Introduction

Smart planning is a step towards better execution. However, smart planning should involve the deliberation of risks, potential challenges, and other aspects of the situation that could go wrong. In other terms, though we may be well equipped with 100 solutions, there is always a 1 to 100 odds of a 100+1 problem that could result in a hopeless turn of events. And even if you are at a dead end in the commercial world, it is still not the end of your financial journey, there is always an alternative, and sometimes even if damaging, there is a possibility for a new start.

Bankruptcy and insolvency are peculiar cases. In the world of business, it is not easy to administer, manage, review, or make changes each beneficial to the financial health of your business. Several other key parameters will sometimes force a winning pair of cards to end up in a stalemate. Market fluctuation, growing competitors, trend management, chain merchandisers, need for staff, unwise financial decisions, and partnerships gone wrong are some of many such cases of impasse. Therefore, knowing what you can do when you encounter such blind turns can help you stay ahead of the road and do the wrong right to better sail the boat.

In this article, we will discuss everything you need to know about bankruptcy and insolvency, what you as an investor can do when filing a bankruptcy. Is it even a wise decision, or should it be given more thought?

What Is Bankruptcy?

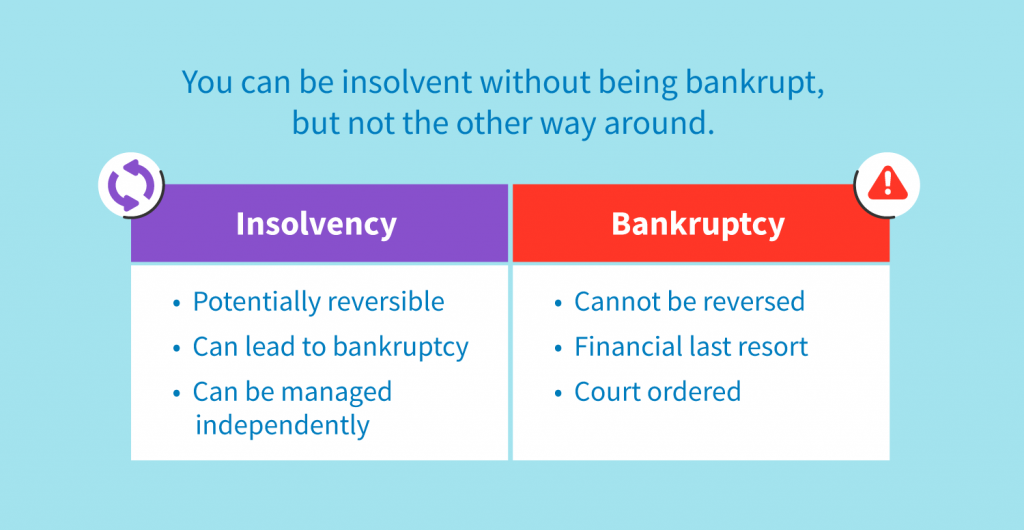

Bankruptcy and insolvency are not one and the same. Legally bankruptcy is a financial reset procedure or process that an individual or a business goes through when they have exhausted their finances and are unable to pay off their existing debts. This is not just a situation where you are in a financially demanding position for the near future, bankruptcy is when the person or business involved in the situation of being unable to pay off their debts has estimated their financial shock to persist for the next five years.

That being said, you should think that bankruptcy is not a painless procedure. It is often involved with social stigma among Indians and is reflected on your credit for a decent time in the future, making you automatically ineligible for loans for a long time.

What Is Insolvency?

Insolvency in a business refers to a situation that happens before the person or the organization may fall into a bankruptcy. It is when the party involved is not able manage their debts effectively and thus is unable to make prompt payments. However, there are 2 types of insolvency.

Cash Flow Insolvency: The person facing a cash flow insolvency is short on cash but not on assets. The organization or the person facing such a situation has the assets to resolve his debts but not enough liquid cash to make his payments. This situation is considered easily recoverable since the parties involved are not short on capital and may gain liquidity from selling or depositing their assets.

Balance Sheet Insolvency: An organization or a business short on assets fall under the category of balance sheet insolvency, thus are at a higher risk of failing to clear their debts, hence nearer to facing a bankruptcy.

What To Do In Insolvency?

It is advisable to bring the concerns to the board members of the company or to company’s directors on how they can manage their insufficient cash flow. Without the acknowledgement of the potential risks and bankruptcy, the company or the organization may fail to bring back their business on a pedestal and may thus fail to curb the consequences of a financial doom. Therefore, being informed with the options, proactive with the creditors, and obtaining a legal advice will help manage the potential risks even before one may happen.

What Happens When You Declare Bankruptcy?

