Introduction

Predicting the future is impossible, however there are possibilities where you can take additional precautionary measures to prevent the potential disasters from taking place in the first place, especially when considering a personal loan. Such a phenomenon is called forecasting. In the world of financing, defaults, missed payments, penalties, etc are a common parameter determining the unexpected expenses of an individual on debt. Whether you have a stable income today or employment, it is not always a possibility tomorrow, however the chances may be slim, but are possible.

COVID is such a situation where several institutions and individuals faced a severe financial crunch and economical crisis. Not only did the nation face an extreme or severe health debacle but also a sharp financial decline due to the national emergencies set forth in several countries. However it may not be possible for the same situation to occur in the similar way, we may not understand the nature of such other emergencies, in personal, professional, or global life. Therefore, to be well prepared in times of financial difficulty you should know what it means to skip EMIs.

In this article, we will discuss what it means to skip EMIs, make late payments, or even default on a personal loan. The consequences however will depend on the severity of the situation and various other factors, therefore understanding is required before you go fishing without knowing the weather forecast.

What Are Personal Loan Defaults?

The process of defaulting on the personal loan starts at the moment an individual starts missing his payments or fails to meet the repayment schedules, thus creating discrepancies. Therefore, if an individual fails to meet the due date as on the initial agreement, several times in a row, is thus defaulted. There are two major classifications on personal loan defaults, as considered by banks and NBFCs: Major and Minor personal Loan Defaults.

Minor Personal Loan Default

There is a grace period of 3 months or 90 days within which the individual or the borrower of the personal loan will be warned about his late or missed payments while he will be charged penalties or fee depending on his repayment behavior on the loan. Those with minor defaults on the personal loan fall under this category of not meeting their due payments for less than 90 days. Minor defaults are recoverable without denting credit or CIBIL scores. Therefore, during a minor default, you will only be warned by the banks and thus have a probability of pulling the plug before a major short circuit.

Major Personal Loan Default

The period after 90 days, after which you have been duly warned, have been penalized, and been charged by the bank, is considered to be a major default. This is when the individual ignores the fair warnings and still fails to repay the personal loan even after multiple notices on the behalf of the lender. With a major default, you are likely to sign up for a legal proceeding or lose a collateral if you have submitted one when taking out the personal loan, while your account is marked as a NPA (Non-Performing Asset).

This will mean that your credit score is impacted, credit report is dented, and even other banks or lenders in the future are unlikely to trust your repayment capabilities to support capital.

The Stages Of Missed EMI’s On A Personal Loan

Personal Loan Stage 1: 1 – 3 Month Period

Stage 1 of missed EMIs is the stage of minor defaults. The consequences during these stages are recoverable without serious consequences on the finance, however not to be taken lightly. Some outcomes of missing on a personal loan EMIs over this period are listed below.

