Introduction

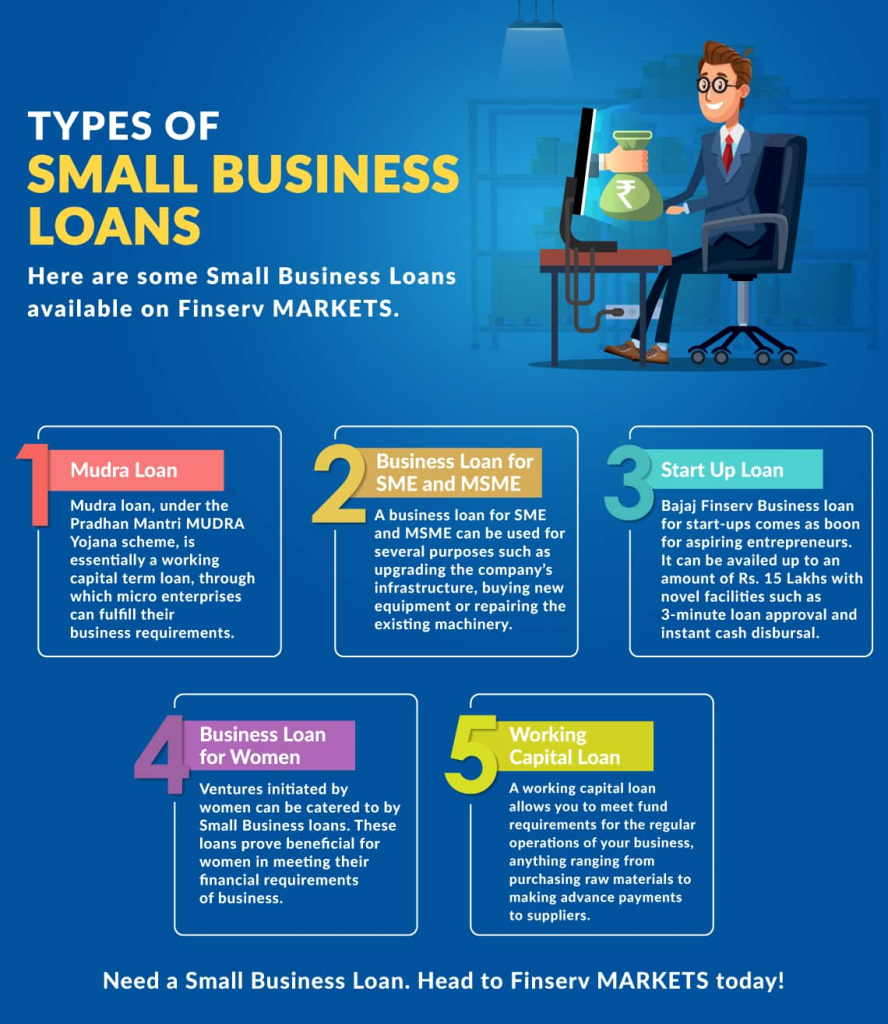

A business of any size needs capital investment to run operations smoothly. Whether you are paying for new machinery, growing inventory, or hiring staff, the bills and expenses will exponentially increase for a small business in its initial stages. Without a source of profit, businesses turn towards capital funds or loans to keep their business invested in the market for long-term growth. However, most businesses instead of funds opt for loans for their obvious benefits such as not asking for a profit share or flexible terms.

While the Indian market is not any different from its global market, owners or applicants need to know their risks when applying for small business loans in the culture-diversified economy to minimize or face the challenges that arise. In this article, we will be looking into some of the common risks and how you can avoid them to become an intelligent investor.

