A

Asset

An asset is a monetary resource with economical value owned and controlled by an individual, organization, or country.

Agreement

An agreement is a binding contract of cooperation between individuals as to a course of action.

ARM (Adjustable Rate Mortgage)

ARM is a loan with a variable interest rate that adjusts over time with the market conditions.

Amortization

Amortization is an accounting technique used to periodically adjust the loan amount through scheduled and pre-ordained installments with principal and interest.

Appraisal

It is an act of estimating or measuring the worth, value, or quality of an asset, person, or thing, such as for sale, taxation, etc.

Appreciation

Appreciation or capital appreciation is the rise in capital or an asset over time subject to market conditions.

Administration Fee

It is the fee collected by the insurer or an agency administering various activities related to record keeping, registration, transaction, etc. at the time of applying for insurance.

Application Fee

The fee is charged by the lender or a financer to study and process the data for the loan application.

Arbitration

The appointment of an outsider(s) or a middleman chosen by two mutually agreed parties to settle a dispute or disagreement.

Advisory

A member of the board who is specialized in giving legal and capital advice to the owner or the organization.

Arrear

Arrears is a financial or legal term determining the payment of the loan. It is the money that is owed and has not been paid by the due date or the predetermined date.

Auto Loan

Auto loans or automobile loans are loans taken on any automobile vehicles such as cars.

Appraised Value

The appraised value is the real or true value of the good determined by the real estate appraiser contrary to the market value decided by the buyers.

Blog Articles

Stay informed with our informative blog on loan market trends, finance tips and strategies. Read our blog for expert insights to help you make informed decisions about your finances.

In the process of pursuing higher education, which comprises the Indian students financial aid for many students they should stand for securing the financial aid. With the rising expenses of education, stable funding sources appears to be fundamental. A common driver for financing are college scholarships and educational loans. It is very important to find the perfect balance between owning and renting. Only in this way can you always have peace about your financial future and avoid being imprisoned by debts.

Educational loans are student loans provided to the students to finance or fund their education experience. Such aid is intended to meet students' education-related hurdles. These student loans commonly cater for tuition fees, books, accommodation, and other relevant expenses. This enables students to steer clear of financial stress, so the student can focus on their studies.

While education in today's fast changing world is advanced education, sometimes, money gets a priority. Educational loans become a means of help for students irrespective of students across India who are eligible to attain higher education standards. Knowing the intricacies of educational loans is of great importance for intelligent selection of the right facts. I.e., for the investigation into an individual's educational career.

Currently, there is a tough competition where education is one of the major factors for the prosperity of a career. Conversely, seeking higher education is extremely expensive. Which makes it hard to cover expenses right away for a large number of Indian students, and their families as well. This is where the educational loans could be considered as a financial option that could be taken into account.

The life of an Indian business is a constant process of discovery and changes. Paying attention to cash flow conditions is a must. Nevertheless, the bankruptcy of enterprises is in the form of a lack of money that will enable them to pay off their financial obligations. This type of financing (bill discounting) provides a lifesaver. While enabling the business to address the liquidity issue at the moment and invest the short-term cash flow in stronger capitalization.

In the modern business economy of India, companies oftentimes have difficulties maintaining their working capital in an adequate fashion. That is why prompt and objective financial management can determine the success or failure of a business. I.e., a possibility of business to capture growth opportunities and to cope with economic fluctuations. One of the rising and powerful tools that is gaining the attention of many people is the bill discounting.

The daily challenge in the rapid nature of the Indian business is to work with the working capital. This valuable point is the one that enables prompt payments, removing hurdles when it comes to the paperwork, and seizing the right opportunities for development. However, there is no convenient solution for perfect planning of working capital. I.e, even support businesses in stable positions. This is where bill discounting comes forward as the sparkling difference.

Many companies now play a receivables financing game as they mainly get advanced high-tech devices & systems on credit for proper operations. The scope of services ranges from machinery finance and loan facilities for the acquisition of the heavy equipment. Which, in turn, creates the opportunities for cost savings for the borrower. However, the ability to deal with risks attached to growth can positively influence business stability.

Machinery finance is also known as heavy equipment finance for short. It is a specialized type of loan that is able to assist businesses in purchasing machinery and equipment. I.e., without having to stretch their financial capabilities. This variety of financing mechanism is designed to help companies meet all their expenses related to purchasing new equipment. Also helps in upgrading existing plants or allowing them to lease capital that is only necessary for specific purposes.

