Introduction

From marriage to an emergency, a personal loan is used for several other purposes that can both satisfy your short-term and sometimes even long-term financial needs. When taking such a loan, it is vital to know where you are investing your money and what extra personal loan fees or charges are levied on top of the loan.

Have you ever wondered why you had to end up paying more than you had agreed at the time of disbursal?

Apart from government-issued taxes, there are several personal loan fees that banks levy upon their customers for processing, pre-closing, or even registering for a loan. In this article, we will discuss the common types of charges that are added by banks to your loan.

Note: The below-mentioned charges are generic. Interest rates and charges may vary from bank to bank and requirement to requirement. Each bank will work independently from the other. Contact the financier or a marketplace to know more about their terms and conditions.

10 Important Personal Loan Fees & Charges

Personal Loan Fees # Rack Interest Rate

Personal loans; short-term or long-term are usually unsecured loans without a need for security or collateral. Hence the increase in interest rate is a common measure by banks to compensate the trust funds. While the ROI for a personal loan may start from over 10% in most banks, personal loan fees will highly depend on the borrower’s creditworthiness, employment status, relationship with the bank or the lender, and other factors.

Personal Loan Fees # Processing Fee

The fees charged for processing a personal loan or personal loan fees are used to cover the operational costs of the bank and the time dedicated to approving your loan. The processing fee is usually low, ranging from 0.5-3% of the loan amount per year varying from bank to bank.

However, you may find several banks that do not require or request a processing fee depending on their existing policies. You might want to check with the lender terms before applying for a loan if they may require you to pay the amount upfront, deduct it from your loan, or waive the fee entirely.

Personal Loan Fees # Penal Interest

Penal interest or additional interest is added if you are late on your EMI payments as per the repayment schedules. In such cases, you will be charged a penal or additional interest rate, a rate higher than your loan interest rate. Usually an increment of anywhere between 1.5% to 3% over the prevailing bank rate.

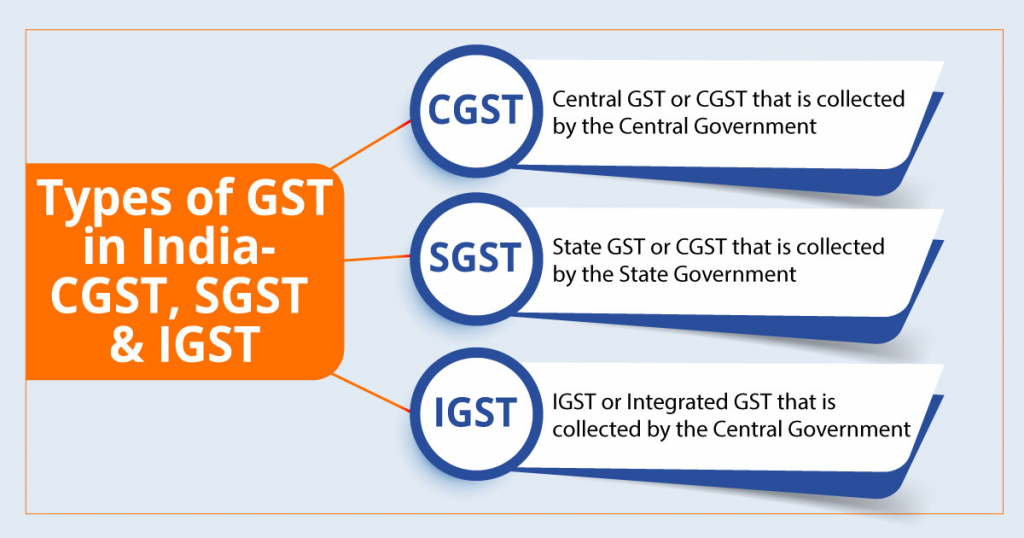

The penalty amount for the penal interest rate will be calculated based on the overdue amount and duration, and GST will apply to this amount.

Personal Loan Fees # Late Payment

A late payment charge is more or less similar to the penal interest when the customer fails to meet the repayment timeline or makes a delayed payment. While late payment charges or delayed repayment are what further attract penal interests over the bank’s prime rate, these can be dismissed as a one-time mistake by subjugating the overdue durations that do not exceed three months.

