Introduction

The lending market in India grew to Rs 174.3 lakh crore in March 2022, up by 11.1% on an annual basis, as compared to March 2021.

Credit Bureau CRIF High Mark

Home is the first and last place that creates a sense of belonging. With real estate prices spiraling, the investment remains trickier than ever. But this does not pull the brakes on the dreams of settling in your new home, as long as you are equipped with the right knowledge of the financial market conditions and the tricks to narrow down the lowest home loan rates available in the market.

This article will include tips to help you find an exit from the upward movement of the increasing interest rates on a home loan and gather resources to negotiate deals with lenders on how you can reduce your burden of paying hefty EMIs on your home loans. If you are planning to buy a new house, second home, or any commercial property, this article is for you.

8 Ways To Reduce Your Home Loan EMI Burden

Comparative Research

Comparative research or checking multiple lender options before taking out a home loan is the base step for acquiring a loan. Thorough research on the nature of the lender and their previous lending policies will keep you informed to stay away from lenders or financiers fishing money. This means that the borrower should be aware of his lender and even do a background check if possible.

Hiring a third-party financial expert or an agency to do the laundry can help you save time and resources on the research. These agencies or agents will conduct the market research on your behalf with low or no commission fee and help you understand different policies and plot holes of the lender this warning you fair and square before falling down a rabbit hole of swindlers.

This means, you can adopt on of the two ways to conduct comparative research:

1. DIY – Do it yourself. This includes asking friends, family, or colleagues who have opted for a home loan for advice. Although this method is not highly accurate, this can do the job in the short term. However, home loans are a heavy money business, therefore the risk of not sharing the same comfort or experience is inevitable when the advice turns out counterproductive in your situation.

2. Hire an expert – Financial experts conduct market research based on factual and credible data backed up with proofs and detailed characteristics. This is one of the safest options as you may even be appointed a dedicated relationship manager with experience at an agency or have a personal finance expert to help you make wiser financial decisions at your disposal. Moreover, this is not a costly affair, and will only save you more money by making sound investments.

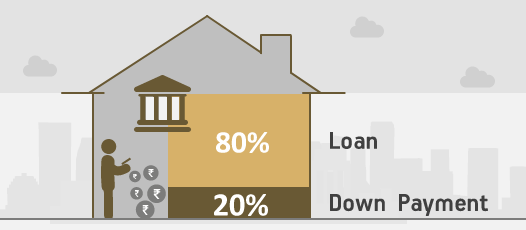

Down Payment

Down payments are always a wise choice when dealing with larger payments like in a home loan. Down payments will not only reduce your interest rates but your EMIs and tenure by large. This means that if you have some money saved up in your bank, for this occasion, it is wiser to make a 20% down payment while opting for an 80% home loan.

The advantages of the down payments are not limited.

1. You will earn the trust of the lender by ensuring your repayment capability and income stability.

2. The trust will gain lower interest rates on your home loan principal amount.

3. You will have a lesser amount to repay in total and thus fewer EMIs.

4. The more you pay, the lesser your LTV, and the more you can fish on deals and offers on your home loan with negotiation.

Longer Tenure

Most loans will suggest a shorter tenure and that is not a lie. Shorter tenure means the loan will close in a shorter period and you will not have to shoulder the burden of higher interest rates with floating or fixed rate options. However, a home loan is a costly affair, therefore there is a lot of money that goes into repayment when the borrower takes out the home loan. In such cases, you can take out the home loan for longer tenures.

But, here is the trick. Initially, even if you have taken out the home loan for a longer tenure, this means, you are reducing your monthly EMI, which also means, in the future, if you have earned or saved up a good income, you can repay the home loan in prepayment or part-payment schemes.

This will mean that the borrower can reduce the growing impact of a home loan by using pre or part-payment schemes after he has crossed a lock-in period, which is usually a 6-month or 1 year mark.

Prepayment

As discussed before, the prepayment or part payment schemes allow the borrower to reduce their EMI burden on the loan. This means that, at one point of the time, you have saved up the money enough to pay in larger sums will help you reduce the outstanding balance on the home loan. The borrower can either opt for regular or auto prepayment options.

Regular Prepayment – Prepayment is an amount that is anything above the regular EMIs you are paying. Therefore, you can either make some regular prepayments to reduce the outstanding balance or choose another option depending on your situation and financial comfort.

Auto Prepayment – If you think that you will have a raise in funds shortly, you can give your bank a standing instruction to auto debit from your funds. This option however is voluntary and can be canceled at any given time by the borrower by analyzing his economical conditions. However, this will highly reduce your beginning and outstanding EMIs, since you are saving up funds.