Are you an Indian businessman wanting to make a market intrusion? One of the critical difficulties that may arise while broadening your business activities is the acquiring of suitable equipment. The functionality of many industries partially depends on the invention of machinery. E.g. in manufacturing or construction. Yet, banks and long-term dealers often offer competitive prices that make buying the machineries in cash more affordable. Here you’ll see the role of machinery loan getting prominent.

In our modern business era, which is constantly changing, being ahead may involve the replacement of your machines. To a large extent , these changes in technology could sound financially burdensome to some Indian entrepreneurs and industries. The grinding nature of the fund is therefore the machinery loans come to the rescue. Of those looking to invest in new machines or upgrade their existing ones.

Initiation of entrepreneurial life is thrilling undertakings without and without doubt various hurdles of financial charisma. It is vital for startups to gather needed funds, mostly through a mix of seed funding and business loans, to propel operational development.

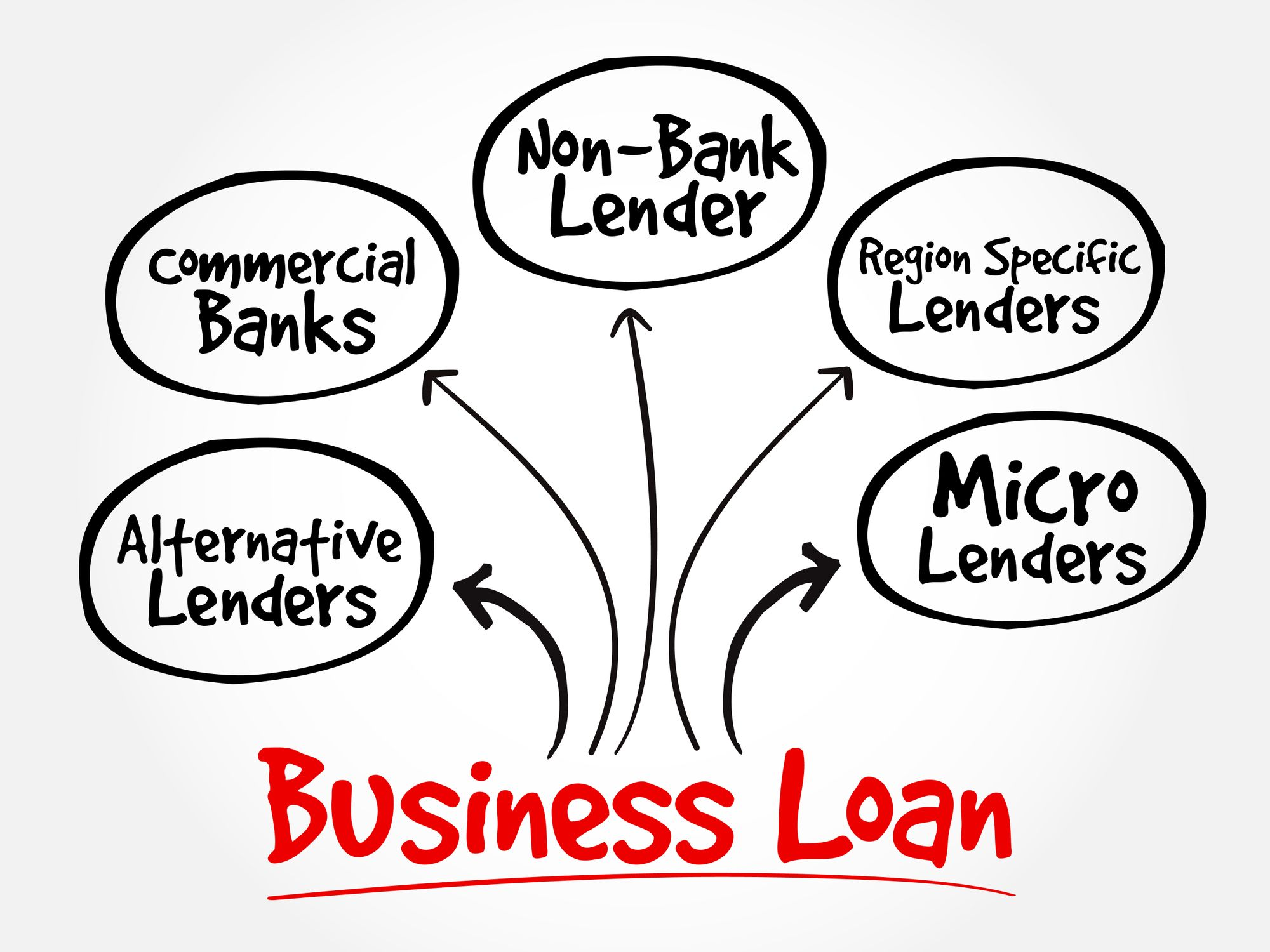

Securing enough funds has become a prime objective in the present competitive business. Especially with expanding business size and operations being the key factors. While domestic finance has provided the main source of business loans, NBFIs also offer alternatives much worth taking into serious consideration. This article unwinds the significance of using NBFIs as a source of business finance. Including a discussion on entrepreneurship, start-up, and small business loans.

Amid the fast-changing environment in the business loans, the borrowing often is very acute for growth and stability of the company. But, ensuring debt management is also key. This is, when it comes to the matter of sound business success for the long-term purpose. If you're a newbie, or a not-so-new one, the ability to engage in learning how to borrow cash has always been relevant.

Attracting startup funds is very crucial in both initiating as well as developing a healthcare startup. Technology in medicine has been progressing rapidly and new firms sprout all the time to provide solutions in the healthcare field. Therefore, founders long for financing to transform their ideas into opportunities. Business loans aiding start-ups in healthcare in which the funds are specialized are one of the most important means of finance for the sector.

