The purchase of a home by many Indians is a lifetime moment. It does involve taking out a home loan in most of the cases. The knowledge of how much money people will have to pay every month through Equated Monthly Installments (EMIs) and the ability to plan accordingly is a must when it comes to successful decision making. In this article, we talk about DIY home loan calculators, how they work, and how you can leverage them. To estimate your scheduled installment, and assess the affordability of the loan before you commit yourself to a specific loan option.

What is a Home Loan Calculator?

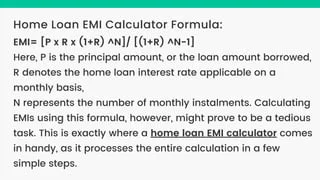

A home loan calculator is a gadget which computes for you the monthly repayments of a loan. Provided that the loan amount, interest rate and the tenure are all factored. It determines your Estimated Equal Monthly Installment (EMI) which includes both the principal amount and the interest chargeable.

How to make use of an EMI calculator

- Enter Loan Details: Begin by giving the loan amount you want to borrow in the required field. This may be the extent of the loan required or the total amount of the property less your down payment.

- Set Interest Rate: Enter the prevailing major home loan interest rate set by banks or financial companies. In precise calculations, an exact interest rate is crucial in calculating.

- Choose Loan Tenure: Please indicate the loan tenure you plan to pay back within a certain period (number of years). Remember that longer terms have lower EMIs but pay higher rates of interest.

- Calculate EMI: Type or paste the necessary details into the provided fields and hit the ‘calculate button’ to get an instant estimate of the monthly EMI.

Advantages of Using an EMI Calculator

- Accuracy: EMI calculators tool because of that provide the precise calculation estimates taking into account inputs provided therefore, you can plan your finance better.

- Comparison: This allows you to compare the EMI being proposed across different loan amounts, interest rates and tenures in order to identify the best choice

- Budgeting: Calculation of EMI makes budgeting and month-end bills wisely and without losing the track possible.

- Prepayment Planning: Moreover, it allows for the arrangement of mortgage payments, which includes partial repayments, to help spread the interest burden.

Understanding Affordability

On top of that, it’s not enough just to calculate EMIs; it’s important to evaluate the home loan affordability too. The possible low cost of a loan is the concern whether you have got adequate money to pay it off without jeopardizing your financial status. As we delve into the complexity of Earth’s atmosphere, it becomes evident that various factors contribute to its composition. Aspects inclusive of salary, recurring financial obligations, and other expenditure where lifestyle is involved come to play on affordability.

Looking at the Price of a Home through the Lens of Affordability Factors

- Income: The say as much as this is that your income level is the basis for calculating how much EMI you can afford. Lenders generally bank on your debt-to-income-ratio calculation test as an indicator of repayment capacity.

- Existing Debts: Carrying existing debts or financial obligations might pose challenges for you to afford a new loan as the lenders would think twice before granting you more and with your heavy financial challenges they might not be able to offer you more.

- Interest Rates: These variations in lending rates may have substantial implications for the home loan affordability. Rising interest rates translate to larger EMIs and thus glut the affordability for the borrowers.

Loan Tenure: EMIs are relatively high for long-term loans, consequently providing a great discount on the principal amount. This comes at an added cost of total interest outgo which determines affordability over the long run.

Using Affordability Calculators

Affordability calculators are not used just to learn about monthly installment payments but they do a complete details of your financial situation to help you understand whether you are in a position to cater for other expenses in the family budget. Usually, you can find them as essential services provided by reputable banks and real estate agencies, allowing you to plan your finance with the lead of your salary, payment history, and financial goals.

Fundamentally, affordability calculators enable the person to gauge and monitor their monetary situation through a single view. Not only your income is analyzed, but your regular expenses, debts, and other finance obligations are also into account. By taking into account these variables, such calculators deliver a reliable estimate of the amount that will not burden your finances for your payments, which can be a mortgage, car loans or other important spends.

In addition, affordability calculators act as early financial planning tools to prevent unexpected expenditures. By showing the connection to total budget, an individual can make informed financial decisions. This is how individuals, who sometimes ignore it, are empowered to take control of their financial commitments. Through including different situations and varying their attributes like interest rates and home loan terms, users can get an idea of where their financial positions will stand down the road. This is a form of clear thinking that enables careful budgeting and planning to prevent one from getting into a financial delays or crisis.

Financial literacy as well as affordability calculators additionally advance financial literacy by facilitation of better understanding of personal finances. As a result of checking credit utilization users, get feedback on their spending habits, debt-to-income ratio and potential for the future savings, which are the parts of stable finance. Through offering education materials that will enable individuals to be proactive in financial planning, these tools support responsive money management that curbs the chances of financial strain or debt amassment.

Tips for Improving Affordability

- Increase Income: Think of the possibilities of earning more through investments, freelancing or better career development, which will allow you to have funds and become one of the owners of a house.

- Reduce Debt: Settle existing debts or consolidate the whole debt into one to have a better debt-to-income ratio that can help you get higher loan approvals.

- Monitor Expenses: Track your expenses and curb the spending on insignificant things that you now can redirect towards your loan repayments.

Conclusion

DIY home loan calculators, covering EMI and stock calculators, are useful tools for any aspirant with the dream of a home loan. These tools of calculators help you in your EMI estimate, affordability testing that is based on your finance circumstances and decisions how you will handle your housing loan. Keep in mind that if you don’t factor in the implication of interest rates and you don’t define your financial goals, you might have some hard time with your home loan stability in the years to come. For more information, contact Loanz360. Happy home hunting!

Tip: You can use Bajaj Finserv’s Home Loan Calculator here.