Introduction

According to a survey from the prestigious Harvard University, more than 65% of people benefit in one of the other ways through the joint home loan.

Most people buying a dream house, individuals, couples, or a family purchase land or an asset in the hopes of raising a new home. Although not everyone is a first home buyer, home investment is a large investment involving greater capital, hence is considered twice by the borrowers and lenders alike to invest or to lend capital on such an occasion, especially when it is a joint a home loan.

But, what if your savings have pulled a brake on your dream, would you stop before reaching the destination, or plan and arrange an alternate route that will take you to the same destination, without wasting more time or resources?

In this article, we will examine the benefits of taking out a joint home loan and discuss everything you need to know about this facility.

What Is A Joint Home Loan?

Loans are typically applied by an individual borrower seeking capital assistance to fund his requirements. On the other hand, as the name suggests, joint home loans are loans taken out by two or more borrowers or co-applicants seeking capital assistance to fund mutual requirements.

Upon qualification and eligibility, the co-borrowers on loan will acquire equal rights of ownership on the purchase of the potential home, becoming co-owners of the property. Not only do joint home loans mean that you will be able to split your repayments between multiple borrowers but also are at a higher chance of seeking a higher capital. The better the credit, the better the terms, the better the interest rates, and the better the qualification on the loan. Hence the joint home loan.

Who Can Apply For A Joint Home Loan?

The co-applicant on the loan is typically an immediate family member, a parent, spouse, guardians, or children. However, friends, colleagues, and business partners are also accepted co-applicants in a few cases given the banks or NBFCs allow the criteria. The main idea behind a joint loan is to share the burden and enjoy the rights equally, therefore the co-borrower on the loan is expected to be a person who is trustworthy and reliable enough to take responsibility for the repayment of the loan until the last penny with interest has been paid off, equal to the prime borrower. Simply put, a joint home loan can benefit significantly when:

- Parents having a significant income source apply for the loan along with the individual seeking the loan.

- The co-owners of the property are siblings who seek to apply for a joint home loan.

- Couples earning income have enough employment stability and working capacity to apply for the loan. The unmarried couples however may have eligibility only if the lender permits.

- Friends, investment partners, or colleagues planning to set up a business apply for joint ownership on the home loan. However, this case is considered to be riskier than the other three considering that the co-owners may face a fallout even if one person among the lot may decide to back out.

The above-mentioned cases are only valid when all the co-borrowers or co-applicants on the loan have a definitive income source, good repayment capacity, and employment stability.

Benefits Of A Joint Home Loan

A joint home loan will not only help the applicants to share the burden of EMIs on the loan but will also allow them to seek higher loans depending on their repayment capabilities and employment stability on the loan. Along with the ease of repayment and co-ownership, some of the other benefits of taking out a joint home loan include

More Funds

A higher loan amount is a benefit when applying for a loan with 2 or more applicants. You will be able to buy a bigger home with the funds acquired while sharing the EMI burden with your co-applicants without having to shoulder all the responsibility yourself.

Tax Benefits

The “joint owners” of home loans have several tax benefits that they can enjoy when the co-applicants on the loan are also co-owners of the property. The tax relief structure for the principal and interest repaid under 80C and section 24 of ITR allows the co-owners to avail of the tax rebates simultaneously. This is only advantageous if the co-applicants of the property are also co-owners since there is no restriction stating that all co-applicants should be co-owners. However, all co-owners of the property are expected to be co-applicants otherwise.

Greater Eligibility

Co-applicants with excellent credits can enjoy the same benefits as an individual with satisfactory credit, however with added advantages. Consider a bargain at a local store. In such a scenario, the owner is likely to budge or negotiate with you when you are promising to get your friend, parent, or a third person to buy their products. Similarly, the more the co-applicants, the more the cumulative income, hence the greater eligibility and funds.

Interest Rate Schemes

There are several home loan interest rate reductions on joint home loans, especially if the co-applicants are women. Most banks and lenders in India have special loans for women customers that allow them to pay lower interest rates than an average person. If you are taking out a joint loan or an individual loan, the benefits are the same, however, the individual or joint-applicants are expected to be owner or joint-owner on the property as directed.