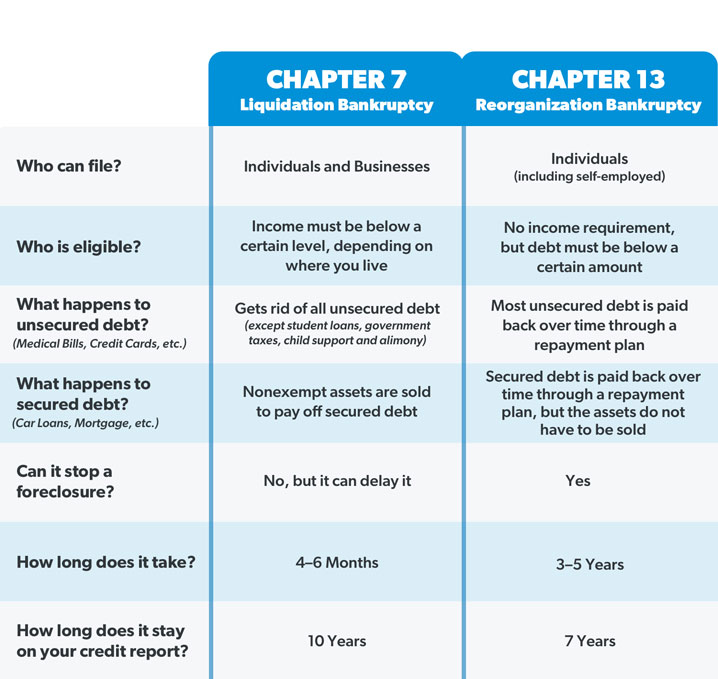

The fear of bankruptcy and insolvency is not invalid, however, there are several myths about the event that makes bankruptcy scarier than it is. Though bankruptcy should not always be the first choice, it is more of a boon than a bane when given the circumstances under which you are suffering a financial shock. That being said, as we know, bankruptcy will affect credit, and that is for as long as 7 to 10 years, however, this is not damaging by itself. When you have filed for bankruptcy, it will reflect on your credit, but that does not mean that you cannot rebuild your credit after the procedure.

However, you will have to surrender your passport, have restrictions on travel, become liable to full financial disclosure, and may lose the right to vote.

On the other hand, though you are to lose certain rights, you are to gain more if you have a serious situation to recover from. The insolvent can get credit, rebuild his credit, purchase new assets, and even become financially better than before. Simply put, you can recover from bankruptcy and insolvency, avoid creditors from pressing charges, retain access to primary residence and other fundamental elements necessary, etc by pressing a restart button on your finances and starting over with wiser financial decisions to even start a new business in the potential future.

5 Things To Consider Before You Declare Bankruptcy

Credit Counseling Course

Everyone filing a bankruptcy MUST complete a pre-bankruptcy credit counseling course within 180 days of declaring bankruptcy through any of the approved credit counselors. These courses offer online solutions and are easy to navigate without wasting time or resources largely. Once you have received the time-stamped completion certificate, you can then file for bankruptcy.

Hire An Attorney

Let your attorney or lawyer know your situation, and consider alternatives if you can resolve the problem without filing a bankruptcy. The attorney will guide you through the process even if you do not know about the topic, however, discuss all your requirements and needs with the lawyer and be as transparent as possible, to avoid further alterations or contradictions between you and your attorney when filing a bankruptcy.

Gather Documents

Keep all your documents ready, regarding your property, assets, utility bills, income, expenses, credit reports, and everything financially related before filing a bankruptcy. This will help the court to determine your assets or repayment plan and choose the type of bankruptcy you qualify for.

Apply For New Credit

Once you have applied for bankruptcy, your previous bank accounts will be seized. This does not mean an illegal or secret transaction of funds to a new account, but restarting an account will make sure you can reestablish your credit once you have filed for bankruptcy and secure your future deposits with full disclosure. You can also keep some cash readily available in case of frozen bank accounts to avoid bailing on everyday expenses in the meantime while your funds are recovered.

Move Money

As discussed earlier, you need to have some money in a safe deposit in case of paying utility bills, as your funds remain frozen for a certain period, utility companies will ask for a deposit for your services to remain active without terminating them as soon as you have done filing a bankruptcy. This will also mean that you can stop paying your unsecured debts as the creditors take time to seize your finances or bank before taking legal action. A few months before filing a bankruptcy, stop making automatic and debit payments, along with using a credit score or paying unsecured debts.

Although your credits will not stop calling you or pestering you to pay EMIs if you have decided to proceed with filing a bankruptcy, you can avoid paying unsecured debts, including payday loans, medical bills, etc to save up some money before everything is seized by the law.

Bankruptcy: Chapter7 Vs Chapter13

5 Steps To Filing A Bankruptcy In India

Step 1: Gather Documents

When filing a bankruptcy, the first thing to do is to keep your documents ready. This will include a compilation of all your assets, expenses, bills, and income. Full disclosure of your financial being is a mandatory procedure involving the court to consider your situation and determine whether your bankruptcy plan fits with your financial record.

