Introduction

Business of any size needs funds to run smoothly. From managing inventory, and payrolls, to everyday business operations, money will foot the bill. According to data compiled by Statista

“In 2021, there were estimated to be over 333.34 million companies operating worldwide, of which 186 million were in Asia,62 million were in Africa, and 33 million were in Europe”

This only means that there is one business born every minute, somewhere. Which only adds to your competition. When the market competition is high, the burden on functional efficiency and client experience increases, thus increasing the need for trend matching. Hence working capital.

In this blog, we will discuss everything you need to know about managing working capital and why you should invest in one if you haven’t already.

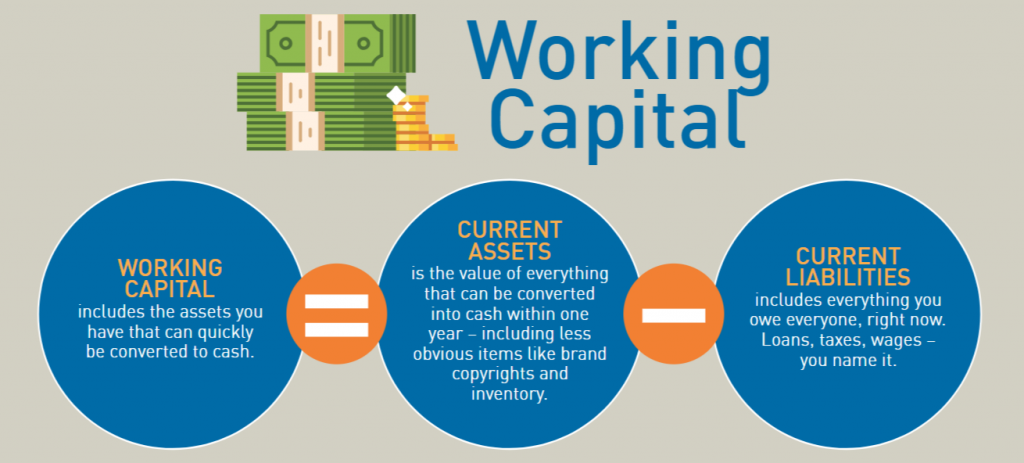

What Is Working Capital?

As we know, as entrepreneurs or business owners, it is the money that runs the business, next to experience and expertise. For example, a doctor with experience or expertise can only do so much for his patients without equipment or staff at disposal. Therefore there are several requirements in business that need to be funded religiously for the business to be serviceable to its clients. As the saying goes, unless you have 100% customer satisfaction, there is always room for improvement, and the room is the biggest one in the house.

Working capital is a type of loan that offers solutions for all the problems mentioned above. It helps a business operate smoothly without falling short of funds. The loans are widely meant to cover the daily expenditures of a business, like distributing wages, recovering debts, purchasing resources or raw materials, etc.

One of the reasons why this loan is popular among Indians is the easiness of the loan and its process where the business owner retains ownership without involving equity transaction or even does not require to submit collateral to avail of the loan since it is a short-term loan that can be renewed yearly.

When Should You Take A Working Capital Loan?

As we have discussed above, a working capital loan is not a loan taken solely based on one reason. There are several reasons why a business might need a working capital loan, either to gap their existing financial problems or not face any potential financial troubles. Therefore, if you are a business alone, you will need to manage funds, thus managing working capital becomes a must. Here are a few reasons why cash working capital includes motivation to take the loan:

Restore financial health from debentures

Working capital loans have many types of loans, from the line of credit, to invoice factoring loans. So there is a type for every requirement built especially around the category of your choice. Check out the types of working capital in our services section, under working capital loan to know more.

The business might or might not have debts that need to be taken care of. Given that businesses invest and reinvest heavily to cater to the growth of the establishment, every business has unforeseen expenses or debts to recover from. This is where a working capital loan can help business owners to recover their financial health by closing their financial gaps.

In such cases, the borrower can apply for a bank guarantee loan, also known as a letter of credit to step in when the borrower defaults on a loan or promise of service. The bank will then directly deal with the losses incurred before the damage is done by evaluating your performance religiously. This agreement is made against security or commission, as discussed with the bank prior to the contract. Likewise, there are other loan types like bridging loans, line of credit, etc. for the same purpose but with different approaches for each.