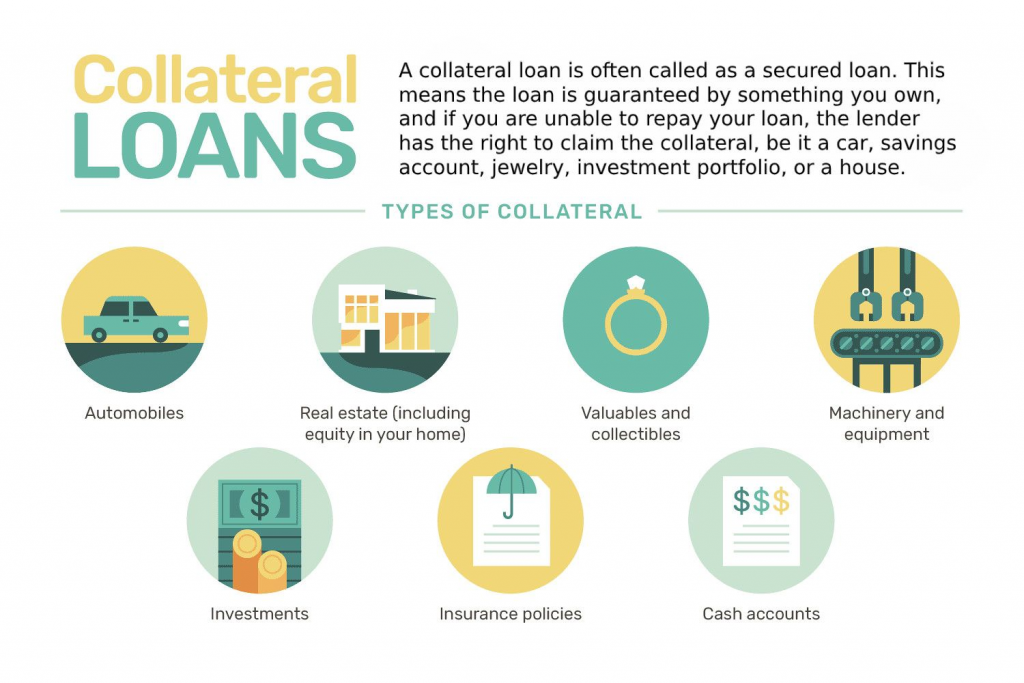

Unable To Provide A Liability (or) Collateral

Personal liability/collateral/security is one of the crucial steps when taking a small business loans anywhere in the world. Large business loans supposedly ask for security for the lender to be able to trust the organization’s and the owner’s repayment abilities. If you are a new business in the market, it is more advantageous to have collateral to get small business loans at lower interest rates. However, with several schemes, subsidies, and NBFCs, offering alternative collateral is not a risk anymore if you can carefully choose among the options. Some may be phishing their customers with attractive offers while taxing and charging them with unnecessary fees.

Contacting a professional or a third-party agent to get the research done on the lender and their policies will be beneficial if you do not have adequate knowledge of the market dealings. Make sure this agent is not associated with the borrowing creditor to be able to get an unbiased outlook on the financial requisites.

Financial Market Fluctuations

Market fluctuations also known as political instability or variable interest rates are largely due to ever-changing economic conditions in the market, especially and largely in India. However, the market fluctuations do not cause a great change in the interest rates regularly, you are at a cross-road of availing of small business loans with variable interest rates that may go up or down depending on the existing market conditions.

While customers may have the options to choose between a fixed and variable interest rate repayment, most urban dwellers, adults, and youth opt for variable interest rates because of the upfront perks and chances of economic slumps.

Problems With Legal System

Registering the company entity is a very important initial step for a start-up business. Legal systems in India are hawk-eyed when it comes to spotting unregistered businesses. In the worst-case scenarios, the business may even be terminated if not registered. However, the partnership act of 1932 does not impose any laws on unregistered firms, it is widely known to be illegal to run a business in the market without having legal ownership. This will largely put you at a disadvantage with your clients for your failed authenticity and staff for your stewardship.

It is advisable to register your enterprise under the MSME Act, although registration is not mandatory; to avoid taxes and enjoy other benefits of a registered business. Especially when taking out small business loans, unregistered businesses attract rejected applications because the lender will not be able to trust an entity of no legal title or existence. Therefore, businesses drafting founder’s agreements, and preparing legal licenses and agreements will guarantee the company’s goodwill to the members inside and outside the organization.

Lengthy Processing Time For Loan Approvals

Sanctioning the large or small business loans highly depends on the creditworthiness, credit history, business stability, and the relationship between the borrower and the lender. However, traditional lenders typically offered loans after an extended period of gathering evidence and documents, processing each, and verifying the authenticity. Sometimes they even took months to get even the small business loans sanctioned or rejected after such a tedious background check to measure profit and loss.

With several financiers making their digital footprint visible to their borrowers, the large and small business loans process has simplified with every being dealt with online. Several third-party agents and financiers have set foot in the digital upfront to roll their sleeves up and bid their services to the lender in a completely hassle-free and flexible manner.

Trusting any online service might be difficult, but with several accreditations and security measures, the financiers and marketplaces have launched a safety net for their customers to avail of small business loans within a few minutes to hours without them fending for months. This easy-to-loan process is now the best option for you to access in times of emergency or necessity without struggling between commutes for various lenders that might or might not agree to your terms.