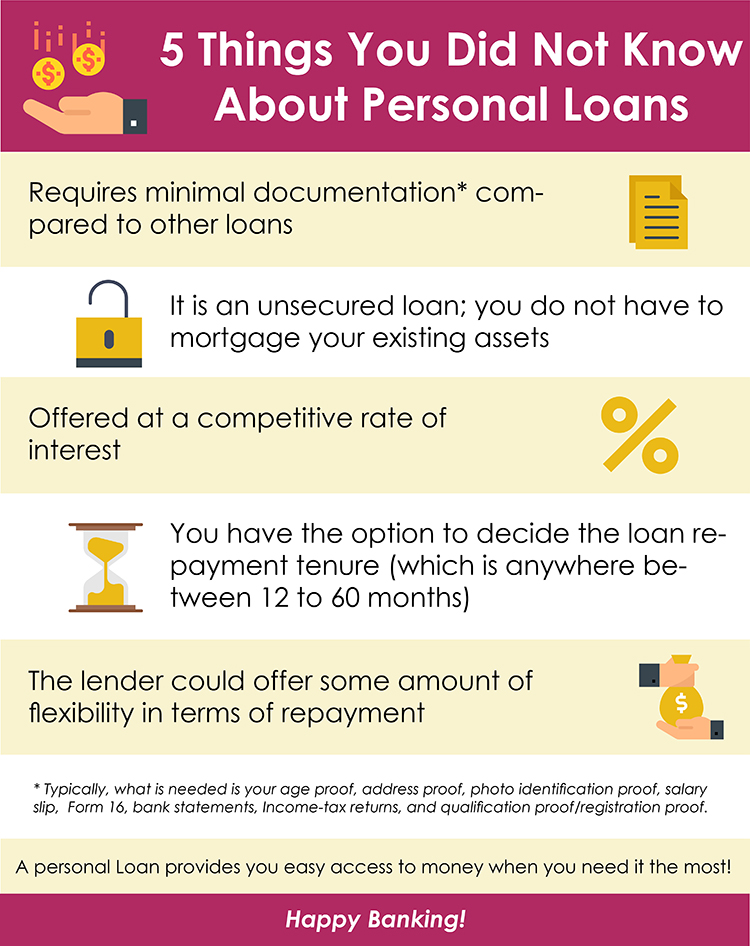

CIBIL Score Impact

CIBIL or credit score is a well-known parameter in the loan universe. Most banks offer unsecured credit checks for the credit score of the borrower before sanctioning a personal loan. An applicant with a credit score 700 or above is considered to be an excellent choice for the personal loan and is thus trusted by the lenders to support capital. However, missing EMIs on your personal loan can make your credit score drop by 50 to 70 points depending on the severity and period of failure, therefore taking away your dreams of getting a future loan with better deals.

However, this is not a major impact considering that you can build your credit again when you have repaid your EMIs.

Negative Credit Report Record

Although you have repaid your EMIs and have closed your late payments, your credit report already now holds a record of your late payments, unless requested by the bank under certain conditions. This means, even if you would recover from your credit fallback, you will likely have a red flag on your report, to make your potential lenders fear of sanctioning a personal loan, thus lowering your borrowing limits, or applying additional conditions on the personal loan, however may not be the case otherwise.

Penalties & Fee

Late payments or missed payments attract fees and penalties on loans for the lenders or banks to recover from the loss. Depending on the lender, varying from bank to bank, the percentage of these fees may differ. However, the penalty charged may be usually around 1% – 2% of the EMIs lapsed.

Higher Interest Rates

Delay in repayments include higher interest rate, of up to 2% per month, depending on the lender or the bank. This will likely impact your EMIs in the future and may increase your EMIs, thus the total amount repayable.

Deflated Creditworthiness

A fallback in credit, a red flag in the report, penalties on the personal loan, all combined impact your creditworthiness, when you apply for a personal loan in the future. Although you may recover from all these factors with a strict regime of managing your budgeting and expenses wisely, you will still fall under a minor disadvantage with the lenders if the impact is large.

Personal Loan Stage 2 – 90+ Days

Once you have crossed the 3 month period, or 90 days, you will now enter a major personal loan default phase with major consequences that may not entirely be recoverable. Though nothing is life threatening, filing bankruptcies is always an option, this will certainly put you in a tight spot for a longer period. The consequences of major defaults include

The Hounding Of Recovery Agents

The moment your EMIs have started to lapse, the lenders appoint recovery agents to chase through your in and outs continuously. Though at first this is not dreadful, repeated behavior of missed EMIs will provoke such jarring experience to only peak as the time flies with finally a dead silence following the storm of legal actions or ceasing collaterals.

Legal Action

The moment the bank or the lender realizes that you are not answering your calls or have not explained the situation, this is where the panic starts. The banks or lenders won’t jump right away into a legal action without approaching their customers first. However, some customers, beyond irreparable, avoid banks when facing a financial crisis, thus making lenders untrustworthy of their repayment capability. In such continuation of events, the lenders will take legal actions against the borrowers to recoup the money.

Legal actions are mostly the cause of defaulting on an unsecured personal loan since there is no collateral to cease. These legal ramifications may vary in extent and impact and may pull the soul of the borrower with proceedings spanning over 5 to 10 years, if serious.

Collateral Loss

If you have taken out a secured personal loan, you need not fear legal issues or court dealings, however the fear is not non-existent with your collateral being withheld. In cases of a default spanning over 3 months without an explanation or reason, the bank will start to seize your ownership on the collateral, and is legally liable to auction or sell your collateral to recover from the loss. This might not sound as scary as standing in the court, however, you stand a chance of losing your hard earned money, therefore is definitely alarming.

How To Avoid Defaulting On EMIs?

Budgeting

Planning your expenses will help to budget your income wisely without falling short of capital when repaying personal loans. If you are facing a shortage of finances when repaying loans, try cutting expenses and schedule your budgets tightly around your income capabilities, thus avoiding any defaults or missed EMIs.