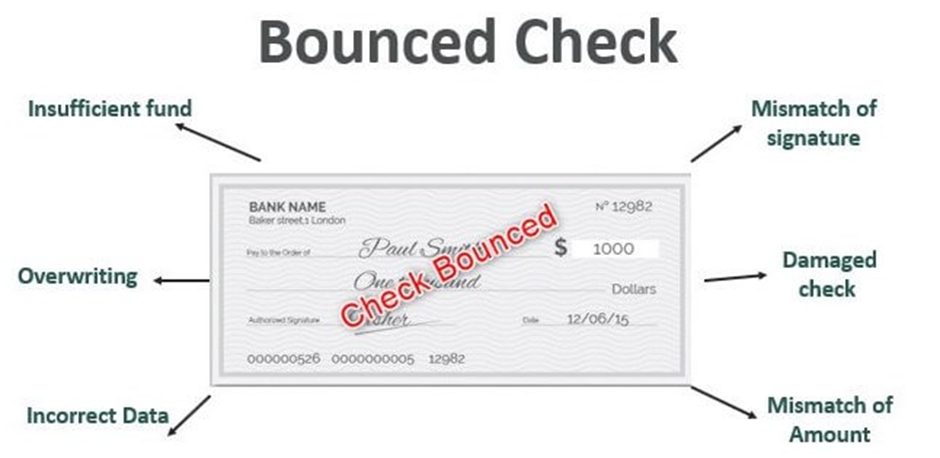

Personal Loan Fees # Cheque Bounce

Bouncing a check comes with a fee from the bank. This fee can be applied to both the account holder who wrote the check and the person who was supposed to receive the payment. This is typically classified as an NSF (Non-Sufficient Fund) fee, meaning there were insufficient funds in the account to cover the check.

The fee for a bounced check varies from bank to bank. The amount of the fee depends on the reason for the check bounce and the type of account. This fee may also be subject to GST.

Cheque bounce fee ~ ₹300/- or above (for one cheque return per month); ₹750/- or above per return in the same month for any financial reasons.

Personal Loan Fees # GST (Goods & Service Charges)

GST or goods and service tax is a value-added tax imposed by the Indian government to supply domestic goods or services. GST is currently applied to loan-related services at a rate of 18%. This includes prepayment and part-payment fees, processing fees, cancellation fees, duplicate statement issuing fees, and so on; inapplicable or irrelevant to interest costs.

Personal Loan Fees # Duplicate Paperwork

Duplicate statements such as NOC (No Objection Certificate), repayment schedules, amortization, and indices attract a minor fee for the processing of the re-printed paperwork. However, the soft copy of the documents are non-chargeable and the reissue of the hardcopy fee is also considered negligible with only ₹50 to ₹500 charged over the GST for the service.

Personal Loan Fees # CCOD Annual Maintenance

For Flexi (flexible) personal loans, banks charge personal loan fees in the form of an annual maintenance fee on the loan limit annually to keep your account active and provide withdrawal services anywhere and anytime. Although most banks do not ask for the annual maintenance fee, it is advisable to check with hidden charges on a bank interest loan rate before you apply for a loan.

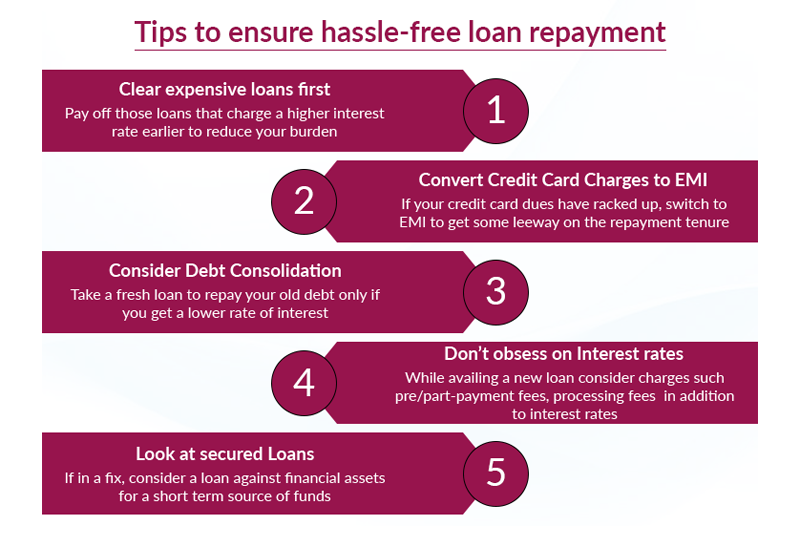

Personal Loan Fees # Pre-Payment in Part or Full

Prepayment is when the borrower decides to pay the loan amount before the due date. A prepayment fee is charged by the lender to the borrower if he/she pays the loan amount well before the due date since the lender cannot anticipate if the customer has paid or paid off with the variable interest rate that may go up or down at the time of the due date.