Capitalize on business opportunities

In the end we only regret the chances we couldn’t take. There goes another saying, but instead, there are chances where sometimes we couldn’t take them due to other influences or parameters in our life that didn’t allow us to. Business is one such place where opportunities knock on doors rarely, and when they do, some find it hard to welcome the change because of a lack of funds or financial risks. It’s often these opportunities that may bring a larger change to the business in a short span. So, why hesitate, that too for reasons that could be fixed?

The working capital loan, gross working capital and net working capital, helps you work on your business opportunities without worrying about the expense. These loans can be repaid over time in due as your business grows.

Moving workspace

While term loans are a popular form of repayment mode, Flexi and balloon loans offer a new lens to view your repayment practices. For a business owner moving from an old office to a new one, he does not need to sell his old office before moving to the new one. Rather, he can take a balloon loan, make considerably smaller payments during the course of the loan, and can do the payment in a large lump at the end of the loan term once he has settled in his new atmosphere.

Meet financial emergencies

There are always financial emergencies when we least expect them, and hence called emergencies. Working capital is instant loans, whether you are taking a bridging loan, bank guarantee, or any other, you can meet your financial emergencies of business with working capital loans quicker and easier.

Cover yearly expenditures

This is a common reason why every business should take a working capital loan. Every business has certain financial expectations to meet on an annual basis, hence the business should be abundant in cash reserves to be able to easily cover other aspects of your business without depleting your resources and suffering a business standstill situation. Therefore to cover sales fluctuations and to let the business operate smoothly even during off-season periods without the imbalance in the fruition of payments and receipts, the business owners should have a working capital set aside.

This is not only why, but the busy seasons alike will benefit from working capital loans without breaking your piggy bank.

Purchase raw materials

Purchasing inventory or raw materials is crucial for businesses of any kind. Not only shipment-related businesses, but digital businesses can only work smoothly when they are able to get proper licenses or equipment to reduce time consumption and labor. Therefore, almost every business needs to match their inventory to the latest trends to avoid heavy competition and being lost in the market. Whether to reduce bulk pricing when purchasing inventory on a larger scale or to realize the everyday needs of your resources, this loan will benefit you more than you may assume. It keeps your financial jar full magically.

Maintain positive cash flow

As discussed, there are several things we can do with working capital, from distributing wages to purchasing inventory. Therefore keeping your business from suffering a financial shock can help your business avoid negative cash flow.

Therefore even if you are taking time to clear your bills or invoices and have higher expenses than turnover ratio, this will help you maintain a positive cash flow without scratching pennies to find funds. And with some money made, you can repay in Flexi loan for the cash reserves used or balloon payments when you can improve over the grace period of the loan and drop the sum in lumps when you have an improved turnover.

Benefits Of Working Capital Loan

There are several benefits to a working capital loan and since the loan is a personalized loan you can also get a generous amount of offers and deals on the loan with a high LTV of up to 80% on working capital. Cash working capital includes several other benefits such as:

No end-use restrictions

The loan obtained on working capital, gross working capital and net working capital, has freedom of expenditure. This means that the borrower can use the money to invest in the growth of the business without having to worry about disclosing or explaining the lenders on his end-use.

Zero collateral loans

Working capital loans are mostly unsecured or collateral-free loans. With short-term capital, the borrower will not be requested to submit collateral on the loan obtained, thus securing his assets.

Flexible withdrawal facility

The Flexi facility unlike term loans allows its customers to borrow loans on a cash limit that they can withdraw at their discretion and pay interest only for the amount used and not worry about the prepayment charges.

Pre-approval on loan

Working capital loans offer a pre approval facility on the loan. This means that the borrower can get a loan pre-approved and then decide where or how to use the loan.

Zero equity loan

The bank or the lender will not ask the applicant for any liability or hold on to their equity shares. Thus the business owner may possess full control over his business with no impact on his ownership or equity of the company.

Final Word

If you are looking for managing working capital and need assistance contact Loanz360 to get the loan at the best prices and deals instantly. Check out the eligibility criteria and documents required in the services section under the working capital loan.

Loanz360 is a supermarket for all-inclusive financial solutions, from management to protection of assets, we provide all financial services to our local and international customers alike.

If you are still not sure how, give us a call at Loanz360 and schedule a meeting with our representative, who will take you through the process of buying and financing a loan, along with comparing the market rates and finding the best deals that fits pocket with discounted offers and flexible services.