Most of the time people in India will consider it a major financial decision when they look for buying a car. However, it relieves you of the pains of the daily chores and gives the much-desired comfort. It too comes with the responsibilities of cash payment. The most important part of the process is, however, to properly organize the money. Since in case of a car loan, this is critical. It might be quite challenging to draw a budget for buying a new car whilst you let yourself afford that luxury, but certainly not impossible. The world of car loans is quite diverse. Below are some of the ways in which you can do so with a durable loan.

Car Loans Tip #1. Research Thoroughly:

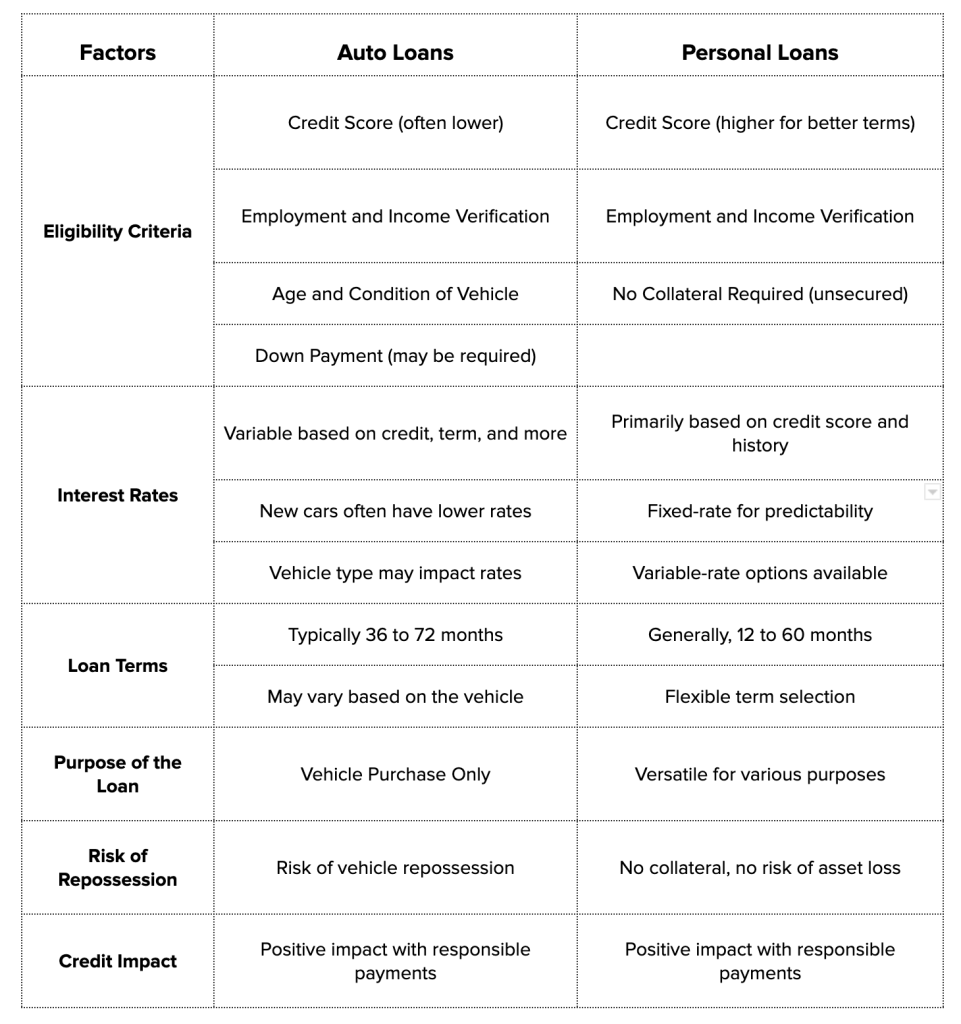

Before getting into the car loan process, it’s high time to conduct comprehensive research. Make sure you examine interest rates, loan lengths and various lenders. Knowing what’s needed for you and where your finders are can help you make a smarter decision.

Interest Rates Exploration: Immerse yourself into a complete exploration of interest rates offered by a broad array of financial organizations, including banks, credit unions and online banks. Compute both fixed and variable rates in order to choose the one that brings the highest benefit to your financial strategy.

Loan Length Investigation: Get involved in repercussions of varying the lengths of the loan. Contemplate on short term loans and the effect of monthly payments versus the longer ones, and also compare the provisions of each one.

Lender Evaluation: Evaluate credit scores, customer service ratings, and terms of the proposed loan from different lending institutions. Explore if the terms of a loan beyond interest rates like flexible in repayment plans and client satisfaction ratings.

