Introduction

There is no better choice as long as the choice is healthy and you are happy with it. But there are several factors that go into determining if your choice can actually be called “Healthy”. And this health down the road will eventually affect everything else around you. Your economy, stress, and relationships. So what is “your healthy choice”?

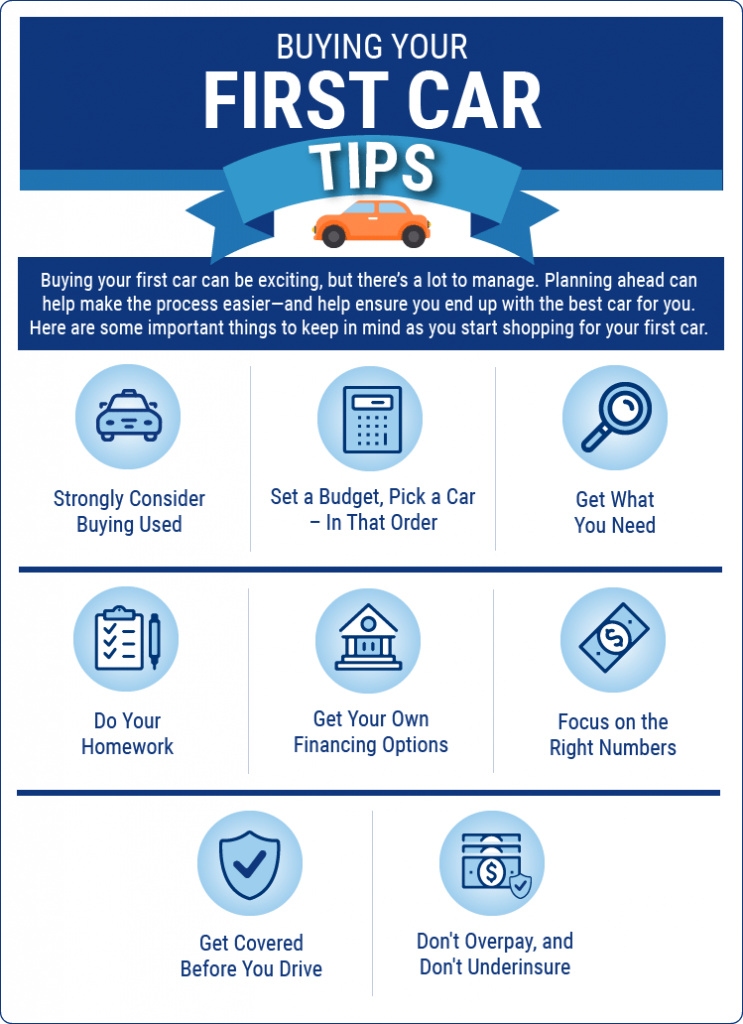

When it comes to buying a car, new car vs used car has been a century old debate. There are a lot of sellers, dealers, and lenders as enthusiastic as you to work with you towards your dreams. But most of them will scam you if you are not thorough with your homework. If you do not know the basics of your assignment, it is likely that the loan sharks will eat your income alive. Therefore a little research is the most important part of a car buying procedure to ensure that your hard-earned money is not going down the drain.

The Better Choice

First, to decide which is the better choice for you, from the new car vs used car debate, you will need to know the differences between new car vs used car.

Differences between a new car and a pre-owned car

| Key factor | New Car | Used Car |

| Warranty | 100% warranty | Depends on the owner (Usually no) |

| Reliability | High | Low – Medium (depending on the owner) |

| Servicing | Free servicing opportunities by the showroom for several times in a row. | Repair and servicing is an added costs if the car has not been well maintained over the period. |

| Ownership | Long-term ownership > 10 years or more depending on your vehicle maintenance and care. | Ownership depends on the age of the vehicle. A 10-year-old vehicle is likely to last another 5 years before you will need to de-register and so on… |

| Loan tenure | is 1-7 years, extended up to 10 in some cases. (Though not preferable) | 1-5 years, extended up to 7 in some cases. (Though not preferable) |

| Interest rates | Interest rate percentages depend on the down payment. With a 20% down payment, good CIBIL score, and credit report, you are likely to get a better percentage on your car than a pre-owned vehicle. | Attractive interest rates start from 7.5% and extend to 16.80% p.a |