Partial Prepayment – Paying out the loan lump sum is called partial prepayment. Check with the lender before applying for the loan on their prepayment policy. Some lenders may levy a penalty for partial prepayments, however, most don’t. Take out a loan with the lender that will allow you to prepay or make part payments without penalties on a home loan.

Co-Applicant

This is a wild card. Co-applicant or a joint loan is sure to attract several benefits on any loan, especially when it is a home loan. Co-applicant for a home loan will mean that you are splitting your burden with another member who is an immediate family. This co-applicant or co-signer can be someone who is a parent, spouse, or guardian. Thus having a co-applicant on a loan will not leave you with the sole burden of paying the total loan amount alone, and also will attract lower interest rates, thus lower EMIs over time.

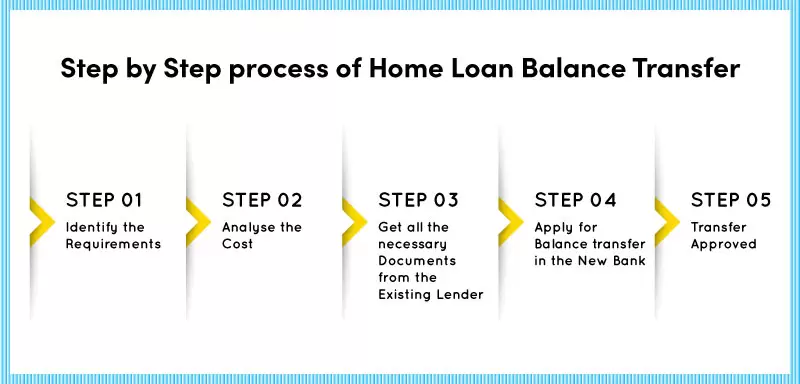

Balance Transfer On Existing Loan

If you are already paying out the loan and are facing issues with higher interest rates, you should either negotiate better terms with your existing lender or should look out for new lenders to opt for a balance transfer on the loan. Balance transfer on the loan will automatically mean that you are getting better terms, deals, and offers with your new lender and thus can repay your EMIs at better conditions with a lender who understands your financial situation or requirements better.

Exploring Plan Options

There are several plan options and relief packages on a home loan. Most lenders offer balloon payments, step-up EMIs, and so on. While balloon payments will help you buy time to pay out larger sums during the maturity of the loan term, step-up EMIs will help you pay larger EMIs at the beginning of the term with reducing outstanding balances during the course. These 2 options will highly depend on your current financial situation if you can spare some extra cash at the beginning or end of the term.

On the other hand, though relief packages bring out tempting offers, there are some hidden loopholes or tricks that lenders use to attract borrowers. This means that the trap of no-cost EMI or other ludicrous offers is often accompanied by other big defeats. Therefore the financial expert assistance as discussed before. This will ensure you know where you can benefit and where you cannot without getting into potential legal battles or financial shocks in the future.

Multiple Interest Rate Schemes

Banks have different interest rate regimes such as MCLR, EBR, BPLR, RLLR, etc, and so on. Each regime is calculated differently, including with flat and diminishing ROIs, and fixed and floating interests. This means that before selecting a lender you should also know the regimes available, the interest calculation methods they use, and to choose fixed or floating ROI.

Regulated by the RBI (Reserve Bank Of India), the banks maintain uniformity but may change with the market conditions. Therefore you should be informed of the options and their policies from time to time to ensure that you are paying the right amount of EMIs without burdening yourself with harder options when you have easy and affordable choices. Check with your bank or discuss options with your agent religiously to know why your EMIs have increased if they have.

Final Word

Though there are several tricks you can perform, from amassing your income to increasing your eligibility to increasing your credit score, these are the most beneficial key devices that a borrower can use to pump down their EMIs easily.

And if you are in a way looking out to take a loan, Loanz360 is India’s most prominent financial marketplace that offers an effortless approach to credit on a single platform. We work with large banks, NBFCs, and Private and Fintech lenders who provide a wide assortment of financial products on our platform. Whether you are looking for a personal loan, home loan, business loan, or vehicle loan, we offer you the best assistance in making your dreams come true with 100% accuracy and unbiased advice.

If you are still not sure how, give us a call at Loanz360 and schedule a meeting with our representative, who will take you through the process of buying and financing a loan, along with comparing the market rates and finding the best option to fund your dream home. Moreover, you can find dedicated relationship managers with over 50+ years of cumulative experience at Loanz360, who will help you in all finance-related endeavors.

4 Responses

I want property loan, verify my details

Sure, Thank you for contacting us. Pl, call us on 9821488489 for the best service.

Welcome to lanz 360 is good for my opinion

Thank you for showing interest in Loanz360, Pl call us at 9821488489 for the best Service.