Be it buying a new house or getting a home loan, the process of home buying sometimes ends up in an ocean of terms and jargon unknown to the buyers, especially the first time buyers. The ability to understand the native tongue of loan terms is important for newborn buyers in order to make reasonable choices. This glossary is intended to decode common phrases used with home loans in India, which in turn will lead to your increased clarity and confidence in the home loan system in India.

1. Home Loan Basics

A borrower borrows an amount of money from a lender to purchase a home or a piece of land, commonly known as a house loan or mortgage loan. The borrower agrees to repay the principal amount and the accumulated interest by a specified date, which can range from 15 to 30 years.

Home Loan #2. EMI (EMI) and Interest Rates

An EMI is a predetermined fixed amount the debtor (borrower) pays to the lender every month. It encompasses the principal as well as the interest component, thus making it easier for borrowers to manage their financial requirements.

The interest rate is the rate people pay to borrow money, which can be expressed as a percentage. It is, however, either fixed or variable, adjusting the final amount to be paid off only after the loan period.

Home Loan #3. Loan Tenure and Prepayment

Loan tenure is the period during which the loan is released. The choice of longer duration could translate into lower EMIs but higher total interest cost; the shorter term, on the other hand, might mean higher EMIs but less interest cost.

Prepayment of a home loan refers to settling a fraction of the loan amount ahead of when the tenure is due. The lender might apply a prepayment penalty; therefore, borrowers should inspect whether or not their loan terms have it.

Home Loan #4. Foreclosure

Foreclosure is a legal action through which a lender takes back their hard-earned property when a borrower doesn’t comply with their mortgage repayment terms. In most cases, the process begins when the borrower fails to repay his debt and eventually the lender sells the property acquired as security to recoup his loss. This financial result may impact either the borrower or the lender emotionally as well as financially. The solution may also have damages on a borrower’s score and credit ability to acquire a home loan in future as lenders may also suffer losses if the properties are sold for amounts lower than the outstanding loan amounts.

Foreclosure is regulated by jurisdiction- specific procedures; however, they all contain several phases, the most common of which include notice of the borrower, conducive to public auction of the property and transfer of ownership to the highest bidder or the lender. Foreclosure is caused by a number of the varied reasons, including for example, loss of the job, health issues, or economic crisis. The owners of homes facing foreclosure can choose from many options such as the loan modification, loan forfeiture and deed in lieu of foreclosure, although these options mostly depend on the policies of the lenders and the finances of the borrower.

Home Loan #5. Down Payment

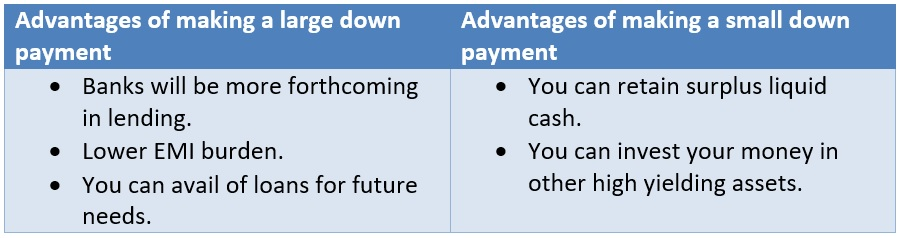

A down payment is called a sum of money which is equivalent to a lump sum payment made as an initial part of the purchase of a property or an asset, particularly in real estate transactions. This is equal to the amount of initial equity that the homeowner has in the property and thus cuts down on the financing required from the financial institution. Depending on the mortgage, the down payment size is given in the form of a percentage of the total purchase price. More money put in for the down payment translates into lower amount of the mortgage and in some cases, getting lower interest rate.

Down payments are supposed to have several essential missions. They illustrate the borrower’s financial involvement/commitment, thus making it possible to cut the chances of default. The fact that a considerable down payment also constitutes a kind of buffer against changes in the property value and helps the buyer avoid Private Mortgage Insurance premiums (PMI) is true. Although conventional wisdom causes us to possess adequate savings for a 20% down payment, to avoid PMI, and to benefit from favorable credit terms, lenders tend to support more borrowers with lower down payment options.