| Depreciation | New cars depreciate faster. The moment you drive off the lot it loses a 10% on its initial value | Used cars have already suffered the losses, therefore are considered worthwhile in the long run. |

| Add-ons or additional charges | You should pay accessories cost, registration tax, RTO fee, and any other add-ons are added on top of the cost of the vehicle. | There are no additional costs for the features already present in the car. Although there is no chance for customization. |

| Features | You can customize as you wish with the added cost incurred | No choice for personalization or customization. |

| Cost | Has ex-showroom and on-road prices depending on the make and model of the car. Often not negotiable. | Has a fixed price depending on the seller and the condition of the vehicle. Often negotiable over the paperwork and proofs provided. |

| Options | There are a lot of options for the new cars in the market with upgraded features and better technology. | There are a lot of options in the market but mostly within your budget or requirement. One of both. |

| Financing | New cars usually have better financing options from various lenders with more options to choose from. | Used cars also have been vying with the new in the market. Varying options from lender to lender. |

| Insurance | New cars usually have a high insurance policy depending on the model of the car. | Pre-owned cars cost less to insure. |

Now that you know the differences, the question arises!

Which Is The Right Choice For You? New Car Vs Used Car?

Now that you know the basics of what you are dealing with, you should start considering the factors that matter to you the most. Price, make, model, technology, features, repayment capabilities, interest rates, EMIs…

Buying A New Car

If your priority is on the reliability, warranty, and features of the car, buying a new car is beneficial if you are capable of paying your monthly EMIs depending on the price and model of the car.

1. Check your credit report history, CIBIL score, and repayment capabilities depending on your work stability.

2. Think if you want a pre-approved car loan, in-housing car loan, or any other type of loan depending on your capacity and requirements.

3. If you have a good credit score, go for a banking lender, if not prefer an NBFC or a private financier.

4. Remember that the interest rates may vary from lender to lender and you may be at an advantage if you have a good credit history.

5. Choose 3rd party services to do your research if you can pay a little fee from your pocket or do not have the time to do the research for yourself.

Keeping in mind, these will help you with buying a new car. No matter what you decide, check with your lender your financing options, so that you are not drained of your capacity down the road when repaying the loan sum.

Buying A Used Car

If your priority is a low price and a good value, new car vs used car is no longer a debate, buying a pre-owned car may offer you a better deal, sometimes at zero-interest loans at lower down payments and minimal EMIs.