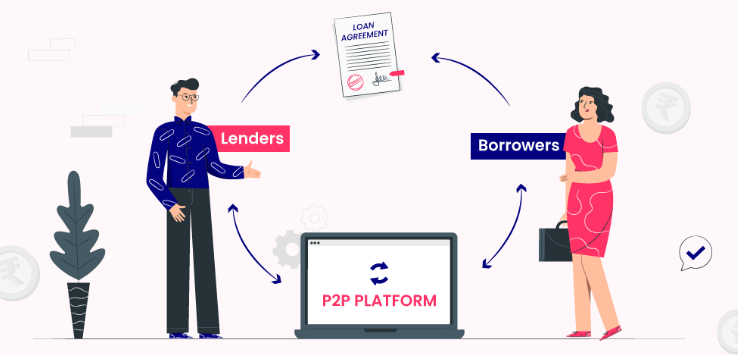

In a competitive business scenario, shortage of good money resources might alter the growth and sustainability of entrepreneurial ventures. In a market which is swarming with a large number of choices, peer-to-peer lending (popularly known as P2P lending) steps ahead as an excellent option for Indian businesses who are seeking simple and flexible loan resources.

Digital lending has changed the way business finances are being handled by Indian business enterprises in the past years. Many start-ups prefer to use online forums to raise capital. This indicates an impressive new wave of financing models. Models that are breaking away from the traditional system of bank loans.

In India, people see gold as a symbol of prosperity and consider it an integral part of maintaining a stable and secure financial life. It holds a special place, often passed down from a grandmother to her grandchildren as a cherished asset. In a scenario where expenses are rising and the requested monetary amounts are also growing. People commonly opt for a gold loan. It provides immediate money without requiring them to surrender their gold jewelry or coins.

Gold loans have been created which are now classified as financial instruments for farmers. As their operation depends on the ever-changing environment of agriculture in India. We will now discuss the important role of gold loans in helping the agricultural sector sustain itself below.

More than often, people have to get a car loan to meet their needs. But getting low-priced loans is an avenue to enormous savings in the long run. Car ownership in India, a remarkable symbol of affluence for many.

Making an error while applying for a home loan not only causes processing delays but creates a financial distraction. Which might eventually disrupt your attempts to be a homeowner. We know it can be tricky. To guide you into making the right decisions, we have listed expert opinions on the home nightmare of pitfalls.

Among the many positive aspects of procuring a home loan, the fact that this allows you to gain access to affordable financial assistance must be mentioned first. Lending institutions have the ability to provide competitive interest rates. As well as flexible payment plans thus they help you manage your monthly obligations. Consequently, the latter gives you an opportunity to own property without you feeling financially burdened at the start.