Communicating

Communicating with the lenders will certainly help to an extent even if not entirely. If you are to shut off the lenders when faced with financial crises, this will create a greater difficulty when the lender does not know the situation. Hence, communicating your situation with the lender and discussing your options is better when you think that you are going to miss an EMI for a month or more. Rule number 1 is not to avoid their calls.

Part Payments

Whenever you have saved up a good amount of funds, it is always better to make part payments. Request your lender to make part payments when your finances are in a good shape, thus lowering your EMI burden in the future when in the off season or in a financial crisis.

Smaller EMIs

If you are having a financial tight situation, you can go for smaller EMIs for a longer tenure, however followed by higher interest rates. But, this is not always a bad deal considering that you can request a part payment in the future whenever you have abundance in funds, thus closing in the personal loans even before the tenure, discussing with the lender.

Moratorium

As discussed earlier, situations such as COVID cause an economical crisis, country wide, with individuals and organizations facing severe financial crunch with loss in GDP. However in such cases, the bank may themselves help you through the difficult situation by extending a moratorium period lasting fairly a few months, extended upon worsened situations. In such cases, you can experience a relief in EMIs or other offers as directed by RBI.

Balance Transfer

If you are facing high interest rates and are unable to pay off personal loans and have forecasted a financial difficulty or a gap between your income and expenses, refinancing or balance transfer are the best options available with better deals and lower interest rates. This will allow you to restructure your personal loan at better conditions, thus avoiding any future difficulties.

EMI Free Period

If you have been facing a job loss or a serious illness or any other condition that might have suddenly pushed you into debt or loss of income, you can request the bank for an EMI free period. However, the conditions may differ from bank to bank and the banks might have to analyze your financial situation to grant such an offer. This period will save you from penalties, fees, credit dents, etc, and make an exemption for you to reconstruct by repaying after the period expires, thus giving you a chance to create income within this time frame.

Flexi Payments

Flexi personal loans offer a chance for individuals to pay interest only on the amount utilized than the limit sanctioned. If budgeted properly, these personal loans will help you manage your finances better by not restricting your EMIs monthly to the same amount. However, if not used properly, you are at risk of abusing funds, and may fall into deeper debts, if so.

Final Word

Lapsed EMIs are a major hindrance in a repeated behavior, therefore to be restricted before the damage is irreparable. Now that you have learned the consequences and how to avoid such risks, you are at a better understanding of your finances and how to organize them.

If you are looking for capital assistance and need help, contact Loanz360 to get the loan at the best prices and deals instantly. Check out the eligibility criteria and documents required in the services section under a personal loan.

Your loan need not be a burden with Loanz360. Loanz360 is an authorized financial supermarket, with financial dealers across India. From management to the protection of assets, we provide all financial services to our local and international customers alike with the help of our in-house financial partners.

If you are still not sure how, give us a call at Loanz360 and schedule a meeting with our representative, who will take you through the process of buying and financing a loan, along with comparing the market rates and finding the best deals that fit your pocket with discounted offers and flexible services allowing you to repay EMIs at ease without succumbing to missed payments.

8 Responses

Your tips for securing the best possible terms were invaluable, and I feel much more confident approaching lenders now. How can I contact your agent?

I do not even know how I ended up here but I thought this post was great I dont know who you are but definitely youre going to a famous blogger if you arent already Cheers.

As someone new to the world of loans, I found this blog post incredibly informative. It’s great to have access to resources like this that help break down complex financial topics in an easy to understand way.

Your tips on managing loan repayments are incredibly helpful. It’s often the little details that make a big difference when it comes to borrowing money, so thanks for sharing your expertise!

I’ve been considering taking out a loan for a while now, but I wasn’t sure where to start. Your blog post has provided me with a roadmap for navigating the loan process, and I feel much more confident moving forward. Certainly, I shall return more frequently, just as I have been doing almost constantly, should you uphold this upswing. Thanks a bunch!

What a fantastic resource! The articles are meticulously crafted, offering a perfect balance of depth and accessibility. I always walk away having gained new understanding. My sincere appreciation to the team behind this outstanding website.

I’ve been hesitant to apply for a loan because I wasn’t sure how it would affect my credit score. Your explanation of the impact of loans on creditworthiness has helped remove some of my concerns. Thanks for the valuable insights!

The knowledge compiled on this website is astounding. Every article is a well-crafted masterpiece brimming with insights. I’m grateful to have discovered such a rich educational resource. You’ve gained a lifelong fan!