Car Loans Tip #2. Determine Affordability:

The way to assess your finances objectively is through an honest self-assessment. Figure out your budget by month and decide how much of your figure you can devote for the car loan payments per month. Keep in mind that these additional expenditures should also be taken into consideration for example insurance, maintenance and fueling costs.

Thorough Financial Assessment: Carry out very detailed financial analysis of your revenue, expenditure, and monetary targets. Develop a budget that covers all your monthly expenses, indicate the needs and the wants if you are to save.

Payment Capability Analysis: Determine the upper limit of a monthly payment that you can just manage keeping in mind the tightness of your budget. For example, you can take on financial calculator to create scenarios that could work for you and find a payment amount that will match the income you have.

Factor in Additional Expenses: Allocate budgets to cover “other expenses” that accompany a car, such as insurance premiums, maintenance costs, and fuel projects. Because you need to include them in your budget to get the correct picture of costing, make sure these are added.

Car Loans Tip #3. Opt for a Reasonable Loan Amount:

It is quite easy to fall for a costly car, but you should never put yourself in a situation in which you end up regretting having asked for a loan amount which is bigger than your capacity to afford it. Decide on the car that most suits your needs but is not a burden to you financially.

Needs-Based Decision Making: Evaluate your transportation needs in a fair way in order to attraction the vehicle that correspond with your needs without crossing the limits of your budget. Take into consideration the attributes of number of seats, cargo compartment, and fuel consumption to decrease the number of your possible decisions.

Financial Prudence: Apply prudence to save yourself from taking a conspiring lending that negatively affects your financial standing. Spending less on an auto does not mean that you always will get a vehicle that compromises your future performance or financial stability.

Balance Wants and Needs: Achieve a balance between your desire of car and money as you choose your car. Pay attention to the elements that you will be using on a regular basis while factoring in the effect they will have on your financial situation.

Car Loans Tip #4. Check Credit Score:

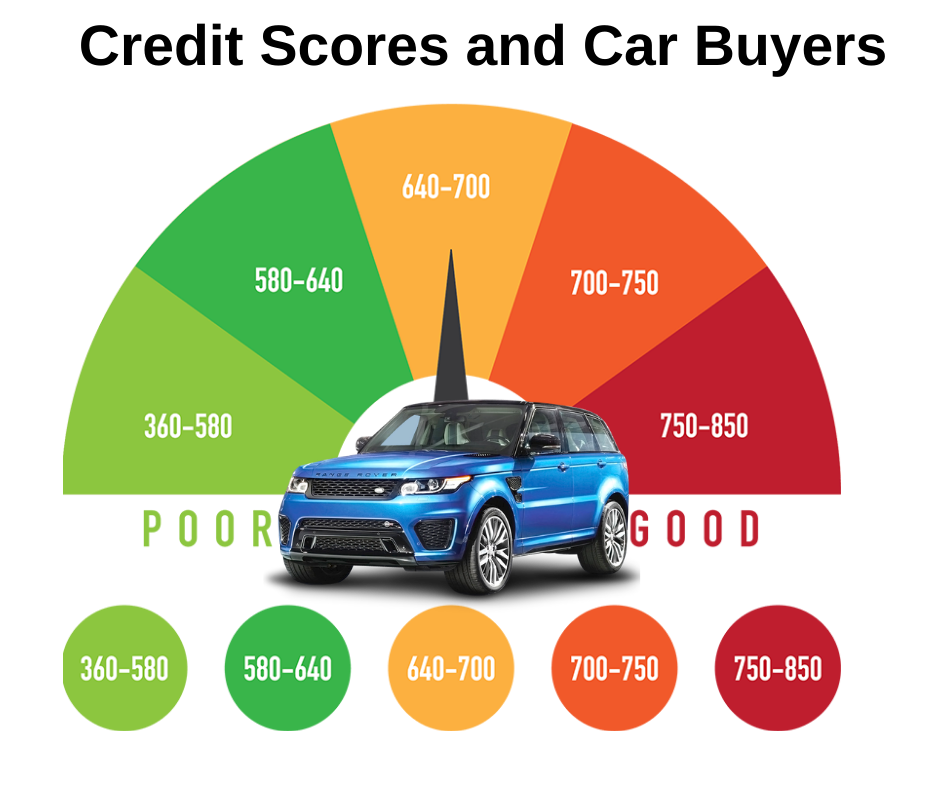

A good credit score happens to be the principal aspect that helps in getting better administrative rates for your car loan. Prior to commencing your loan venture, it is very important to find out what your credit score is. By evaluating where you are financially, you are able to understand what actions are most necessary, for example, improving your credit score if required. A higher credit score is not only important because it increases your chance to get a loan but it but it also helps you obtain better conditions and lower interest rates, resulting in you saving money in the end.

