Introduction

A personal loan is different from a line based personal loan, also known as line based personal loans. However, both have a common ground when it comes to collateral, as they do not typically demand the individual to submit security to avail of their benefits. When choosing the type between each, it will largely depend on the “why’s” of your financial requirement rather than the aspect of “how much”.

In this article, we will attempt to make you understand the differences between loans and the line of credit, and how you can decide whether you need either of the two.

What Is A Loan?

A loan, also known as a term loan is a non-revolving credit limit. Simply put, a borrower applying for any loan will get access to the funds deposited in his bank account only once over the requested amount as a lump sum, which he will make payments over a fixed period of time, for a fixed or variable interest rate until the debt is paid in full with the accumulated interest over the principal amount. However, there are several types of loans, obtained for the same purpose, i.e with a definitive tenure.

Whether you have applied for a secured loan or an unsecured one, you are still in a one-time agreement for the loan, which once expires should again be applied if you have the need to do so.

What Is A Line Of Credit (LOC)?

LOC or line of credit is an unsecured revolving credit limit. Like a credit card, you will receive funds in allotments on which you can draw the amount as required and pay only for the funds utilized. Unlike personal loans, this type of credit will allow interest rates to only rack up on the amount utilized rather than the principal amount allotted. Once the PLOC is paid back in full, you will have the option to draw money again or to close the account, as you wish.

However, LOC (Line Of Credit) does not entirely function as a credit card does. A major difference between a credit card and a line of credit is the purpose of the funds. While credit cards are used for everyday expenses, the line of credit is mostly used for big-ticket expenses and may be secured or unsecured. Also on the bright side, LOC has a lower interest rate on a higher credit limit, unlike credit cards with a higher interest rate on lower credit limits.

Line Of Credit In Business

A business LOC works like a working capital but with a much bigger scope of disbursement. These funds can be accessed as needed to meet the business’s cash flow fluctuations. LOC keeps the business running smoothly without a shortage of cash reserves maintaining a positive cash flow. Other than demand or business purposes, you can use LOC funds for other purposes such as home renovation, student debts, etc.

- Unlike a term loan, funds are readily available to withdraw as required, instead of in a lump sum.

- Flexible repayment is a feature of a line of credit as the borrower will only pay interest on the amount accessed.

- Secured and unsecured options are available across all banks and NBFCs, as desired.

Approval for both types of financing (Loan/LOC) depends on various parameters of the borrower, such as his creditworthiness, relationship with the lender, and several other fundamental aspects that a lender looks for in his customers.

Loan Vs Line Of Credit Vs Credit Card

| Factors | Loan | LOC | Credit Card |

| Credit Type | Installment | Revolving credit line | Revolving credit line |

| Loan Limit | Pre-determined | Based on credit limit | Based on credit limit |

| Disbursement | One-time | Recurring | Recurring |

| Fund Type | Lump sum | Allotments | Allotments |

| Usage | Use in one go | Withdraw as needed | Withdraw as needed |

| Repayment | Fixed EMIs | EMIs depend on the funds used | Minimal Monthly EMIs |

| Collateral | Yes/No | Yes/No | No |

| Interest Type | Fixed/Variable | Variable | Fixed/Variable |

| Interest Rate | Low to High | Low to Medium | Medium to High |

| Rewards | No | Rarely | Yes |

| Hard Enquiry | Yes | Yes | Yes |

| Documents | Intensive | Intensive | Less Intensive |

| Size Of Purchase | Larger | Larger | Smaller |

| Best For | Predictable expenses, emergencies, debt consolidation, wedding, vacation, etc. | Overdraft protection, home renovation projects, emergencies, irregular income recovery, etc. | Everyday expenses, cash reserve, smaller emergencies, etc |

Pros & Cons of LOC

| Pros | Cons |

| Pay only for the funds utilized | 700+ credit score required |

| Lower interest rates than credit cards | Strict eligibility requirements |

| Continuous access to funds | Risk of overspending funds |

| No end-use restrictions | Unpredictable EMIs |

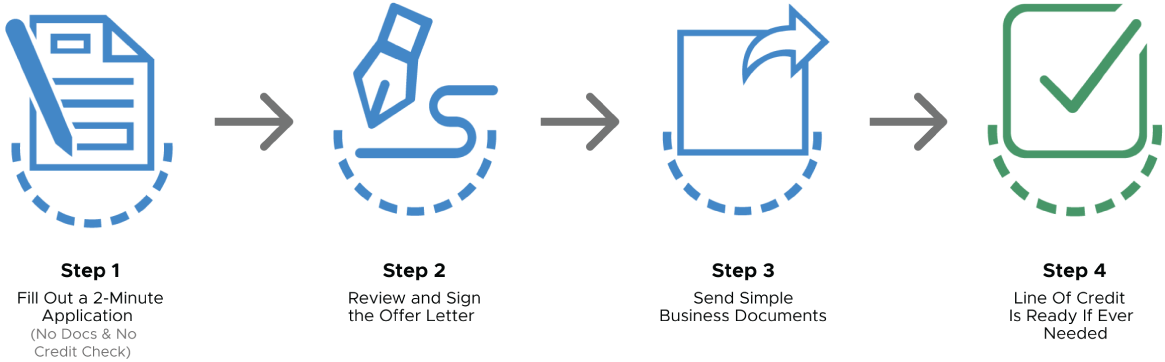

How To Get A Line Based Personal Loan?

The process of getting a personal LOC is simple if you have a satisfactory credit score of 700 or above. You can reach out to a respective bank or lender, online or offline, who provides the LOC services and discuss your requirements. Once you have decided to avail of the service, the lender will run a hard credit check to determine your creditworthiness and request you to submit proof documents, such as bank statements, employment history, investment details if applicable, identity, address, and income proof. The process is authorized online through a portal and moreover, you can view and manage your finances as you wish, digitally.

Once you have passed the qualification process and are eligible to avail of LOC, the lender shall issue a credit line based on the eligibility of the applicant.

However, as much as it is flexible, you should remember that an interest rate on LOC depends on the usage of your funds, and the faster you exhaust your funds, the more you are damaging your credit. Also with the temptation of overspending your money granted on this type, you might be at greater risk if you do not have a plan on how to use these funds.

Which Is The Better Option?

While loans are a safer option given that most loans now have a flexible loan option that allows individuals to enjoy the similar benefits of a LOC, you should be aware that each type depends on why and where you would want to use the acquired funds.

- If you have a one-time usage, loans are better options to apply for.

- If you do not have a definitive amount requirement and have an ongoing project to fund, LOCs are a better investment.

- If you have everyday expenses and unstable funds, credit cards offer better services.

Therefore depending on the purpose and requirement, you can now decide which is the better option for you and why you would want to apply one over the other.

Final Word

If you are looking for a line based personal loan or any kind of capital assistance and need help, contact Loanz360 to get the loan at the best prices and deals instantly. Check out the eligibility criteria and documents required in the services section under a personal loan.

Your loan need not be a burden with Loanz360. Loanz360 is an authorized financial supermarket, with financial dealers across India. From management to the protection of assets, we provide all financial services to our local and international customers alike with the help of our in-house financial partners.

If you are still not sure how, give us a call at Loanz360 and schedule a meeting with our representative, who will take you through the process of buying and financing a loan, along with comparing the market rates and finding the best deals that fit your pocket with discounted offers and flexible services.