Initiation of entrepreneurial life is thrilling undertakings without and without doubt various hurdles of financial charisma. It is vital for startups to gather needed funds, mostly through a mix of seed funding and business loans, to propel operational development.

Business Loans #Seed Funding:

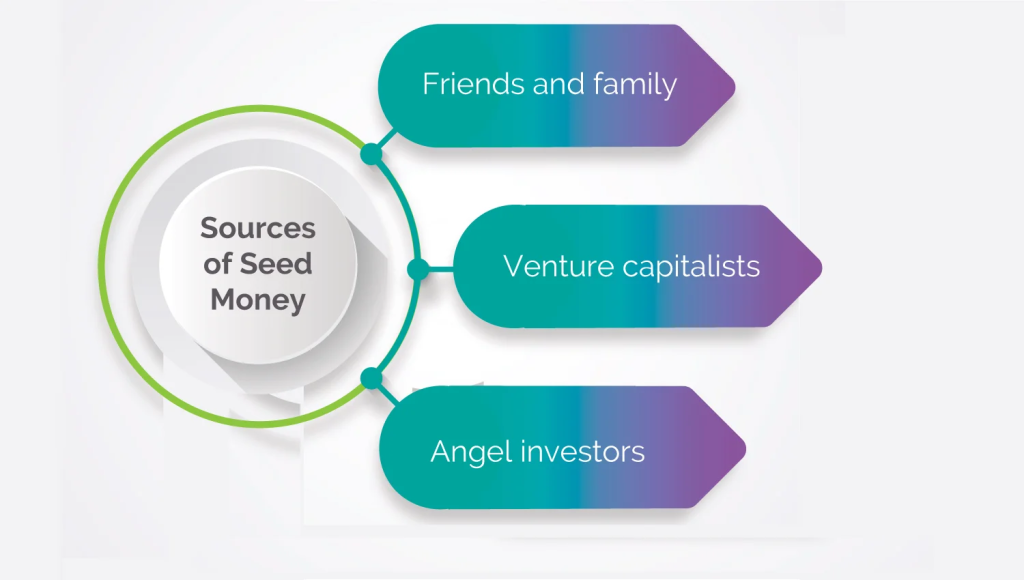

Seed funding is the paramount element of entrepreneurial plans, providing the energy and the resources that lay the foundation of the idea. It stands as one of those game-changing times for visionary businesspeople who usually receive support from angel investors, venture capital firms, or crowdfunding platforms, among others. Thus, this initial capital injection is vital for successful development and transformation of promising ideas into efficient and competitive business projects.

A seed financing in its essence gives those crucial resources that help move innovative ideas from concept to actually existing products. This crucial money equipment aid many brilliant ideas to remain active, actualized dreams still yearning for manifestation. It is a heart that brings life in the entrepreneurship existence, where imagination feeds the creativity process in transforming concepts to practical solutions that sort out day-to-day problems.

Apart from offering just a financial help, seed funding serves many complicated functions in startup environment. It becomes much more than a mere financial investment, instead becoming a statement of trust by the investors who have faith in the future of the entrepreneurs vision. This validation part is a right motivator for founders, they will build the confidence and energy to tackle all kinds of barriers in this start-up phase.

Furthermore, seed funding plays the role of a catalyzer; causing startup establishments to have the necessary competencies as well as resources to wade through the rough waters of the business road. Whether in the case of hiring key staff members, market research, developing prototypes, or growing initial operations, these funds act as a reliable pool of resources and an amplifier for the full utilization of growth opportunities and market positioning.

Business Loans: Achieving Expenditures and Start-up Costs

Finance equity is a financing instrument that involves giving up ownership. However, the loans provide the entrepreneur an alternative way of getting more funds to his business without compromising ownership. A type of debt finance.

Banks or alternative lenders typically secure this type of loan, requiring borrowers to repay the borrowed sum along with the interest in most cases. Small business loans provide the slack to meet varying expenses. Like workers’ hiring, buying equipment, launching of marketing campaigns and addressing any cash flow issues, thus facilitating the growth of the startup and its regular business operations.

- Ownership Retention: Unlike equity financing which requiring the founders to give up some of their ownership percentages, business loans help the owners maintain total control of their investments while raising additional cash on credit.

- Debt Financing Structure: Debt financing that includes formal business loans is a structured form of business financing in which the borrowers are obliged to repay the borrowed sum together with interest during a prespecified period, thus improving the certainty of financial duties.

- Lenders: These are the loans secured by banks or alternative and significantly different loan products designed to meet wide range of needs of the entrepreneurs.

- Expense Coverage: Business loans are a source of financing that can be utilized to cover a wide range of expenditures, which include hiring of human resource, improvement of technology, sales promotion, and managing of cash flow difficulties.

- Financial Flexibility: With loan proceeds, entrepreneurs gain the flexibility to spend money at their own discretion based on their specific business goals, ensuring that any investments are done when and where it is most needed and contribute to the growth of the business.

- Versatility: Owing to their versatility, startup loans work not only for different purposes, but also adjust to changing needs of business as it grows and develops.

- Bridge Financial Gaps: Startup business loans comprise an indispensable component in the arsenal of financial instruments at the disposal of startup firms for the purpose of covering shortfalls and making headway in their development.

- Support Growth: Through the funds provided, startup business loans contribute to growth paths of small enterprises and help them achieve their goal by making them bigger.

Combining Forces: From Growth to Maturity

The combination of seed funding and business loans may therefore be an effective strategy for the beginning stage of a company wanting to achieve long-term growth. Equity funding serves as the seed money that jump-starts a company and establishes its provisional model of operation. While business loans add fuel to the venture and facilitate opening up of new markets and take advantage of emerging opportunities. The mixing of these financing tools by entrepreneurs; risks can be reduced. Thus firms have an opportunity for fast growth and eventually these startup firms can be positioned for long-term successful duration.

Considerations and Strategies: Experiencing the Best of Both the Hardships and the Success

However, individuals must employ this approach carefully and with sufficient awareness of the potential implications of their choices. The seed funding might necessitate the surrender of equity or convertible notes. Or the business loans demand the exit cost with interest, may affect the cash flow and the income. Essentially, the start-ups must develop a comprehensive financial plan that addresses every detail regarding budgeting, payments, and reducing current expenditure. It is therefore essential to define the blueprint and realistically allocate appropriate money. While fabricating the contingency strategy to combat unforeseen problems.

Building Strong Relationships:

The good news is there is hope. We understand that people can create change when they come together to improve their circumstances and tackle environmental issues like pollution, global warming, and waste management.

Moreover, increasing economic factors, developing good partnerships with investors and lenders is the startup’s major agenda. Transparency, frequent reports and a good reference list of milestones recorded assure stakeholders. That they are on the right path and therefore increases the chances of getting funds for the next round or loan facility. Nurturing these relationships is targeted in order to establish trust and collaboration. Those synergies that help startups realize lasting success in the startup environment.

Conclusion:

So as for making possible startups to succeed one should approach financing thoughtfully and using seed funding and business loans. Continuation is a key to creating a startup which can develop its innovation. Entrepreneurs can find the ideal capital arrangement for each step of their progress. As they can make use of countless forms of funding such as investments and credits.

In order to manage the risks which may be associated with their fledgling business and lay a strong foundation for the future growth of their startup. Otherwise, startups may be able to get over the financial obstacles they encounter, when tactically and adequately supporting themselves can survive the competitive business context. Contact Loanz360 for more information. Check your credit score now here.