Step 2: Hire A Lawyer

As discussed before, you need to have a lawyer when filing a bankruptcy, and not just for legal advice. The lawyer will also be your attorney during the adjourning trial in the court and will help you through the dealings from determining the cost of the process to filing a bankruptcy until the end of the bargain.

Step 3: Individual (or) Joint

You can either opt for filing a bankruptcy alone or with a spouse, however, both have different outcomes and will depend on your financial situation and understanding between the parties involved. Discuss your options with your partner, or lawyer, and then consider what you should do in such cases.

Step 4: Declare Bankruptcy

To declare bankruptcy, you should file a petition under PIA (Provincial Insolvency Act), with the help of your attorney. However the recipient of the petition might differ depeding on the type of insolvency. The insolvency and bankruptcy board of India (IBBI) is such regulator for insolvency proceedings responsible for IPA, IP, IU, short for, Insolvency Professional Agencies, Insolvency Professionals, and Insolvency Utlities respectively.

There are certain rules involving filing a bankruptcy, including that the wife or husband should not have assets registered with their names, etc. This will mean that you should discuss why, how, where, and any other doubts or clarifications you have with your attorney before registering for bankruptcy.

Step 5: Attend Ruling

Once you have done filing a bankruptcy, the court will order a hearing and you will have to explain your situation with the documents and proofs, which the court will perform a background check and declare your bankruptcy upon eligibility. Once you have acquired interim order, you can then consider yourself at the benefit of a do-over.

Note: You should know that if you have previously or immediately provided false information, your application will be at a risk of disqualification. This will include any prior abuse of the system, defrauding, or blacklist activities that the individual or business may have performed.

5 Things To Consider After You Declare Bankruptcy

Track Your Credit

Maintaining and repairing your credit is essential when you are bankrupt. Although taking time to build your credit, it is a trickier process to maintain the record in the initial days of your bankruptcy. During the period of 7 to 10 years, you are expected to rebuild your credit to its healthier state. To do this, one has to maintain a debit until you are confident about maintaining and repairing your credit. Keep a check on your expenses annually or once in six months, along with considering your interest rates on your credit, if applied.

Consider Budgeting

Initially, you will be low on funds as you are doing a do-over, therefore you need to budget your funds and wisely distribute the capital among your expenses. This will include cutting off finances that were unnecessary and paying bills where essential. The post-bankruptcy period is when your credit record is cleaned clear of your past doings, therefore now, more than ever, you should be careful about maintaining this clean slate without following late or missed payments.

Manage Paperwork

Filing a bankruptcy will involve a lot of paperwork for you to manage. This paperwork and documents will help you keep track of your rights and manage it before it escalates into legal warfare. Contact professional financial experts to help manage your finances if necessary, this way you do not need to do all the legwork alone. However, they will require you to pay a commission, therefore need to be carefully budgeted.

Reconsider Offers

Do not jump on offers that the creditors offer once you have gone bankrupt. These offers are tempting and that is just why creditors may even trick you into falling into despair. If you have banks lining up offering you tempting deals, you should reconsider your options, ask as many questions as you can, get a third-party financial advisor or agent to do the market value, consider the creditor’s experience and reputation, etc. Meanwhile, you can just manage fine without credit, just a debit, for your expenses. Therefore, it is crucial to make a wise decision when taking out new credit, as much research as possible.

Find Help For Future Loans

Acquiring a loan during bankruptcy is hard, but not impossible. Get help from family to find yourself a co-signer or guarantor when taking out a loan. However, avoiding any future investment plans up to 2 years after filing a bankruptcy is advisable given the time to rebuild your financial strength before investing in a lengthy affair again. The process is a bit tiresome given the lack of trust that may cause companies to cost you more, but hang in there, get the best advice possible, and even try to postpone your investments as much as you can until your financial situation gets better.

Final Word

There is light at the end of the tunnel is more than true in cases of bankruptcy. People who have gone through this stage have found their redemption by following the guidelines better in the do-over. However, you must know what you are getting yourself into when filing a bankruptcy and how it can impact your life thereby. Money is not just about your financial health. In modern times, money is about your physical, mental, emotional, and psychological well-being, therefore to be managed and tamed well.

To avoid bankruptcy and insolvency is to avoid a financial crisis, therefore to hire the best financial experts possible to guide you through finances with unbiased advice.

Your loan need not be a burden with Loanz360. Loanz360 is such a third-party supermarket for all-inclusive financial solutions, from management to protection of assets, we provide all financial services to our local and international customers alike with the help of our in-house financial partners.

If you are still not sure how, give us a call at Loanz360 and schedule a meeting with our representative, who will take you through the process of buying and financing a loan, along with comparing the market rates and finding the best option that fits your monthly budgets without worrying about the threat of bankruptcy and insolvency.