A Millennial who wishes to accumulate wealth and enhance wealth management should look at planning his budgets carefully. The focus of this article is to highlight the major strategies and the common tips that will go a long way in helping the millennials make sound financial decisions.

Wealth Management: A Holistic Approach

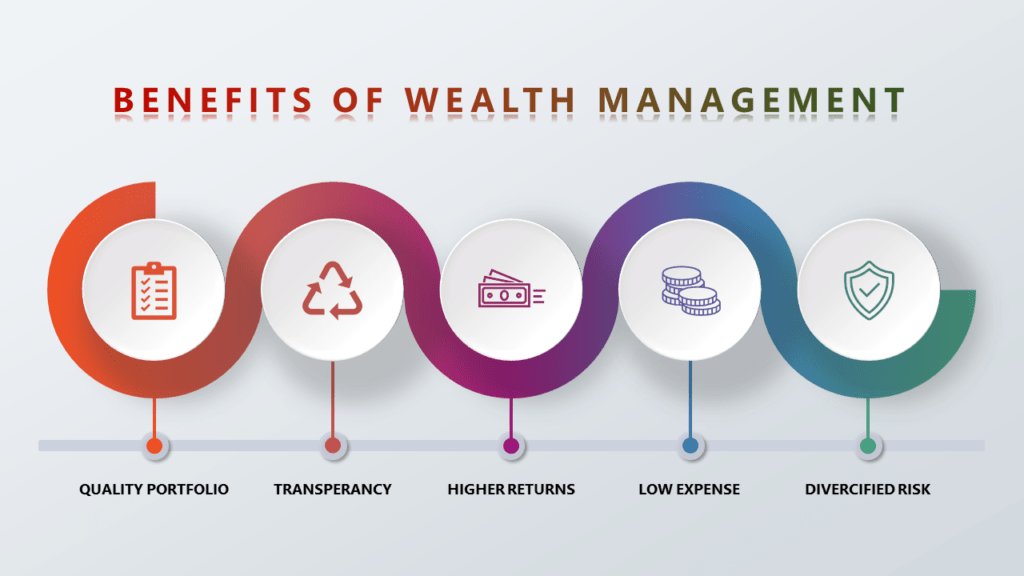

Wealth management is much more than just devising investment strategies; it embraces a holistic approach to creating and preserving wealth for the long term which involves different tools and tactics. This approach recognizes complex interlinkages that the different elements have within the financial system in order to maximize their potential for long-term growth and stability. Wealth management division will rest on selective basic pillars which are strategic investment planning, methodical retirement preparation, risk reduction strategies, and sensible estate planning.

Budget Planning: Track your Income and Expenditure

The purpose of budgeting is not merely just to cut down expenses; it is a vital tool for thoughtful wealth management of finance, especially, for the millennials. Through careful monitoring of both savings and expenses, people can become aware of a detailed picture of both the inflow and outflow of income. This procedure serves the purposes of identifying areas for savings and as well as providing efficiency in resource allocation. Developing budgeting apps or online tools not only simplified this task but also cultivated learner’s financial discipline and skills. In the end, successful budget planning enables people to have an understanding of the issue which they use in making informed choices, thereby contributing to their financial well-being.

Investment Diversification: Promoting Greater Returns

Spreading of investments is not just a strategy but the very essence of sound wealth management. It comprises choosing the capital distribution depending on the diverse types of assets classes such as equities, debt, real estate, and alternative investments as well as the commodities or virtual currencies. The diversification strategy is implemented, mainly by investing in different sectors and types of assets with a view to minimizing the overall risk while enhancing the possible portfolio’s returns.

Here, the diversity in behaviors of various asset classes is taken into consideration with the understanding that they perform in different ways under various market conditions. Such like stocks can give rise to high growth opportunities but at the same time they also carry a considerable amount of downside risk. Bonds are inherently more stable, however, returns you get could lower than stock returns. Through the diversification of assets, investors may gain something they have not lost in other assets and as a result when calculated average they get smooth portfolios.