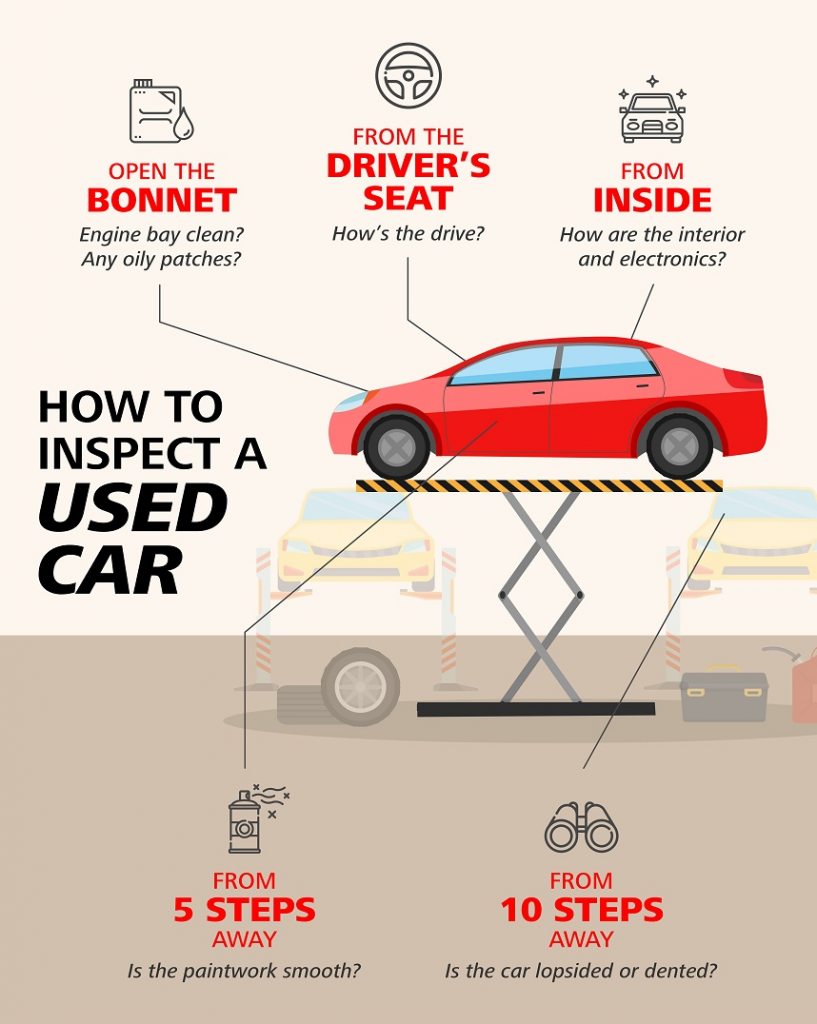

1. Check with the seller the documents and proof of service on the car. If the car is well maintained and has proper certifications.

2. Negotiate the price with the seller depending on the features, make, model, and resale value of the car in the market.

3. Check your financing options with different lenders and make a deal with the most reliable and beneficial option.

4. Calculate how much you can save on the insurance premiums on your potential car.

5. Get the car registered in your name and ask the seller for a transfer of the documents.

By doing so, pre-owned cars are the most sound choice if you have a constrained budget. But if you do not have one, it is good to buy a new car if you want one in the long run. Whether you are a salaried employee or a business owner you have a lot of schemes that offer lower interest rates on your vehicle, all depending on the repayment capacity.

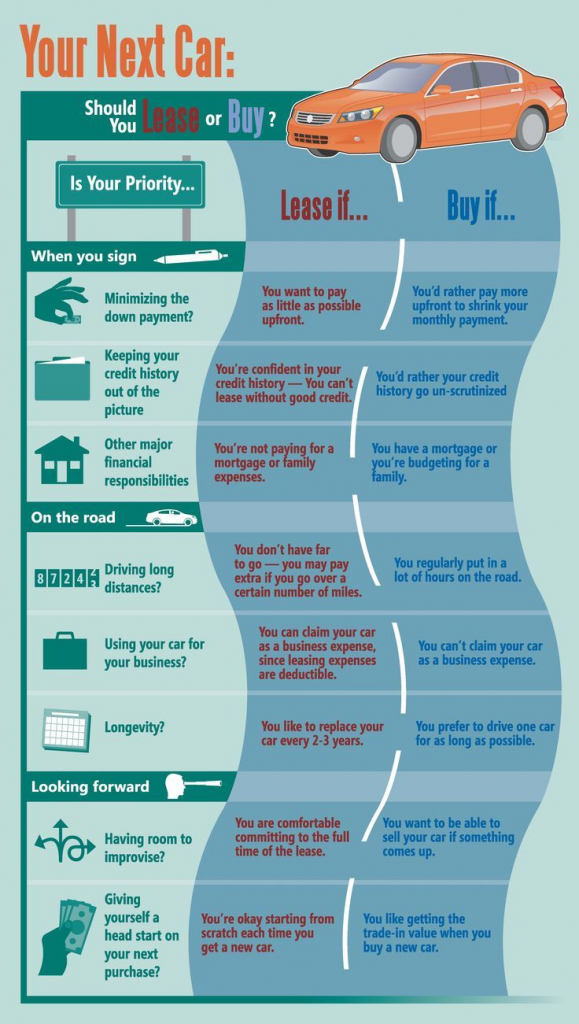

The Right Choice: Buy or Lease

The Bottom Line

New car vs used car is a tale as old as time. Nothing goes into profit without research, so whether you are buying a new car or a used one, it is advisable to do your homework before diving into the pool of choices. If you know little about cars, then hiring a third-party agent like ours may help you with finding the best option out there within your budget without having to pay a large sum. The fee may be as low as hundreds that we spend on something invaluable on any given day.

If you are still unsure how, give us a call at Loanz360 and schedule a free consultation with our representative, who will take you through the process of buying a car at the best rates possible, saving you time, money, and sweat in acquiring the best car loan in the city. You can also check out other options and offers on your car today, here.