The daily challenge in the rapid nature of the Indian business is to work with the working capital. This valuable point is the one that enables prompt payments, removing hurdles when it comes to the paperwork, and seizing the right opportunities for development. However, there is no convenient solution for perfect planning of working capital. I.e, even support businesses in stable positions. This is where bill discounting comes forward as the sparkling difference.

Understanding Bill Discounting:

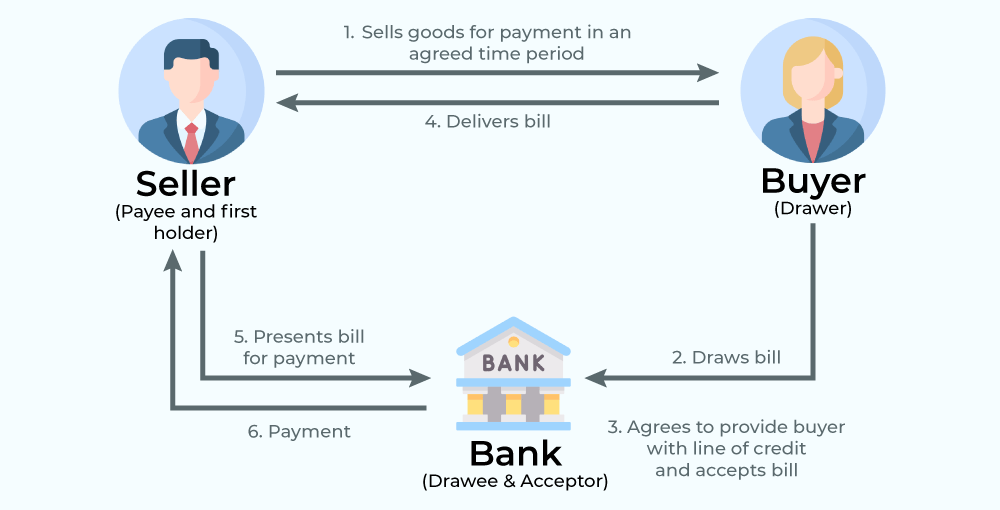

It is a financial tool through which a business sells its receivables like invoices to a third party which most likely is a financial organization in return for a lesser amount. This way business accrues cash instantly instead of waiting for invoices to be cleared by the customers. Bill discounting is an important tool for enterprises to unleash the hidden value in their customers’ accounts receivable and turn them into real cash.

Furthermore, bill discounting should be understood as a transaction process of transferring the invoice ownership to the institution of bill discounting, which collects the full invoice amount from the customer when it matures. In exchange, the business will be paid a percentage of the invoice value, less a discount or a charge according to what suits the financial institution as the latter’s profit. This technique is often used by companies to better manage cash flow and meet short term financial needs like settling accounts with suppliers or covering day-to-day costs.

How Bill Discounting Maximizes Working Capital:

Bill discounting is critical for an effective working capital management scheme, especially for businesses that experience long periods of cash transformation. Through the applying bill discounting techniques, businesses can speed up the realization of cash by up to 30 days, reducing the time gap between the sale and payment for the delivered goods or services.

This increase in cash influx allows a business not to borrow traditional credit facilities or to use overdrafts in a way that ensures working capital requirement. Instead of waiting for bills to settle, businesses can obtain funds by selling their receivables discounted at a price lower than the face value of the bills. This way, the businesses can finance their day-to-day operations, pursue growth opportunities and also manage any unexpected costs.

On the other hand, the efficiency of cash flow management is enhanced through bill discounting due to the elimination of the uncertainty that could come due to the delays of the customer payments. If business entities allow the collation of receivables by the discounting institutions, they can minimize the risk of defaults and devote their attention on the core business without the worries of arrears.

Benefits of Bill Discounting for Indian Businesses:

Improved Cash Flow: The cash flow acceleration mechanism of accounts receivable discounting is the ability for companies to get their funds in advance in respect to their accounts receivable before the date of payment. This therefore provides the required relief from financial constraints resulting in a smooth running of operations.

Enhanced Financial Flexibility: Through the bill discounting, businesses acquire immediate funds that may go a long way in expanding more, making research and development investments, or improving upon the dynamic market issues. Therefore, the financial freedom allows enterprises to be more dynamic and prepared for opportunities and difficulties.

Risk Mitigation: The financial services sector’s management of receivables lessens the risk of bad debt occurrences. The repair houses do deep level credit scrutiny and rating determination before they finance the bills and thus reduce the chance of debtors not making payments and possible business loss.

Interest Cost Reduction: The usage of bill discounting approach allows a business to avail funds at a lower cost compared to taking loans or an overdraft facility. Since the discount rate typically sits below the existing interest rates, businesses can cut down on interest costs. This will eventually bring them to a better financial position.

Improved Working Capital Management: With bill discounting, receivables are quickly turned into cash, thus helping to improve enterprises’ working capital allocation. Firms can use the cash to cover near-term responsibilities, pay suppliers early, and get early payment discounts, which increases efficiency of the whole system.

Creditworthiness Enhancement: Regular use of the trade credit facilities and maintaining a solid payment history will give rise to the firm’s credit worthiness. Such change may trigger positive response of banks and other financial institutions based on the availability of credits, favorable terms and conditions among others.

Streamlined Operations: When bill discounting is in place, a business regularly receives cash flows which in turn diminishes the requirement for customers’ delayed payments on credit. Such an approach facilitates improved scheduling and implementation of business processes without any delays created by cash flow gaps.

Factors to Consider Before Opting for Bill Discounting:

Before diving into bill discounting, businesses must assess various factors:

Cost vs. Benefit Analysis: Evaluate the opportunity cost of surrendering discount rate. I.e., for the benefits that accrue from accelerated cash flows.

Credibility of Financial Institution: Co-operate with reliable banks or NBFCs on favorable rates and secure. By choosing the right college, students shape their future and make their way towards a successful career.

Impact on Customer Relationships: Transparency should become the essential part of a message. Converse with customers for a smooth changeover amid the utmost security of trust.

Real-Life Example:

Consider a case study of an enterprise in Pune that is having to deal with budget deficits arising from late payments from clients. With the help of invoice discounting, the organization works together with a reliable financial organization. I.e., while owing the purchase of the invoices. This is a sure way of tapping into idle cash inflows. These financial sources impede the firm from providing for its various operations. Including operational expenses, raw materials procurement and fulfillment of pending orders without disrupting the company’s operations.

Conclusion:

In summary, bill discounting is a fertile choice. Especially for the Indian based business markets, banking on enhancements of working capital timely management. It facilitates incoming and outgoing flows of cash and consequently, boosts enterprises’ financial health amidst economic uncertainties. Besides, it provides flexibility to capitalize on growth opportunities. On the other hand, the risk of loss of control and cost estimation errors should be weighed and matched. With sound criteria for picking lenders to tap the full benefit of trade discounting. Contact Loanz360 today for sustained growth and success. Check your credit score here now.