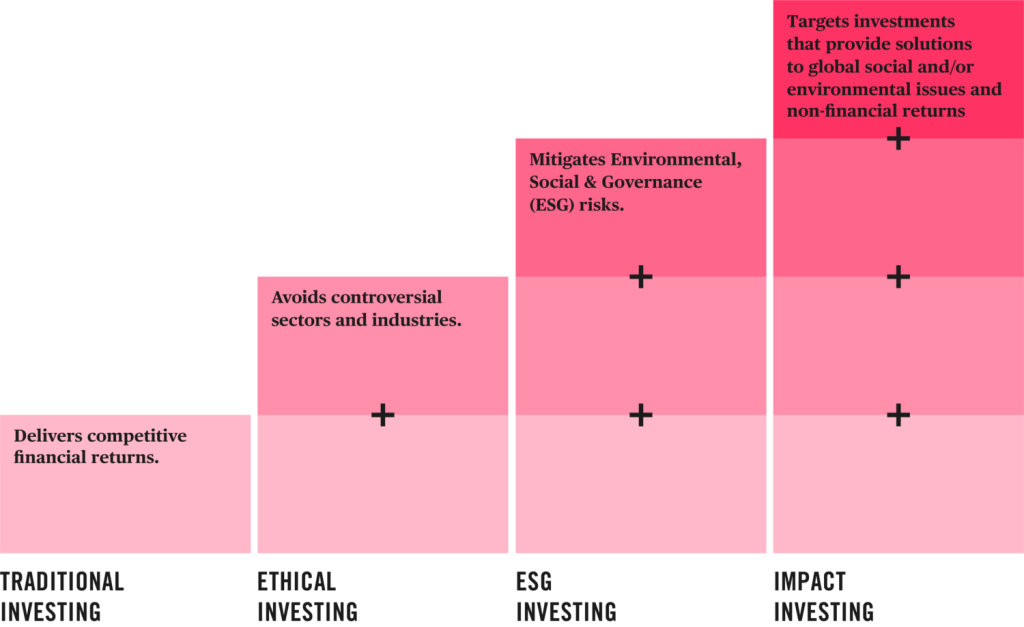

Social impact investment covers multiple methodologies. Including impact funds and social impact bonds intended for support of existing solutions. Also for the most urgent social and environmental issues that also offer investors the possibility of good returns.

What is Impact Investing?

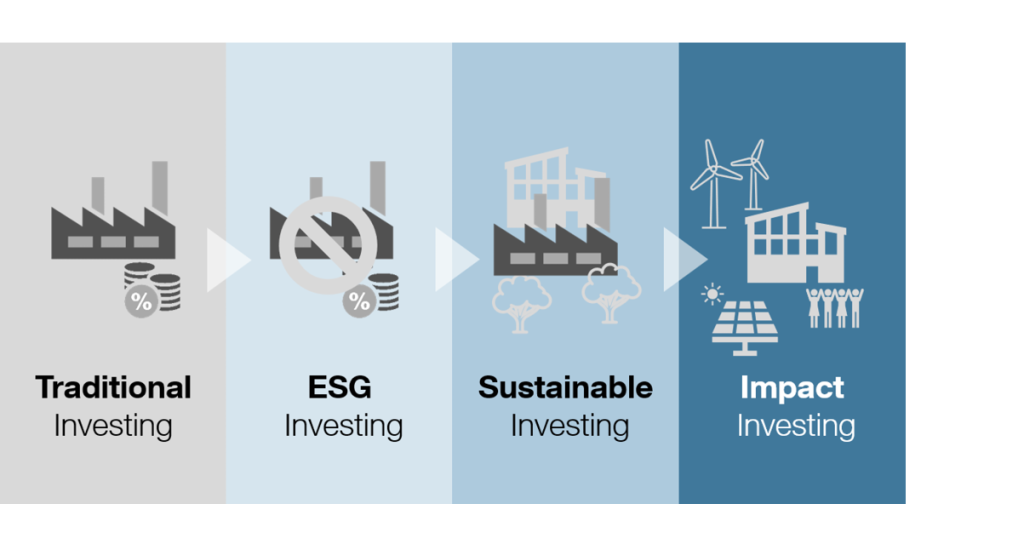

Impactive investing is without doubt the root cause of effect of attracting funds to projects as well as social enterprises that in return generate both financial returns and measurable social or environmental impact. Impact investing promotes the good of society and the environment while achieving success, in stark contrast to the standard model of investing focused solely on gaining profits. This shift toward this vision corresponds to the growing consciousness of sustainable development and corporate accountability.

For what reason impact investment matter in India

In India, where the sector is growing by leaps and bounds, impact investing has great potential to change the world. Issues such as poverty, health, education, and sustainability of the environment need philanthropy and there are many better ways to deal with these issues. This model provides a possibility for private investors. To move capital to those areas which hold a guarantee of propagating effects of change.

