Introduction

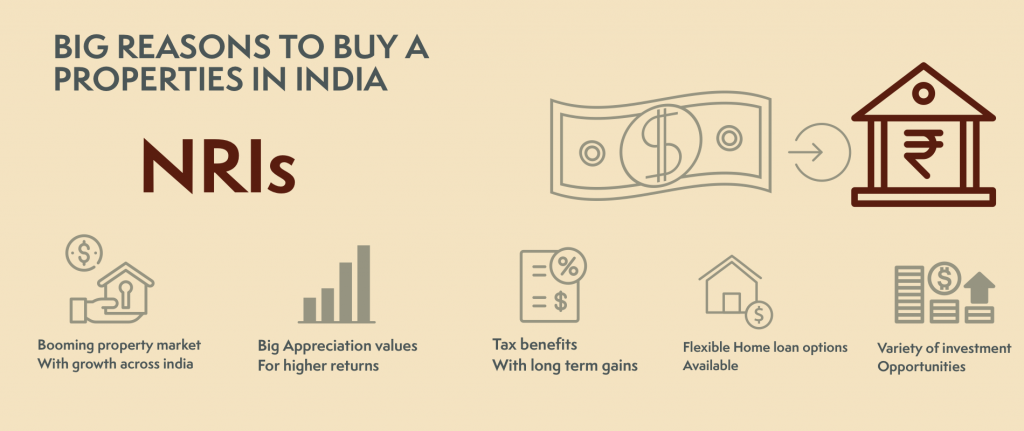

India is one of the fastest-growing economies in the world. The country’s real estate market is booming, with a shortage of homes and a lot of demand. This has led to many developers and builders coming up with new residential projects and this has also led to an increase in home loans in India.

Everyone; including residents in and around India, are enthusiastic to invest in the residential market to upscale their economy. The loan can be processed and transferred to the bank without the physical presence of the applicant. This makes the process and transaction easier for Indians posted or located abroad. However, there are certain things that an NRI should know before applying for a NRI home loan in India. In this blog, we will discuss everything about NRI home loans.

Who Is Eligible For NRI Home Loan?

Non-Resident Indian (NRI) loans are a type of loan given to people who are not in the country (India) they are borrowing from. If you are living in any country for an indefinite period of time, obtaining a loan from the residing country is complicated without a permanent resident card. Therefore, to meet unforeseen expenses, the Non-Resident Indian applicant can easily avail of a loan to meet his capital requirements with the help of an NRI home loan.

According to FEMA (by definition), An NRI (Non-Resident Indian) can be an individual,

- Who is a Person of India Origin (PIO), residing abroad for education, employment, business-related purposes, or any other?

- Who is an Overseas Citizen of India (OCI), previously citizen or native of India, guaranteed certain rights conventional for Indian citizens.

- Who stays outside India for more than 182 days in the preceding fiscal year for business, vocation, employment, or any other reason.

10 Things NRI Buyers Must Know Before Applying For A Home Loan

#1 Banking Channels

Before applying for an NRI home loan in India, NRI has to have a valid bank account in India. According to RBI (Reserve Bank Of India), NRO, NRE, and FCNR accounts are some of the valid repayment modes for NRI home loan applicants. You can repay the loan with remittance from the resident country (inward remittance). However, the EMIs should only be paid in INR (Indian Rupee) and permissions are subject to change with revised policy RBI guidelines to Housing (or) Finance companies. As a result, most borrowers pay their EMIs through rentals received from the property for which they took the loan to avoid complex repayment practices.

#2 Countries For NRI Home Loans

Both salaried and self-employed NRIs can apply for an NRI home loan. Even if most banks have religiously followed the pattern of imposing country restrictions in their immediate policy, financiers today are adopting increasing options as a part of the gentrification push in India.

Besides growing services in wide nations, countries such as the U.K, U.S.A, Australia, New Zealand, Canada, European Countries, Middle Eastern Countries, and a few East Asian Countries such as Thailand, Japan, South Korea, Hong Kong, Malaysia, and Singapore do not face any complications or disturbances when applying for a NRI home loan in India.

On the other hand, citizens of Nepal, Pakistan, Bangladesh, Afghanistan, China, Bhutan, etc are not allowed the right to purchase assets (real estate) in India. However, the conditions may vary from bank to bank and should be discussed with a financial expert or bank representative to be well-equipped with information and terms before applying for an NRI home loan.