Here is a home loan checklist that will get you through the home buying process - with only minor changes made to keep it concise. To achieve Your Dream Home - Follow these steps and increase your chances of getting a home loan and making your dream home a reality.

Is it really a good time to apply for a house loan in India? Being instant consentably qualified for your home loan does bring about a dynamism especially in the cutthroat housing market. The changing dynamics also are a nuance when considering finances. To make it easy for you, we have outlined five important tips, provided below.

As a gold ornaments secured loan, you present your consent to your gold ornaments which will guarantee payment. Determined gold value will fix the loan. These credits less frequently carry higher rates of interest than unsecured loans. That is why financial institutions favor them when giving credit to individuals for short-term needs.

Gold loans have now come to the fore as an effective instrument for finance in India. Which provides instant funds for a small portion of one's gold supply. But lots of players are not confident enough about various nuances of this financial instrument. Here, we are looking at the most common questions asked by borrowers in application for gold loans. So as to make it easier for them to courageously navigate the world of gold financing.

In India, small business owners often have difficulties getting money required to run companies in a secure manner. However, the working capital loans also known as gold financing secured against gold work well. To enable these entities to offer an opportunity to grow in greater measures.

Have you already made up your mind about a car loan to purchase your target car? Are you double-checking the feasibility of such a deal? Your choice will definitely depend on your budget. In considering your mortgage, it's crucial to focus on the down payment. Your initial upfront investment or down payment significantly influences the overall car loan amount, monthly payments, and expected interest rates.

Modern life speed and convenience have been the only prominent factors to matter when the discussion used to acquire a car finance arise. The revolution of car loan apps has indeed brought a sea of change in regard to the borrowing experience, and now obtaining a loan is a breeze.

Sailing around in your car dream is no longer scary. Among these routes, there exists a roaming path which leads to fulfillment of your dream. We'll talk now about several new car loan solutions. To provide a great platform for you to drive away with a smile on your face and a pep in your step as well.

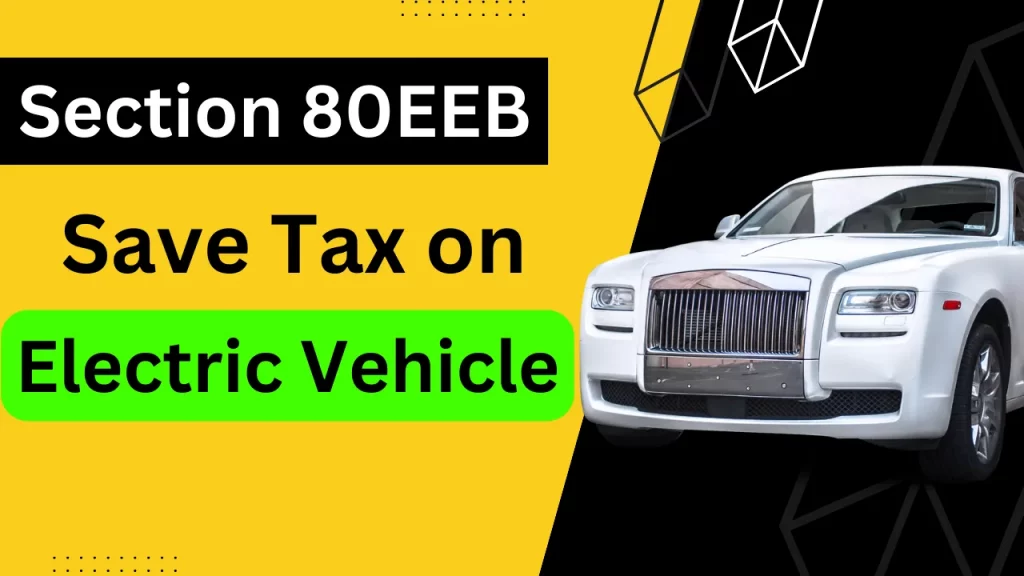

Sustainable transport is becoming the new norm in the automotive industry. Electric cars are at the vanguard of this departure from green to electric mobility. This transition does not only imply the reduction of emissions, but it also consists in the refashioning of a car loan. Which of course, includes car loans as a fundamental component of the electric car movement.