Home Loan #6. Credit Score

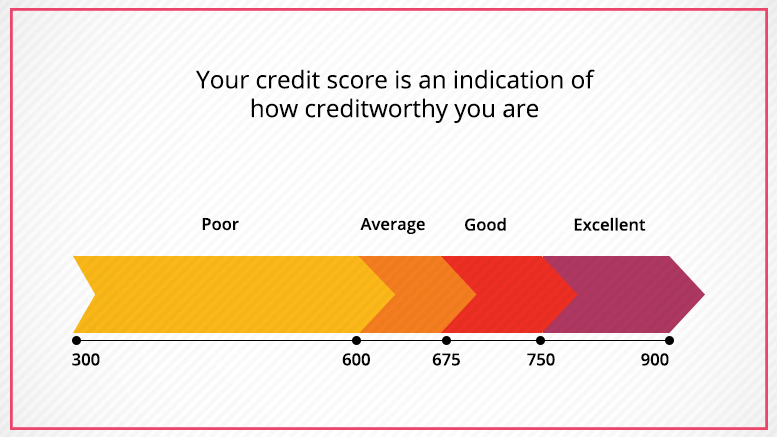

A person’s credit score is 3-digit number which reflects their creditworthiness, it is based on the past credit and financial actions of borrowers. It stands for the probability of a debtor repaying the debt within the timeframe agreed, and it plays an important role when it comes to evaluating risks before extending credit or loans. Corresponding credit scores are usually in the range of 300 to 850, the higher the score, the less credit risk the customer has and the bigger chances are of home loan approval and at favorable terms.

The credit scores are determined by the whole range of factors which the person’s payment history, credit utilization, length of a credit history, types of credit, credit inquiries belong to. Being consistently on time with your payment obligations, keeping credit card balances low, and likewise cutting down on the excessive number of credit applications, are some of the best practices that can help you build a good credit history over the long term. Yet, it is worth mentioning that a credit score can be affected negatively by missed payments, high debt levels and derogatory remarks like bankruptcy or foreclosure, which limit availability of credit as well.

Tip: You can check your CIBIL score here.

Credit scores are extremely useful in the financial sphere by the means of determining borrowing approval, interest rates applying to loans, insurance premiums, rental applications, and even influencing employment prospects. Careful supervision and the usage of credit score responsibly are supposed to give people the possibility to determine their financial life and favorable conditions on credits and other financial services.

Home Loan #7. Loan-to-Value Ratio (LTV)

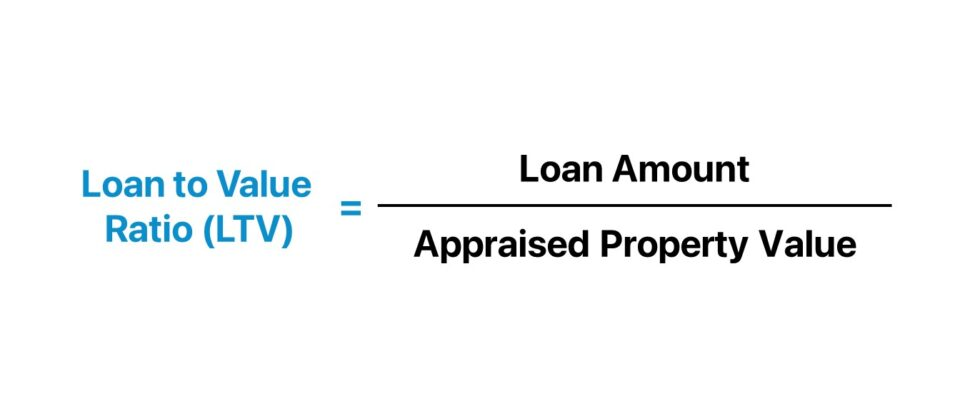

LTV is a financial metric applied by lenders to evaluate the risk of a loan to the loan amount in the proportion to the property appraisal value that serves as collateral. It refers to the proportion of the value of the property financed via debt. The lower this LTV ratio, the lender is less risky and it could potential be favorable credit terms for the borrower.

LTV ratios are very useful for mortgage lending purposes where they judge the amount for the down payment and demand for private mortgage insurance (PMI). A lower LTV signifies a bigger down payment volume and more equity in the property; thus, there is a possibility of low level of defaults and asset losses for the lender. Consequently, LTV ratios below this value lead to better conditions for borrowers such as lower interest rates and larger home loan amounts.

Lenders usually evaluate loans by the highest LTV for each type of loan and the borrower’s credit standing. A common case in conventional mortgages is that the limits for LTV ratio do not exceed 80% without PMI; however, programs run by government like FHA loan may exceed 80% with mandatory mortgage insurance. In order to succeed on making a smart choice about borrowing, borrowers should calculate the LTV ratio and figure out how it is going to affect the terms of their mortgage advantages.