#3 Source Of Income In India

Most banks and lenders expect NRIs to have a minimum work experience in their current country of residence at the time of applying for the loan. However, a few financier policies may also stipulate a minimum threshold for NRIs of at least 20% of their total income earned from sources within India (taxable income) for at least 2 to 3 consecutive years to avail of tax benefits on the loan. However, the rules are subject to change, varying from lender to lender and this is not mandatory.

#4 FEMA

FEMA, short for Foreign Exchange Management Act stipulated by RBI, asserts certain rules on NRI to make their investment process convenient and easier. According to FEMA, NRI with a valid passport can avail of commercial or residential loans In India without any added obligations. However, NRIs looking to invest in agricultural land, plantation, or even a farmhouse cannot do so without government and RBI approval, unless inherited (through succession) or gifted.

#5 Tax Benefits

Similar to Indian residents, an NRI with rental income is subject to taxes by ITR. If the NRI has a long-standing (>2 years) income source in India, the asset will be taxed at 20%. Therefore, NRIs with taxable income in India can avail of a NRI home loan, purchase a residential property, and claim taxes under set sections.

#6 Switching Banks

If you already have an existing loan on your home and are contemplating switching banks or obtaining a balance transfer to benefit from lower interest rates, you should first check with the bank or the lender about the fees that they may apply for the switching process. If the financier is promising a zero-fee policy, then there might be other hidden charges involved in the process depending on the pattern of the transfer. Such as, the application of stamp duty charges if the borrower decides to transfer title to a new owner.

Check with the bank or a marketplace to discuss your financing options. Make thorough research or appoint a third-party financial expert to do the research before applying for the loan, to benefit from the renewed services.

#7 Co-Applicant Requirement

Most banks will ask for a co-applicant, co-owner, or co-borrower on the loan. The co-applicant requested should be an immediate family member residing in India. If you do not have any members of your immediate family (spouse/parent/guardian), you can negotiate with the respective bank to change the terms of your contract or bargain alternative solutions to the problem.

#8 Loan Repayment

EMIs on an NRI home loan are processed through one of the banking channels mentioned above. The funds held in an NRE (or) NRO account can be used to repay the loan. Popularly, borrowers use rental income acquired on the loaned property to meet the repayment requirements of the loan, as it is one of the easier methods to reserve currency in INR (Indian Rupee).

#9 Joint NRI Home Loan

You can take out a joint NRI home loan to increase the chances of availing of the loan. Under certain categories, there are benefits on the loan if the co-owner of the property is a female. The rate of interest obtained on the loan is lowered in this case, varying from bank to bank. However, primarily, as discussed before, the co-owner/co-applicant of the loan can only be a person from the immediate family.

#10 Power Of Attorney

If the applicant (NRI) is submitting the NRI home loan application,

From India: Trusteeship or POA (Power of Attorney) provided should be locally validated.

(or)

From Abroad: Trusteeship or POA provided by an Indian consulate in the residing country should be legally documented.

Therefore, the rules of applying for the loan are consistent among all applicant(s) of the loan, and the Power of Attorney should be also issued and legally documented in the name of your co-borrower.

Should NRIs Apply For A NRI Home Loan In India or Their Resident Country?

Taking out a loan in the residing country is a challenging task if the resident does not carry citizenship. And when taking out a loan in India, changes in Forex (Foreign Exchange) may have an impact on EMIs. Therefore primarily suggested to pay through rentals, NRIs can also explore other alternatives to repay their loans in India.

One such may be when the residing country has a bank that has an extended or native branch in India. In such cases, the banks may offer attractive rates and deals on the loan without having to worry about the forex. However, the NRIs should strictly consider currency fluctuation risks when taking out a loan, therefore should proceed carefully with the help of a financial expert.

Final Word

These are the basic requirements that you need to fulfill to take an NRI home loan from India. A lot of these requirements can be fulfilled by having an account with an Indian bank, but they might not be able to get a loan without providing proof of income. The process is fairly lengthy and can take at least 6-8 weeks if done independently.

You can cut short this processing time by taking a loan with a reputed marketplace that can assign a dedicated relationship manager to provide information and unbiased advice on the loan process and help with the entire procedure of the loan with quick hassle-free solutions, a best NRI home loan interest rate, and easy and minimal documentation.

Loanz360 is a store for all-inclusive financial solutions, from management to protection of assets, we provide all financial services to our local and international customers alike.

If you are still not sure how, give us a call at Loanz360 and schedule a meeting with our representative, who will take you through the process of financing a loan with the best home loan interest rate, along with comparing the market rates and finding the best option that fits your monthly budgets without breaking a sweat.