Car Loans Tip #5. Negotiate Loan Terms:

When it comes to striving for the optimal loan rates, remember to stand up for yourself and ask the lender to consider a better option. If you discover that the initial terms specified by the lender don’t square off with the financial goals, it’s time to renegotiate. It may be about shopping around for interest rates that do not burden you or spreading out the repayment period to make payments manageable. Either ways, smart negotiation will improve your financial life greatly. Through active participation during the negotiating process, you can customize the loan terms to better match your convenience and, therefore, help you attain a more comfortable and sustainable financial future.

Car Loans Tip #6. Consider Down Payment:

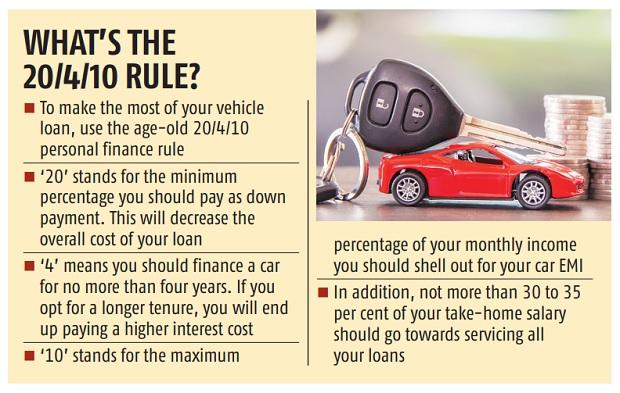

A down payment speaks for itself as a powerful sign of reducing the total amount you owe for your vehicle loan. When you fork out a substantial amount of cash at the beginning, you can easily cut the loan principal by a sizeable margin which leads to cheaper monthly payments. Saving to contribute to the down payment showing your goal oriented approach and commitment to responsibility. In addition to this, a bigger down payment can clear you for better offers or maybe even lower interests. Through the wise choice of your down payment you will overcome the most difficult stage of your transaction , which is its beginning, in much more reasonable and financial sound way.

Car Loans Tip #7. Explore Special Offers:

While choosing the car to buy, you should get familiar with the kind of offers provided by different financing providers and car dealers. This can include special rate for car loans, exclusive offers or bundled packages which includes added benefits such as extended warranties or maintenance offers. Ensuring that you are always aware of these offers is of utmost importance, as they stand to immensely boost your purchasing power, as well as your bargaining position when you are trying to secure the optimal loan terms. Using such price drops frequently save you and enable you to maximize your experience when shopping.

Car Loans Tip #8. Understand Loan Terms and Conditions:

Before taking up a car loan, one needs to have a clear understanding of the terms and conditions as laid out in the contract. Carefully read through the contract document and make sure that you clearly understand the specific elements/clauses of interest including the interest rates, repayment schedules, and any associated fees or penalties. Sticking to the details is a crucial thing that makes you not to be surprised in an unpleasant way and do not interfere with your decisions which are based on your goals. Through making sure agreements are clear and open, you can cruise through the lending process with clear mind and relief.

Car Loans Tip #9. Avoid Impulse Buying:

Although the appeal of a new car may end up strong, showing some self-control and avoiding hasty decisions will help to secure a wiser financial future. Do not satisfy your immediate impulses. Rather, stand back and compare the viable choices in a systematic way. Look into key attributes of vehicles like features, pricing, and long-term ownership to make sure that you choose a car that meets your needs and your budget. Applying a rational mindset to the entire buying process will help you to make purchases which are based on facts, not only for your current financial situation but also for your overall financial wellness.

Car Loans Tip #10. Seek Professional Advice:

What seems to be simple at the beginning can turn into something overwhelming when you find yourself in the complexities of car loan process having no experience or trying to cope with other even bigger problems. Holding hand of financial experts or loan advisors specialized in auto financing during the times when one may be lost can give one much needed help and direction.

These practitioners, with their professional expertise, are knowledgeable and can develop a special counseling just for your situation. This can be by explaining loan terms, exploring alternatives, and providing a repayment schedule, professional advice can help rid of precisely doubtful moment, and aid borrowers to make fast and informed decision. Do not overlook such platforms because they will come in handy in times when you are confused and don’t know what your next move will be during the entire buying time.

Conclusion

Hence, buying an affordable car loan is contingent on the development of a feasible plan and evaluation of the current situation. With the help of research, calculating, and bargaining, you can fix the delicate tie among your financial boundaries and the perspective of having a drive as if you are riding a luxury car. Ensure information updates, rate comparison, and intelligent investment choices proposed here on the project website closely follow your long term financial plan. The right combo will allow you to pat autos on your sleeve without impoverishing yourself. Contact Loanz360 for more information.