Lower Stamp Duty Charges

Similar to the interest rates schemes, if your co-applicant is a woman who is also the co-owner, you can get reduced charges on stamp duty and thus can enjoy more savings. However, the charges may differ from state to state, bank to bank. Therefore discuss with your lender or the bank before demanding lower stamp duty charges.

Disadvantages Of A Joint Home Loan

Co-applicant Restrictions

The co-applicants on the joint home loan can only be immediate family members in most cases. However, even if some banks allow friends or investment partners that is still a risk considering the nature of the bond between the co-applicants. The restriction on the joint home loan does not end here, however you can only get up to 6 people or less to apply for a joint home loan and not more, depending on and varying from lender to lender.

Credit Score

When there are two or more people involved in repaying the loan, both or more co-applicants are at an equal risk of denting their credit if they skip or miss their payment dues. As much as the benefits apply to all, the risks apply to all in a joint loan scenario, hence the potential gamble.

Death

Though hard to discuss, death is always a possibility for anyone, hence the risk. The death of a loved one involved in the contract can push the EMI burden to the immediate borrower, thus creating a greater pressure on the loan. However, you can discuss with your bank or relationship manager on the alternatives to this situation to curb the stress for a little longer until you have managed to find a solution.

Co-Borrower Dispute

There is always a chance of separation. Be that be with a family member or a friend, a dispute can arise anything making the individuals fall apart and thus generating a reason to fight for the ownership of the property. We will discuss the nature of disputes in later sections as they have a greater risk of generating legal issues.

What Are The Rules Of A Joint Home Loan?

- A minimum of two members and a maximum of 6 members can only borrow the joint home loan.

- The co-applicants on the loan should be immediate family members for greater eligibility.

- All the co-applicants on the loan should have a stable income source with employment.

- Co-owners of the property should always be the co-applicants on the loan, however not mandatory the other way around.

- Co-applicants on the loan need not necessarily be co-owners of the property but is mandatory to avail of the tax rebates.

- The co-applicants can either use a joint account to repay the loan or distributes it among themselves as they see fit.

When Should You Consider Taking Out A Joint Home Loan?

There are a number of reasons why it might be worth considering taking out a joint home loan.

For example, if you and your partner have different credit ratings, you may find that it is easier to get the mortgage you need by taking out a joint mortgage with your partner. Similarly, if one person has a better income than the other and they want to buy a property together, they may find it easier to take out a joint mortgage.

Another reason why people might want to take out a joint mortgage is because they are worried about their partner being able to afford the repayments on their own. They might worry about them getting into debt or even losing their job in future because of the increase in home loan interest rate percentages with the market fluctuations. If this is the case then it would be worth talking through these concerns with them before making any decisions about whether or not to take out a joint mortgage.

Apart from situations like these you can also take out a joint home loan to share your burden, increase your eligibility, enjoy tax exemptions, and as such benefits. However, considering the risks, it is advisable to take out a joint loan only if you can trust the co-applicant entirely, even if not, drawing up a contract of sharing liabilities between the parties may ensure you do not run into legal disputes in the future.

Home Loan Eligibility For Joint Applicants

Home loan eligibility for joint applicants is what qualities the borrowers on the loan to avail of the capital benefits by the bank or the lender. Hence is important to know or determine before visiting a financier for the loan. However, the eligibility may differ from bank to bank, and lender to lender, but knowing the generic eligibility requirements will help you prepare for the basic needs in advance.

Age: 21 – 68 (Conditions Apply)

Nationality: Resident of India/NRI (Conditions Apply)

Type Of Employment: Salaried/Self-Employed/Business Owner(Govt, Large Enterprises, Etc.)

Employment Stability: 1 – 2 years prior experience and minimum of 1 year with existing organization

Income: Monthly Minimum ~ Rs. 15,000/- To 25,000/- INR and above (Salaried/Self-Employed), Minimum ~ Rs. 2,00,000/- p.a onwards (Business Owners)

Maximum EMI: EMI ~ maximum of 40% – 50% of the net monthly income

Credit/CIBIL Score: Any profile (Credit score ~ 750 or above has a higher chance of getting a quick and instant loan with high funding at lower interest rates)

Note: The eligibility criteria mentioned above are generic and may vary from lender to lender

What Are The Documents Required For A Joint Home Loan?

