Bill Discounting

Contact Our Experts

Phone

9821 488 489

info@loanz360.com

Other Loanz

For More DetailsCall Us

9821 488 489

Upto 100 % Cash BackOn Processing Fees |Zero Collateral | Easy Documentation | Competitive Rates | 20+ Best Deals

Bill Discounting

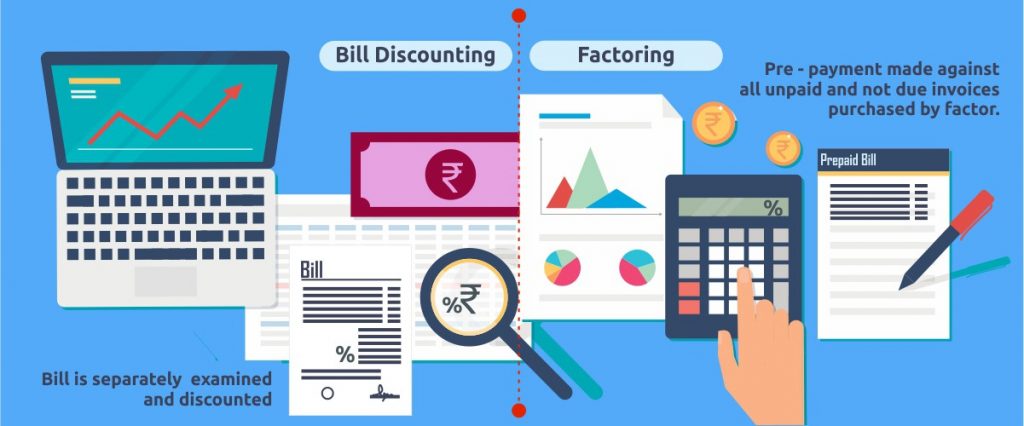

When a business needs urgent funds and its cash is tied up in bills or invoices, then the bill discounting or invoice discounting loan is given by lenders to save traders from the negative cash flow situation. Invoice factoring loan has quickly become a popular financing option for small businesses. This type of loan allows businesses to borrow money against the value of their outstanding invoices. This can be a great way to get the cash you need to keep your business running smoothly.

Bill discounting is also a handy way for traders to get paid for their invoices, even if they’re not due until a later date. Instead of charging a commission, the trader can sell the invoice to a lender, who will then purchase the promissory note before it’s due and credit the bill’s value to the customer’s account.

Simply put, if your business is facing a financial storm and is finding it difficult to keep up with unpaid debts and late payments, a bill discounting facility could help stabilize your business during periods of financial turbulence. By allowing you to sell your unpaid invoices to a third party at a discounted rate, you can free up much-needed cash flow to keep your business afloat.

Offering companies the ability to sell their invoices at a discount to a factoring company to receive an immediate cash injection, bill discounting can provide your business with the working capital it needs to stay afloat during tough times. Not only does this type of funding give you access to much-needed cash, but it also provides a safety net during periods of financial instability. So if you’re struggling to keep up with unpaid debts and late payments, don’t hesitate to consider this life-saving option. This would enable your business to remain focused on its goals and growth, even when revenue is unstable.

Unique Points & Features

Zero collateral loan

For availing of a bill discounting loan, you do not need to submit security or collateral against the loan since it is no debt incurred loan. You get the money against the invoices provided therefore safe from suffering any liabilities or losses.

Rapid cash flow

The loans provided on the invoices are quick and hassle-free. You will get instant access to cash without any delay within 24 hours of application thus minimizing any dents in the cash flow.

No tax liability

Bill discounting loan has zero impact on the balance sheet and is an off-record loan that does not make you liable for any taxes.

Minimal Documentation

At Loanz360, our financial partners work towards making your process simple and easy with standard documentation procedures thus making your loan easy to access.

Competitive Pricing

Loanz360 works with leading financial institutions and other financiers to bring you the best and most convenient deals on your loan with lower interest rates and flexible repayment tenors.

Types Of Bill Discounting

Factoring: Factoring is where the customer sells his account receivables to the bank or a financial institution at a discounted or agreed price to meet their working capital needs for the short term.

Reverse Factoring: Also known as supplier finance, reverse financing is a mechanism in which the business can offer early payments to the suppliers with their approved bills or invoices.

Spot Factoring: Spot factoring is when the client or the customer gets only one invoice or bill discounted with the bank. Although not always preferable with the given disadvantages, the client may choose so if he wishes.

Contract Factoring: Contract factoring is when the client makes a long-term agreement or contract with the lender to factor in every invoice or set a minimum monthly volume to make the exchange.

Recourse Factoring: If the factoring company is unable to collect a payment, your company has the right to buy back invoices or unpaid receivables thus shouldering a credit risk.

Non-Recourse Factoring: The factoring company or the lender will bear the risks of unpaid receivables thus asking for higher discounted invoices. Check with the bank or the lender on their policy before signing an agreement to know which factoring method they use.

Eligibility Criteria

Type of Employment: Self-Employed/Business Owner(Govt, Large Enterprises, Etc.)

Nationality: Resident of India

Income: Contact Loanz360 for business turnover requirements. (Business volume and annual turnover as requested by the bank)

Credit/CIBIL Score: Any profile(Credit score ~ 650 or above has a higher chance of getting a quick and instant loan with high funding at lower interest rates)

Business Vintage: 2 – 3 years and above (With a stable income and continual flow of money)

Note: The eligibility criteria mentioned above are generic and may vary from lender to lender. Please reach out to us at Loanz360 for a personalized eligibility chart.

Documentation

Note: Documents requested may vary from lender to lender, contact Loanz360 for any inquiry.

Proof of Identity/Address Proof/Bill of Exchange/Copy of Business Registration(If required)/Copy of latest 12 months bank statements/ Copy of Income Tax Returns (ITR)/Letter of Credit/Commerical Invoice/Packing List/Delivery Fines(If applicable)

Charges & Interest Rate

Interest rates on bill discounting loans are only paid on the sum of money utilized. The Flexi loan offers borrowers an overdraft limit to utilize funds as they wish. Instant cash or working capital options are available to provide much-needed funding alternatives to business owners (purchasers/vendors) without funds.

We are partnered with leading financiers such as SBI, Bajaj Finserv, IDBI, EFL, ICICI, Tata Capital, HDFC, Bank of Baroda, Hero Fincorp, Federal Bank, and more to bring you the best deals on your raised bills or invoices with low or zero security guarantee.

Note: Contact Loanz360 to discuss options. The interest rates may vary subject to conditions.