Introduction

Poor credit ratings can bring a huge toll on the overall financial health of an individual. Most banks and financial institutions do not work well with their investors with poor credit histories, as they would not be able to attest to the credibility of the lender if he would or would not repay his loan back on time with regard to his former credit habits. But, all hope is not lost. There are still lenders gracing customers of any profile with their flexible policy standards. However, there are a few rules to make this work right.

In this blog, we will look into some of the alternatives of getting zero down payment home loans for customers with poor credit.

Find a co-signer

Finding a co-signer or guarantor for the zero down payment home loans will put you at an advantage of availing a loan with a reputed bank or financial institution. This will give the lender gain extra trust on repayment capabilities since the financier can uphold the guarantor with a legal responsibility to repay the loan if you may fail to do so in due time.

This is not the worst option out there, but considering you have a trust friend or family member to take a fall on behalf of you or trust you with your capabilities, this might be just the option for you to get the financial institutions to fund your dreams.

Ask friends or family to finance down payment

Unlike asking for a family or friend to co-sign the agreement, if you have an understandable relationship with an individual, it is better for you to get them fund your down payment. However both may do so, make a legal binding contract, or trust the word of mouth, you will be able to make your payment without worrying about interest rates or penalty fee.

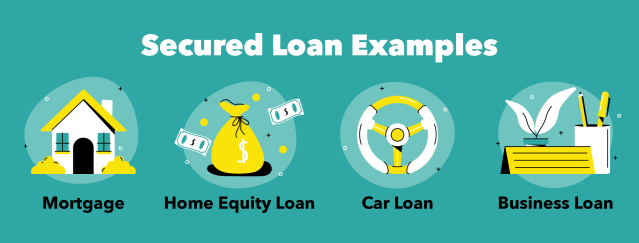

Take out a secured loan

Secured loans offer a security or collateral against the loan amount borrowed. Usually secured loan financiers will not bother heavily about the credit rating as they can take a legal action on the pledged asset if you may fail to meet the repayment requirements of the lender. The lender in this case can uphold the ownership of your asset until the loan is repaid in full with interest.

Borrow less

Usually, borrowing less on home loans is not an option. This is because the home will cost a lot and probably needs a higher funding as with other commodities. However, if you are borrowing amount for renovating or refurbishing your home, these loans will come easier with less liabilities unless you are buying a house with poor credit. This will also further improve your credit rating if you are able to repay the loan in due time without any late payment history on the existing loan. Hence, making it easier to pave a path towards zero down payment home loans.

Apply for a conventional loan

Zero down payment home loans are easier with conventional loans. Conventional loans have the lowest down payments starting as low as 3%. Also the conventional financier has the control over their requirements and are not particular about the investor profiles when taking on a loan. However, there are certain expectations set by the lender, that a borrower may discuss at the time of the agreement, such as income to debt ratio, LTV, etc.

Contact NBFCs

NBFCs and credit unions are known to lend zero down payment home loans to users with any profiles. They do not check the credit score of their customers and lend a fair share of loan amount to fund their requirements. However, interest rates at NBFCs are annoyingly higher than several banks or financial institutions. Considering your need, budget, and repayment capabilities, this is not the worst or the best choice for anyone needing funds on their dream home.

However, discussing your budget and goals with a financial expert will help you make better financial decisions and get zero down payment home loans if necessary. There are several third-party marketplace that offer services and serve their purpose as a mediator between the borrower and the lender. These marketplaces have gained trust among banking, financial, and private institutions to bring customers varied deals and offers on behalf of the lenders. Therefore if you are looking for the right loan in your budget, or easy home loans for poor credit, it is wise to consult an agency, perhaps one like us. Contact us today at loanz360 to know more about your benefits of getting a loan with our financial partners.

Opt for a line of credit

Multiple loans are often risky, but line of credit is not a huge loan compared to the different options available in the market. With flexi loan options, line of credit will serve its purpose if the borrower may wish to pay his down payment and get the loan with better deals and terms.

However, consider paying off your existing debts to avail of a new loan. Having multiple loans at once can put you at a risk of financial shock in the future. Thus, avoiding a heavy financial burden is a wiser choice when compared with an impulsive purchase.

Improve your credit rating

This may take time. However, it is the safest option out there. Improving your credit is not a bad idea considering you will be at a benefit for not only home but all other loan types. However, to improve your credit, you should work on paying off your current debts, clearing your dented records, and rewriting your credit history with a squeaky clean record. This means you will make ontime payments, check your previous records for incorrect information, and keep your credit utilization minimal.

Should you take out a loan with poor credit?

This is an ambiguous question considering everyone have different goals, requirements, responsibilities, and roles to meet. However, the choice will depend entirely on your reasoning. If you are seeking for easy home loans for poor credit and would want to fund your new home early, as soon as possible, considering one of the options above is not a bad idea. However, if you are not in haste, and have even a little more time in your pocket, considering you improve your credit score can highly put you at several advantages and would even make your loan process much easier, reliable, and better.

There are financial institutions for every one out there and marketplace to help investors with any profile to find these lenders willing to work with their needs and meet their end goals. Zero down payment home loans are no longer a fairytale with all the alternatives available. Therefore, it should not be a risk to choose either of the options, depending on your need or want at that point of time in that point of existence.

Final Word

Cars, gadgets, clothes, and other commodities can depreciate in time and might need a change once a while depending on the market and financial conditions of the person. However, homes are a huge investments, for some, even a life-time investment. Therefore, the person should take time to sort his quandrams and decide whether or not buying a house with poor credit is suitable. However, putting aside everything, he should decide if he should or should not wait to take out of a loan with his existing financial health or conditions.

And if you are either way looking out to take zero down payment home loans, Loanz360 is India’s most prominent financial marketplace that offers an effortless approach to credit on a single platform. We work with large banks, NBFCs, and Private and Fintech lenders (HDFC, ICICI, SBI, Kotak, and more!) who provide a wide assortment of financial products on our platform. Whether you are looking for a personal loan, home loan, business loan, or vehicle loan, we offer you the best assistance in making your dreams come true with 100% accuracy.

If you are still not sure how, give us a call at Loanz360 and schedule a meeting with our representative, who will take you through the process of buying and financing a loan, along with comparing the market rates and finding the best easy home loans for poor credit.