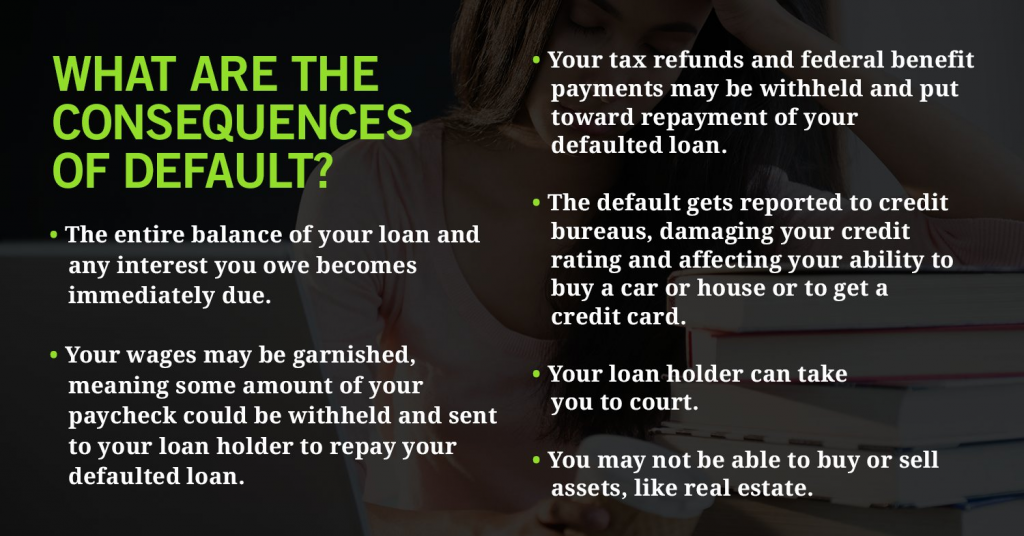

Risk Of Defaulting On Loan

When a start-up becomes greedy about making money, they end up taking multiple loans that may in long term become a burden to repay in full. In such cases of making or taking too much debt, the more they borrow the more they are putting their credit at risk, and the sooner they will have to face bankruptcy.

Defaulting on small business loans or any loan for a matter of fact will also convulse in a similar risk of bankruptcy but with the due dates not being met by the borrower thus making late payments. Both these scenarios are probably worse for a business that wants to make its presence visible in the market since this could get them into serious legal complications if neglected.

With the negative cash flow and challenges of being on default, the owner and the organization might want to consider refinancing as their next better alternative to benefit from lower interest rates and better deals at which the business can flourish within its expenses without burdening the economic health of the overall wellbeing.

Small Business Tax Implications

As discussed before, an unregistered business may have severe tax implications. However, whether you are registered or unregistered, tax is an external force applied to you by the government, you may choose to wing and face legal consequences or pay and enjoy its several other benefits.

When taking out an online, small business loans, especially in India, most (every) lender will look into the income proof of the applicant. Though there are even some lenders rarely who do not bother, these lenders will come at a price of higher interest rates, collaterals, guarantors, and various other clauses of compensation with inadequate tax proofs.

Tax structure in India is complicated compared with other economies, however, because of its rapid international growth, several foreign and international firms benefit from registering their business In India whether as an Indian entity or a foreign business in the Indian market. Therefore, tax is one such bill that should fit the pocket if the owner wishes to travel safely without worrying about the interest rates or other implications he may have to face if he/she fails to provide appropriate tax receipts for their business.

Choosing A Wrong Scheme

There are several government schemes in India for business owners, especially entrepreneurs to benefit from small business loans at lower interest rates. If you do not know about these schemes, subsidies, or offers that governments have to offer then you are automatically putting your trust in a lender who might put you at a disadvantage of larger interest rates and fees. Schemes such as PMMY, CGTMSE, MSME, Udyogini, CLCSS, etc can be considered before applying for small business loans in India.

If you’re doing business in India and registered under MSME Act with Udyog Aadhar or Udyam Certificate, you’re eligible to avail of small business loans. Whether you’re an individual or a business entity, if you’re looking to start new manufacturing, trading, or service sector business, a loan can give you the boost you need.

Forgetting To Submit Project Report

Missing project reports or inadequate business plans will put off lenders from sanctioning any business loans to their customers because they couldn’t get an idea of where the money is being invested and if invested will make profits for the owner to be able to repay in due time.

A well-organized economic system is more appealing than one that relies on spontaneity. Additionally, planning and sticking to a schedule increases the chances of obtaining an attractive online small business loans. And, before you even step into a lender’s office, it’s necessary to have a detailed business plan. If you’re unsure whether your business plan is convincing enough to persuade a lender, you may want to consider hiring a business plan specialist to analyze it. A typical business plan contains an overview of the organization, its industry, goods, and financials. On the safe side, it is more trusting to mention how the funds borrowed will be used in the business structure.

Final Word

It is difficult for small businesses to up their game in the initial stages of their business upgrowth. However, consistency, persistence, and resilience are much-needed boosts for small businesses when setting a foot out in the market. Therefore, to make their dreams come true, small business loans help business owners to loan an amount needed to fund their business.

In this article, you have learned about the risks following the applicants of small business loans and how you can overcome them. Therefore, knowing your bid before raising a toast is important in the market’s survival. Apply for a online business loan today and keep your investments safe by making smart decisions on your finances.

If you are still not sure how, give us a call at Loanz360 and schedule a meeting with our representative, who will take you through the process of buying and financing a loan, along with comparing the market rates and finding the best option that fits your monthly budgets without breaking a sweat. Loanz360 also have several government loans for women’s to start business. Choose your dream boat today with Loanz360 financial partners.