Impact Funds: Continuing the Eco-Friendly Agenda

Impact funds are a critical tool to help attract more capital. To purposes that have high social and economic value. These funds, set up by specialists and teams, are that of those businesses. That is not only about the financial returns but also, the impact of those businesses in the social or environmental field. India has set its eyes on impact funds that are infiltrating vital sectors including energy efficiency, health service provision, educational technologies, and responsible agriculture, evoking transformational changes.

Social Impact Bonds: Collaboration as the Focal Point

Social Impact Bonds (SIBs) being another tool that is in the pockets of impact investors in the impact investing area. Investors, service providers, and governments collaborate to address social challenges, creating what are known as social bonds. In India, these collaborations, known as Social Impact Bonds (SIBs), have been utilized for various purposes. Such as educational improvement, skill-enhancement, and healthcare delivery.

Instead of leaving social needs to the charity sector and doing nothing annually, SIBs link making a profit with social outcomes. Outcomes that are measured beforehand, and which this way incite efficiency and accountability of the social programs.

The Technology Prowess in Impact financially

Technology, in the face of impact investing, is a mighty catalyst, which modifies the whole domain of finance and increases the level of its ability to change the world. The birth of advanced platforms coupled with special tools opens the way for a new era of effectiveness providing better transparency, assessment of risks, and smart financial decisions. Such technological improvements are not only a place of great creativity but also practical instruments that help make the whole investment process more rational and smart.

At the core of the technology-driven revolution in impact investing lies the growing of advanced monitoring platforms designed to facilitate impact measurement. These platforms make use of big Data, artificial intelligence, and Machine learning to measure the financial and social performance of investments with a level of precision and details that have not yet been attained. This is achieved through technology that provides investors with views on the actual results of capital allocation. These tools thus enables investors to make more intentional and purposeful decisions.

Technology also revolutionized risk management, the risk of which impact investors conquer via advanced solutions which are designed to deal with the complex web of financial risks. Impact assessment algorithms with sophisticated risk assessment capacity enable investors to detect and minimize specific risks the initiatives involved may have in order to generate more robust and sustainable portfolios. The combination of predictive analytics and scenario modeling allows investors to accurately forecast market movements and make slight adjustments on their portfolio to improve risk adjusted returns.

Moreover, technology has created platforms to facilitate the development of intelligent investment strategies diversified to the unique tendencies of impact investing. Powerful tools like portfolio management platforms which screen dashboards and performance analytics let investors observe their impact portfolios results in the present time. Through using automation and algorithmic trading, investors can execute trades rapidly and effectively, pocketing trading approaches as they get even while they lessen their transaction expenses.

Challenges and Opportunities

Though technology is good in the sense of advancing impact investing to greater heights, it is not free of challenges which, if not addressed, may hinder its effectiveness and its wide-scale adoption. Striking the foremost of challenges is the lack of common impact standards, which obscures fairness and cross-section transparency in impact investments. Also, regulatory obstacles and compliance difficulties pose hurdles for adoption of impact investing by investors, since it takes them away from full realization of the potential of impact investing.

It is true, however, that tech-driven impact investing is confronted with certain challenges, which are however being remedied through the use of different approaches. The public sector, impact investment groups, and some industry associations are also working together to develop set standards for impact measurement and reporting, which will help to ensure accountability and transparency. Also the regulatory reforms to maximize the yield of the impact investing is in place with the vision of creating a sustainable investment environment.

The Future of Impact Investing in India

Perhaps, the future of impact investing in India involves an integration of its objectives and offering with those of other social enterprises. Most notably microfinance institutions, to expand the potential reach and viability of these types of investment.

The pathway of sustainable capital investment in India pulls us towards a brighter future. Profit-minded investors with a purpose are increasingly recognizing the market, which forecasts soaring growth in the sustainable finance sector. Governments’ efforts to advance sustainable finance by means of appropriate incentives, novel impact reporting frameworks, and information exchange at a level of responsible actors will be pace-setters.

Conclusion

Impact investing is no longer a trendy buzzword. It is an ideological change that started to redefine the position and capabilities of investments in realizing constructive social and environmental changes. In India where the problem (of poverty) is too huge, impact finance as a progress will be achieved by the method of inclusive and green development. Investors who follow this logic will not only accomplish their financial goals but also build this world into a better one. To live in for future generations to enjoy.

On the whole, impact investing in India is driven by factors beyond just financial profits. It is a way of creating the long-term impact that the society and planet needs. Through the rapid development of this principle, it can come up with the concepts of investment. Which would serve for extraordinary revolutions in this area that await us and will be put into life. Contact Loanz360 for more information.