Gathering documents before applying for a loan will ensure that you save time and resources during the process of loan. Once you have been qualified for the loan, the lenders will require for you to submit proof documentation for determining your authenticity and credibility to process the loan. To be eligible for a joint home loan, all the co-applicants of the loan should gather these documents mentioned below:

Age Proof – Birth Certificate/SSC Certificate/Matriculation Certificate or Marks Sheet/etc.

Proof Of Identity – Voter’s ID/Passport/PAN Card or Form 60/Driving License/Aadhaar Card

Address Proof – Aadhaar Card/Electricity Bill/Ration Card, Copy of Utility Bill/Insurance Bond/Bank Statements/Income Tax Assessment Order/Property Registration documents/Pensioner Book/Property Tax Receipt/Employer Certificate

Income Proof Documents – Copy of latest three months’ salary slips/bank statements, Form 16 for salaried individuals, Copy of Income Tax Returns (ITR)/C.A certified Balance Sheet and Profit and Loss Statements along with business stability and ownership proof.

Existing Loan Documents (If Any), Property Papers/Documents of Property to be Purchased.

Documents Required For NRI Applicants

ID Proof – PAN Card/Photocopy of Passport

NRI Status Proof: Copy of work permit(if applicable)/Visa/Current overseas resident card

Address Proof: Passport/Drivers License/Ration Card/ Any other certificate from Concerning Statutory Authority

Income Proof: Employment contract/Appointment letter with current employer/Latest three months salary slips/Bank account statement for last six months for salary proof/General power of attorney/Last year ITR except for NRIs in Middle East nations and Merchant Navy Employees

Property Papers: Documents of property to be purchased/Detailed home plan estimates from the architect (Upon request)

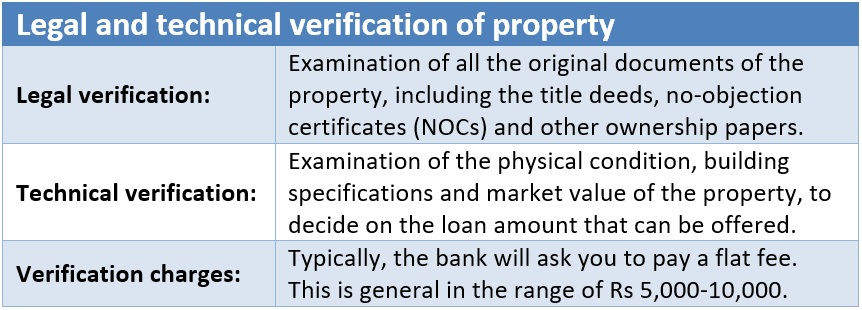

How Banks Do Verfication Of The Property?

The collateral for a home loan is the home itself. Therefore banks prepare a legal team for a verification of property with a flat fee applicable to arrive at a fair market value by advancing the validation. Banks or NBFCs use high quality assessment tools to further the process containing 2 stages.

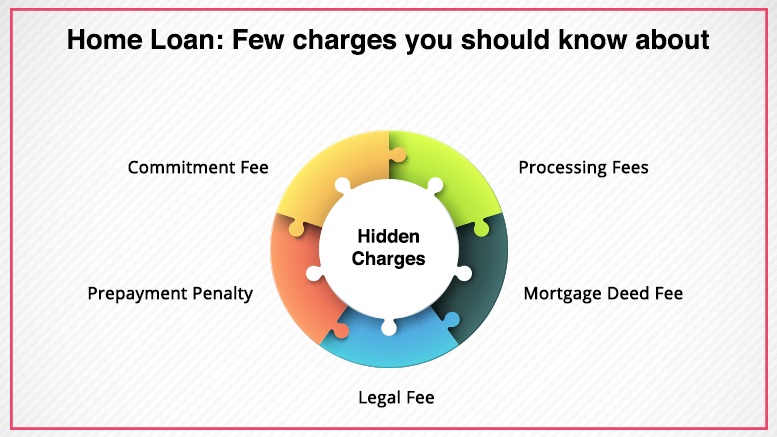

Joint Home Loan Fees

Processing Fee

Appplying for any type of loan will or will not require a processing fee depending on the bank or the lender you are applying a loan with. With digitalization, the paperwork for the loan process has been minimalized and thus several banks have encouraged their customers with low or no fee facility.