Most banks have a lock-in period for closing the loan before the term expiry, however, several banks do offer a flexible prepayment option depending on their policies without zero charges. Marketplaces or third-party dealers may help you find a bank or lender with a zero prepayment policy to float your boat without paying those pesky personal loan fees and disowning the burden of repaying loans for a longer period of time even when you have the funds readily available.

Personal Loan Fees #

Customers have the freedom or flexibility to change their loan repayment mode (ECS/ACH), although they may have to make an additional payment. When you change your repayment mode in the middle of your loan term, whether with another rep payee or bank account for PMII/MI payments; lenders may charge a fee of ₹500 plus 18% GST.

ECS – Electronic Clearing System; ACH – Automated Clearing House.

Personal Loan Fees # Loan Cancellation & Rebooking

If you decide to cancel your loan after it has been approved, the bank may charge a loan cancellation fee. This fee may be a fixed charge plus 18% GST, or the equivalent interest payment from when the loan was issued until it is terminated.

Personal Loan Fees # Conversion

Borrowers who have already taken out a loan but wish to sell their asset and purchase a new one can opt for a conversion loan by paying the personal loan fees to avail of the conversion.

Personal Loan Fees # Instrument Exchange

An applicant or borrower who wishes to exchange their loan liability or cash flow for a different financial instrument, such as bonds or equities, can do so after paying personal loan fees, such as instrument swap or exchange charges.

Personal Loan Fees # Part Payment

We often take loans whether or not we have cash in hand, but when we do, we wish to pay the bank interest loan rate in full and dust our hands to decrease the repayment burdens. However, part of full payment before the term maturity is often followed by penalties or charges levied upon the customer by the banks. Similar to the pre-payment charges where the lender might or might not incur a loss for the pre-scheduled payments by his consumers, part payments will also subject him to similar conditions where he might have more to lose than gain on the loan with the repayment term and interest rates cut down to half.

Therefore, most banks may or may not charge their customers on part payments depending on their policy to compensate for the loss. With some offering the flexibility to pay two to five times of EMI or even more to their consumers, others levy charges as a percentage of the principal amount or the amount prepaid.

It is advisable to check with the bank before applying for a loan and choose a bank offering penalty-free services to avail of benefits.

Personal Loan Fees # Foreclosure

When you foreclose on your loan, you are essentially paying off the remaining loan amount in one lump sum. This is instead of making your usual monthly installments. Most banks will charge an additional 2% to 4% on the outstanding loan principal for foreclosure, plus any applicable taxes.

Final Word

To make an informed decision while negotiating loans, a borrower must know the clauses and terms of the banker. He must have a basic understanding of the financial jargon to file an advantage on his loan process. However, the customer might not know or be aware of the entirety of a procedure followed by his bank or lender, he may appoint a third-party or marketplace service to bid his rates.

Loanz360 is one such India’s most prominent financial marketplace that offers an effortless approach to credit on a single platform. We work with large banks, NBFCs, and Private and Fintech lenders who provide a wide assortment of financial products on our platform. Whether you are looking for a personal loan, home loan, business loan, or vehicle loan, we offer you the best assistance to be in charge of your dream boat.

If you are still not sure how, give us a call at Loanz360 and schedule a meeting with our representative, who will take you through the process of buying and financing a loan, along with comparing the market rates and finding the best option that fits pocket with penalty-free policies and services.

Lessen your burden by avoiding personal loan fees at Loanz360 and get the best bank interest loan rate on your 0 processing fee personal loan today. We are partnered with leading financial banks and NBFCs, such as, HDFC, IDBI, ICICI, SBI, Kotak, and more with interest rates as low as 7.25%! Check out our services now!