Home Loan #8. Processing Fee

A processing fee, meanwhile, is a fee levied by the loan providers to help offset expenditures devoted to reviewing and managing loan applications. Normally, this fee isn’t money back guarantee, but is paid along with other loan fees like origination fee and closing costs. Lendee’s should be aware of any processing fee charged and ensure that it is included in their overall cost of borrowing.

It involves a broad range of duties performer, including verifying applicant’s financial information, conducting a credit check, and processing the required paperwork. Although the processing fee charged by the lender may differ for this type of loan or another; hence, it’s important that the borrower understand and budget for this extra expense when calculating the total expenditure.

Home Loan #9. Amortization Schedule

Amortization schedule is a more detailed break down of each individual payment due with time, usually linked with long-term loans including mortgages and car loans. It shows exactly how we separate the payment into the part that is used to pay the interest and the principal amount, which becomes smaller over time. This schedule enables borrowers to actually visualize the progress towards the total loan amount elimination over a period as they make regular payments.

The main idea behind teaching borrowers that the allocation of each payment is between interest versus principal is to ensure that borrowers have a proper understanding of the overall cost of borrowing and savings that can come with paying off the home loan earlier. Another benefit of an amortization schedule is that it brings clarity and transparency to the borrower; along with this, it enables the alternative to track progress and thus make informed decisions.

Home Loan #10. Co-Borrower

In a co-borrower situation, the other individual who simultaneously applies for the loan is liable for payment just like the main borrower. Typically, the lender requires that the co-borrower is included in the application process for reinforcing the borrower’s financial stability, and increasing the opportunity of the loan approval. Co-borrowers come to the scene mostly in the mortgage applications. With this, a borrower can merge his/ her income and creditworthiness with that of the other person so that overall the loan application can be accepted with favorable terms like lower interest rate.

If the co-borrower possesses a steady job and a good credit history it will strengthen the impact of the applicant on the lender and consequently gain higher chances of approval and better loan terms. Nevertheless, all the parties involved in the joint borrowing, such as both the primary borrower and the co-borrower, need to be aware about the legal and financial responsibility attached with the payments of the loans.

Home Loan #11. Default

Default is a situation in which a debtor fails to satisfy the due payments in a loan agreement. It signifies a violation of the loan agreement and this could affect the borrower with dire consequences that include court suits and repossession. Besides, you may face the following scenario: if you default on a loan, this will have negative consequences for your credit rating which could make it harder or a lot more expensive for you to borrow in the future. Lenders usually possess certain additional processes for dealing with these arrears. The approaches can include negotiating new payment terms or launching collection procedures.

Home Loan #12. Mortgage Insurance

Mortgage insurance stands for a financial instrument that offers indemnity to lenders in case the borrower is unable to make their payments on the mortgage loan. Sufficient insurance is generally required from homebuyers who make an initial down payment below the minimum amount set by lenders for the purpose of reducing the risk borne by lenders by covering a specific part of the remaining loan in case of default.

Mortgage insurance helps lenders endure losses in the event they lend mortgage to borrowers who have lower credit ratings or less down payment which in turn reduces their own downside risk. The calculation of mortgage insurance premiums is based on a number of factors, including the loan-to-value (LTV) ratio, which is the relationship between the value of the loan and the appraised value of the real estate.

Home Loan #13. Stamp Duty

The stamp duty is an official tax which is set by a government in many countries worldwide and which is levied on various types of dealings like the ones related to property transactions. There comes a tax that is usually collected as a percentage of the property’s sale price or value and in land development it must be settled by the buyer.

Stamp duty gradients differ a lot amongst the regions and the jurisdictions and is also dependent on the value of the property in question. it is a primary factor to be taken into account by either party in property transfers, because the unintentional involvement of stamp duty costs, stemming from wrong calculations or legal complications, might lead to additional expenses.

In India, on the other hand, disparity in stamp duty rates persists between the states. Thus, it is imperative that the prospective buyers conduct a thorough research about the rates applicable in their specific locations as failure to be aware of the prevailing rates might lead to an overestimation of the total cost of purchasing a property.

Conclusion

To a first-time buyer, the universe of home loans can be quite intimidating. For them, however, understanding the basic terms and terminology play a key role in making the process of buying a house lessened and more transparent. The process of attaining firsthand knowledge of these definitions and of seeking appropriate guidance from financial advisers will enable the rising homeowners in India not only to start the acquisition of property but also to do so with confidence and wisdom. Contact Loanz360 for more information