In a competitive business scenario, shortage of good money resources might alter the growth and sustainability of entrepreneurial ventures. In a market which is swarming with a large number of choices, peer-to-peer lending (popularly known as P2P lending) steps ahead as an excellent option for Indian businesses who are seeking simple and flexible loan resources.

Business Loan #Peer To Peer Lending

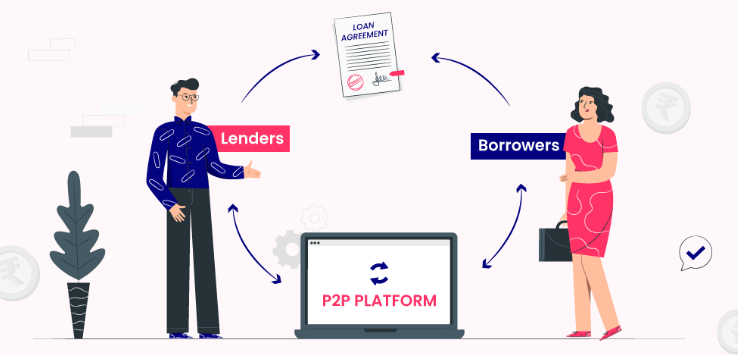

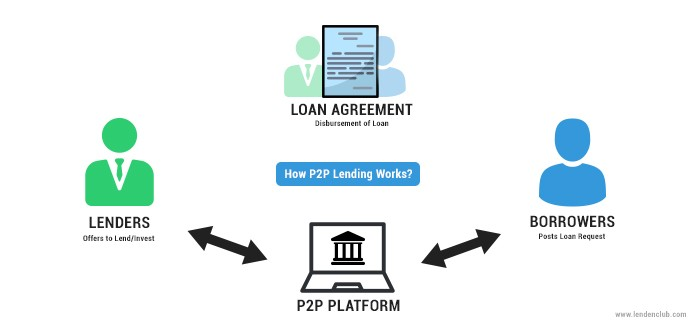

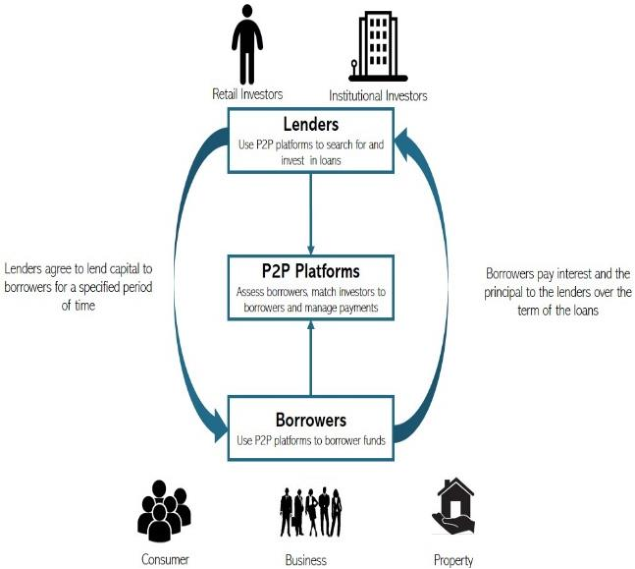

Peer-to-peer lending (P2P lending) is the financial revolutions in which people can by pass the banking institution without having to go through the banking institution by the use of online platforms. The individuals borrowing have more accessible and convenient terms as they don’t have really strict criteria of eligibility and offer the quick release of money compared to a traditional bank. P2P lending offer a chance to diversify the investments portfolios and possibly get matched adequate returns by removing the intermediaries.

However, besides all the pros, the P2P lending bears several risks also for the borrowers and lenders. Borrowers will probably have higher interest rates than the traditional loans show, which proves that increased risk for lenders.

Moreover, absence of regulatory supervision in some cases creates doubts about the openness and consumer security which is a great concern. While lenders remain exposed to borrower default, which can be even higher during a general economic downturn or an individual client’s financial crisis. The measurement of past performances of investment as the barrier to risk assessment is also added to this complication.