Diversification is even broader, covering not only asset classes, but also the regions, industries, and investment styles. This further diversification beyond companies ensures that the risk extent is spread out evenly and there is reduced exposure to specific economic or political events which can travel negatively to some sectors and markets.

Emergency Fund: The Development of a Financial Safety Net

Life that is unpredictable, and financial discrepancies that can unexpectedly show up at any time, are the norm. Because of this, saving an emergency fund should be clear to anyone who is looking after the financial security. The purpose of an emergency fund is simple yet invaluable: in order to provide a financial net when the times are tough for life.

Experts usually suggest that you accumulate from three to six months worth of your living expenses to keep them in the savings account which is easily accessible. Funds shall cover the essential costs including housing, utilities, food, and transportation so that persons and families facing unexpected emergencies would have an opportunity to avoid high-interest debt or lose from depleting long-saving.

With saving money in an emergency fund you need to keep in mind only two things which are liquidity and safety. The high-yield savings accounts and the money market funds are the products which are currently popular due to the low risk combined with the feature of liquidity. On the other hand, these vehicles may not be able to offer the highest returns, yet they serve the purpose of keeping the capital invested and of providing ready access to liquidity when it is at the most vital.

Through the gathering of an emergency fund, people achieve the sense of security precisely knowing they have a financial safety net in their time of need. With this preventive approach of financial planning, not only the stress level is reduced, but also a solid base is created to handle long-term adversities with ease.

Retirement Planning: Starting Early on Financial Management

The retirement might look really far away, particularly for young people who are still studying or starting to have their own professional career. But life has many different and interesting stages that these people will go through and enjoy. Yet, the earlier people start to look into planning and savings for retirement, the better adjusted they will be in terms of long-term financial matters.

One significant factor in retirement planning is comprehending the valuable nature of retirement accounts with tax advantages like 401(k)s and IRAs. These cars also have a number of advantages such as tax deferment and designated employer contributions in certain instances. Through regular and early deposits into your accounts, you get to enjoy the effect of compound interest that would in turn translate into sizeable retirement savings over an extended time.

Besides, retirement planning goes beyond wealth accumulation, it also includes managing the risk and keeping the needed level of financial security in a later stage. Disabled people sometimes face special problems while trying to accomplish financial independence, but it is a realizable target with the proper strategy and help.

Staying Informed: Keeping Up With Financial Trends

As you know it is not so easy to keep abreast of financial trends. Therefore it is necessary to train the users of this platform to analyze the financial market. It is by reading financial news and learning important financial instruments.

Having so much knowledge about which direction the market is heading, new financial essentials and regulatory changes is paramount when making financial decisions. Inside grasping financial newsletters and consulting to reasonable financial advisors are the tools millennials use for taking good decisions.

Leveraging Technology: Streamlining Financial Management

The digital revolution comes with all kinds of technologies that can be applied to combat the challenging issue of financial management. Because of the use of mobile banking apps, robo-advisors with highly developed algorithms and user-friendly budgeting tools, technology enables millennials to have the full command over their financial situation as no one has ever enjoyed. Besides the improved efficiency through these developments the transparency and accessibility to finances are also promoted and a proactive mindset for financial wellbeing comes as a side effect.

Setting SMART Goals: The Roadmap for College Students’ Financial Management Success

The college students who have set SMART (Specific, Measurable, Achievable, Relevant, Time-bound) goals for their journey towards financial independence, consider it a critical way to their success. Enumerating achievable and tangible goals would ensure the youth to expend their resources prudently towards vital financial targets. Periodic adjustments and evaluation of the goals ensure that goals move with changes, and the discipline to accomplish financial management and achievement persists.

Conclusion

Financial management is vital, and millennials need to plan out young to accumulate wealth for their future. Millennials who utilize techniques such as wealth management, budgeting, risk diversity, emergency savings, retirement planning, research, technology awareness, and SMART goal setting will be able to face financial dilemmas calmly and feasibly achieve financial security. Contact Loanz360 today to make your financial future secure. You can also check your credit score now, here.