Therefore considering such a lender with flexible fees is an added advantage considering that the other criteria’s on the loan are also reasonable, if so. However even if your lender will apply a processing charge on the loan, the fee is only 1% to 2% of the loan amount.

Commitment Fee

The period between the processing fee and the loan within which the customer avails of a loan is determined as commitment. Most banks do not charge this fee, however discuss with your bank if your bank or lender have such a policy.

Pre Payment/Part Payment Charges

These are another common charges or fees on the loan depending on the bank. However most banks offer a lockin period after which the individual can make part payments on the loan, if not, discuss with your lender on what their policy mght suggest and consider reconstructing your loan depending on the ease.

Miscellaneous

Hidden charges or miscellaneous or other fees that might include stamp duty, consultation, etc. These charges are mentioned in the contract when signing the agreement, however you should ask you bank or the lender on what your fees might be and what their process of calculating interest rates is.

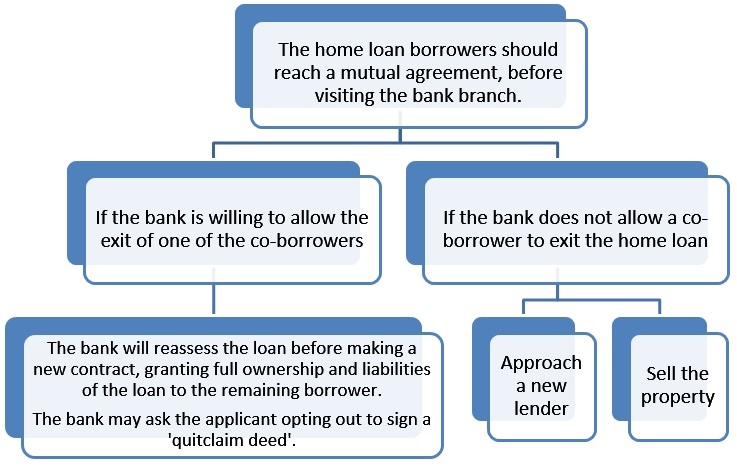

What Happens When In A Dispute?

As mentioned before disputes between the co-applicants are always a possibility irregardless of how close or not the relationship between co-borrowers is prior to the application of the loan. A family might get into disagreement, a couple can get a divorce, an investment partner might get into dispute, a friendship can fallback, etc, however signing a contract between the co-applicants can reduce stress and impact of legal issues when the problem arises. This will ensure an equal liability where both are parties have attested to repay the loan in full whatever might the consequences or their relationship be.

If you haven’t already done so, you should be prepared for some legal issues that may arises, like fighting for the ownership. These disputes may even go on for several months or years in a severe situation, hence is bothersome. Discuss with your applicants before deciding to take out a joint loan, such as:

- Will you open a joint bank account to repay the loan?

- If not a joint account, who is responsible for repaying the loan?

- How do you distribute the EMIs among eachother?

- What happens in a dispute, who gets the ownership?

- Will the co-applicants be co-owners?

- How long do you plan to repay the loan?

- What happens when a partner dies, etc.

Final Word

Though there are several benefits and equal risks, it is always worth sharing the burden if you can trust your partner with making responsible payments. Sharing is caring is what will apply to this type of loan, however two of them can keep a secret if one of them is dead will also apply equally if disputes break war between the co-applicants. Therefore to be carefully meaded and discussed among the potential partners of the loan before applying for such a loan.

And if you are in a way looking out to take a loan, Loanz360 is India’s most prominent financial marketplace that offers an effortless approach to credit on a single platform. We work with large banks, NBFCs, and Private and Fintech lenders who provide a wide assortment of financial products on our platform. Whether you are looking for a personal loan, home loan, business loan, or vehicle loan, we offer you the best assistance in making your dreams come true with 100% accuracy and unbiased advice.

If you are still not sure how, give us a call at Loanz360 and schedule a meeting with our representative, who will take you through the process of buying and financing a loan, along with comparing the market rates and finding the best option to fund your dream home. Moreover, you can find dedicated relationship managers with over 50+ years of cumulative experience at Loanz360, who will help you in all finance-related endeavors.