Understanding Peer-to-Peer Lending

Peer-to-peer lending serves as the intermediary between the demand and supply sides of the loan market where lenders meet borrowers. Funding comes to these online lending portals with the help of these sophisticated algorithms and credit assessment systems. Systems that connect the borrowers with the lenders who qualify on the basis of riskiness of business, loan requirements and applicant’s risk profile.

The lobbying-for-rent concept stands for transferring political issues from the public sphere to the private sphere. That is by raising funds from rich individuals and influencing economic policies. In the process of lending banks, small and medium-sized enterprises (SMEs) have difficulty in obtaining traditional commercial loans. Due to excessive requirements and long waiting times for approval. P2P lending platforms provide a digital alternative that offers a sounder way of getting a business loan. Businesses may be able to secure funds more conveniently.

Although P2P lending remains one of the fastest-growing products, it is also highly dependent on financial technology and the demand for alternative funding options outside of banks or institutions. Regulators develop stricter regulations to have better control over P2P platforms, and ensure their reliability. Thanks to the fact that it provides the opportunity to everybody to take part in an investment activity and can yield good returns, P2P lending is not going away, it will be an important part of financial services market.

Peer Lending Potential for the Small Business Sector in India through Social Lending

- Flexibility: P2P lending facilitates businesses to borrow liquid funds for many causes. I.e., allocating them towards working capital, expansion projects, equipment purchase and more. Not bound by any restrictions inherited by classical loans attached to a precise spending case, P2P lending gives freedom in managing funds for borrowers.

- Speed: The standard business loan approval processes can be very time-consuming. A fact that also slows down the implementation of essential business initiatives. What differs from the former is the fact that P2P lending has a faster approval and payout processes. This is to accommodate business ventures that need to be suitable immediately.

- Competitive Rates: P2P lending platforms are not immune from the play for lower interest rates. Because they use competition and efficiency in their models. This factor translates P2P lending into a sound alternative of the last if the costs are what they pay attention to.

- Diverse Investor Base: The P2P lending platform brings together business with a diverse range of investors. From the individuals, private investors, and institutional investors group. Such a heterogeneous approach increases investors’ pool and raises their chances to obtain fundings on beneficial terms. Through investments in renewable energy sources, venture capital, and innovative technologies, investors are able to finance projects and contribute to a transition to a sustainable global economy.

- Technology-driven Solutions: P2P lending platforms incorporate modern technologies into their operations. For instance, AI and machine learning algorithms are used to evaluate the cases and to reduce risks. This tech approach-driven attitude increases the speed and precision of business loan processing by facilitating the use of digital financial services.

However, lending to individuals comes with its unique set of challenges. One of which is scrutinizing a borrower’s credit history and repayment ability.

Factors to Consider Before Financing:

- Risk Assessment: Ensure the utmost due diligence, and a risk assessment prior to lending through P2P platforms. Examine the platform’s reputation, borrower screening methods, loan default rate, and regulatory compliance to make a knowledgeable decision-making.

- Loan Terms and Conditions: Realize the clauses and agreements inside P2P loans. Like interest rates, repayment exercise, penalties for delayed payments and other charges. Make sure you understand and fulfill all requirements upfront. Contact the main platform operator in case of any doubts to avoid future issues.

- Creditworthiness: Keep a great credit rating to raise your odds for profitable personal loans on the P2P lending platform. A sound credit history shows an image of trust to the business loan providing institutions and helps to decrease the default risk. Check your credit score now.

Conclusion:

The idea of a peer to peer lending has become a practicable and ongoing concern. Especially to Indian enterprises who are looking for the solution in the form of asset-based financing. Through the adoption of technology, the P2P lending offering accelerates. It is flexible enough, brings a competitive, and a diverse investor. That, in turn, enables businesses to fulfill their necessities effectively.

While the Indian business environment is in the state of development, decentralized tools for financing such as peer-to-peer should be a motivation for the process. Moreover, they will cut down costs and open up small business support in all spheres of the economy. Implement P2P lending to your toolset to give a new impulse to your business endeavors and season your entrepreneurship with Loanz360.