Investing through real estate crowdfunding has become the most preferred choice for investors. Who also wants to explore different markets and create a percentage in crowded housing. As Fundrise Investment and other fundraising platforms get more popular, Indians opt to do this method of investment. They are ready to put their money on real estate projects not only in the country but even abroad.

How much is Real Estate Crowdfunding?

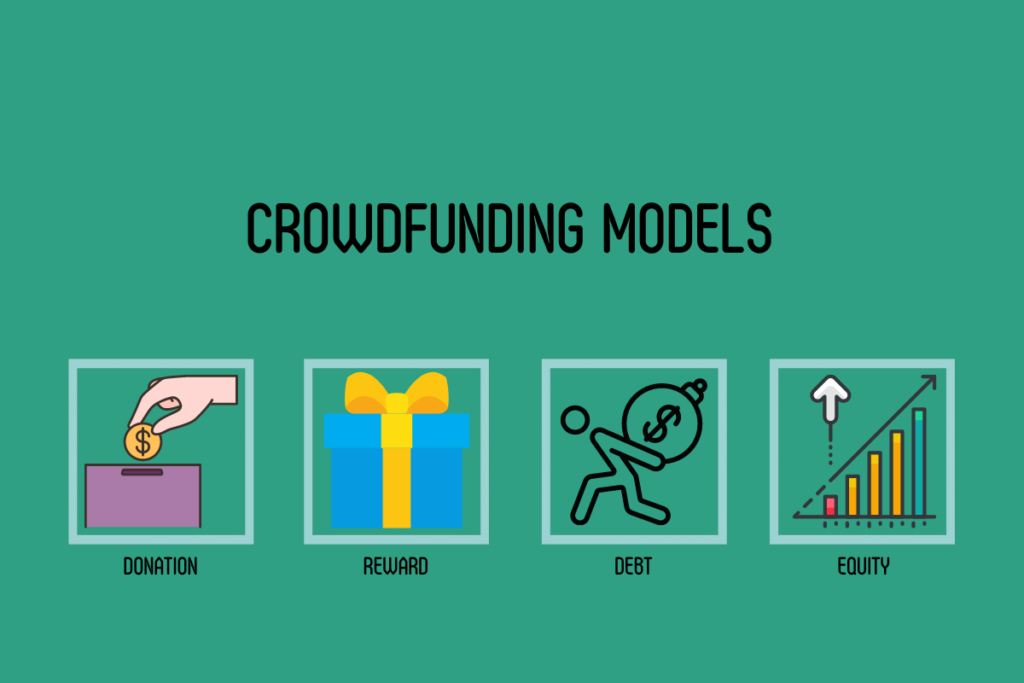

Real estate crowdfunding is an instrument through which money is accumulated in a community of many individual investors. To invest in the given real estate projects As a result, even small scale investors can get on board with real estate investments. That would be through the involvement in large scale projects that were previously closed to small investors.

Real estate crowdfunding has become a transformative tool in the investment world, where individuals can combine their borrowed capital and collectively invest in real estate projects. The democratization of investment opportunities which the crowdfunding has created has removed the barriers to entry, allowing even small investors to participate in projects that were previously reserved for rich individuals or institutional investors.

How Does Crowdfunding Work?

Intermediate agencies such as Fundrise Investments acting as intermediaries connect investors and developers. Or even business owners who are in need of money for their projects. Investors can have the same tendency of trawling through the different projects that are listed on these platforms. Analyzing the gains and the risks and finally buying the ones which meet their investment goals.

Real estate crowdfunding mechanics are rather easy to understand. Fundraise platforms function as intermediaries; they link investors with property developers or owners who are searching for funding for their projects. Investors are given the freedom to look at a huge number of initiatives listed on these forums, examining indicators like potential returns and related risk levels. This high degree of openness and transparency equips investors with the information they need to make decisions that align with their investment goals.

The Merits of Real Estate Crowdfunding

Easy participation of the investors is another reason of a high interest to this instrument. As compared to other building investments which require a lot of capital, crowdfunding is the best economical option. This one place where one can invest the smallest unit of money even he/she has, and the risk is made bearable, and that’s a big plus. Investment also serves as an effective way of spreading the risks by disseminating money into different projects. Moreover, the fact that it helps a lot in reducing the overall risk.

One of the main advantages of real estate crowdfunding is its low minimum rise. Real estate equity investing usually requires large capital inflows, but crowdfunding enables individuals to invest smaller sums, making equity participation more feasible. This accessibility, aside from the democratization of investment opportunities, also defines financial inclusivity by permitting the participation of a wider percentage in real estate investments.

Investing Across India

Real estate crowdfunding provides investors with an unmatched chance to join in residential projects in India, both at its most enhanced locations and its up-and-coming new markets. With new venture being the trend, investors are given the liberty to chose projects, which suits their risk appetite be it residential or commercial.

Crowdfunding in real estate in India let the investors experience numerous investment alternatives. The investors can get down to business with projects like residential developments in the fast-paced cities like Mumbai, Delhi, and Bengaluru or can explore the commercial projects which are fast growing in the metro cities. The flexible nature of the alternative investments will provide the investors the ability to shape their portfolios according to their preferences and acceptable risks.

Risks to Consider

Both, the promising prospects of real estate crowdfunding and the necessity of being cautious and recognizing the inherent risks should be kept in mind by individual investors. The market volatility so often associated with project delays and ever-changing regulations are challenges that can negatively impact returns. Conducting thorough and proper due diligence and choosing platforms with transparent transactions is a significant condition to be met to minimize risks. Through risk management, investment decision can be closely linked to increase in capital while leaving room for profit optimization.

Choosing the Right Platform

A selection of the perfect crowdfunding platform is sine qua non for investors who are interested in multiplying their funds in India’s real estate market. Factors like platform reliability, criteria for project selection, and fees system should be a consideration in investment decision-making process.

The platform Fundrise Investment puts investing on the forefront where transparency, investor education, and risk management are the primary goals, thus helping to develop trust and confidence between investors. Through teaming up with widely reliable platforms that showcase transparency and dedication to investor protection, investors become able to improve their investment experience and, accordingly, grow their return on investment.

The Future of Real Estate Crowdfunding in India

Real estate crowdfunding in India will have a bright future as technology advances, and new regulations are forged. The evolution of fintech and its integration in a strong regulatory framework is conducive to the development and expansion of the crowdfunding ecosystem. The number of influencers and companies choosing crowdfunding as a novel investment strategy grow daily resulting in an evolving crowdfunding landscape with many opportunities for the investors. With time, as the industry gets honed and refined, investors will come face to face with better accessibility, transparency, and efficiency in real estate crowdfunding in India.

Conclusion

Investors are also attracted to real estate crowdfunding which allows the investor to diversify the portfolio. Accessing some exclusive property projects and having a contribution impact on the improvement of the real estate sector of India. One such platform is indeed Fundrise Investment. That has taken the lead in this space for both the investors who wish to navigate it confidently and who rely on them to conduct their research and complete due diligence.

Real estate crowdfunding from India therefore provides unique investment avenues. With advantages of being accessible, diversified and potential for growth. Through the use of Fundrise Investment and keeping up with market trends, investors can take advantage of their investment decisions and not miss any chance present in real estate crowdfunding. Contact Loanz360 for more information.