Before getting into the car loan process, it’s high time to conduct comprehensive research. Make sure you examine interest rates, loan lengths and various lenders. Knowing what’s needed for you and where your finders are can help you make a smarter decision.

The purchase of a home by many Indians is a lifetime moment. It does involve taking out a home loan in most of the cases. The knowledge of how much money people will have to pay every month through Equated Monthly Installments (EMIs) and the ability to plan accordingly is a must when it comes to successful decision making. In this article, we talk about DIY home loan calculators, how they work, and how you can leverage them. To estimate your scheduled installment, and assess the affordability of the loan before you commit yourself to a specific loan option.

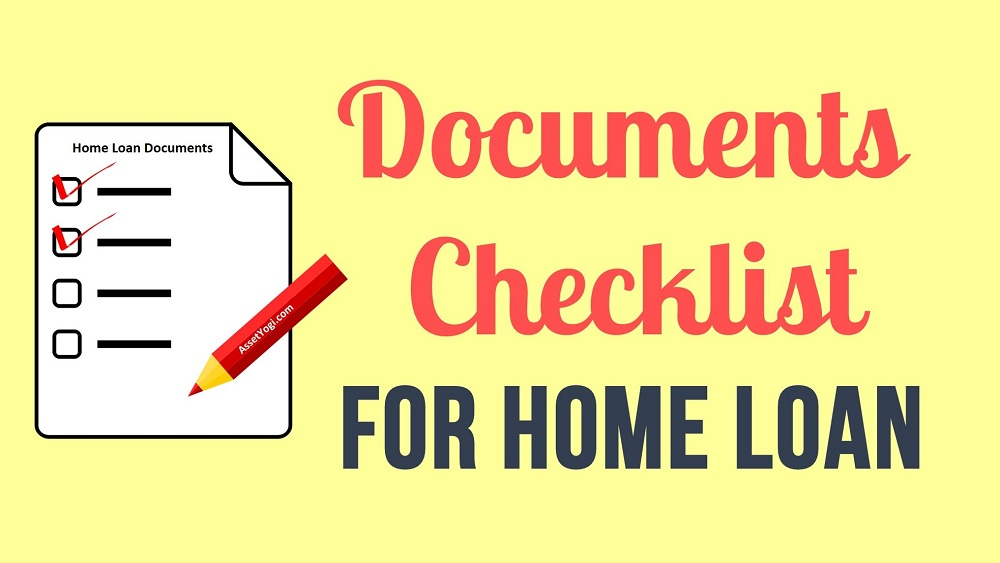

Paying a mortgage is a part of the process to a dream of becoming a homeowner. However, instant access is one privilege that requires you to go through a never-ending paperwork. It is essential to know exactly the type of documents they will need and that they have them in order will save you time. This will also in turn even give you an upper hand in the repairs. This blog will take you through the major documents, which are important for any home loan applicant in India.

Be it buying a new house or getting a home loan, the process of home buying sometimes ends up in an ocean of terms and jargon unknown to the buyers, especially the first time buyers. The ability to understand the native tongue of loan terms is important for newborn buyers in order to make reasonable choices. This glossary is intended to decode common phrases used with home loans in India, which in turn will lead to your increased clarity and confidence in the home loan system in India.

Green home loans play the role of an important piece in encouraging eco-friendly movements, because environmental awareness and financial benefits are combined in one action. These tailored loans known as ecological or green mortgages and green home loans that are innovatively designed motivate sustainable housing. On the most basic level, they substantiate the notion of ecology through their highly competitive interest rates and extra benefits that their counterparts can't match up. Green home loans motivate financial gains for ecological-friendly housekeeping activities therefore stimulating positive environment modification. They give individuals the ability to make considerations in their housing decisions, which will result in more homes being energy efficient and an increasing number of sustainable properties. This is a balance where the financial incentive and environmental accountability do not only enjoy individual homeowners benefits but even significantly to the outer goal of environmental conservation. Besides the personal finance sector, the impact of green home loans is felt on the housing and sustainability broader landscape. With such loans becoming more popular and helpful to people, this becomes the path for creating a culture that embraces nature. Through them, participants will get a concrete way through which they can contribute to the protection of the environment as they earn more as a result of a sustainable lifestyle.

Financing is one of the important concerns in today's dynamic real estate sector while tenants figure out means to become homeowners. One of the typical choices has been the adjustable interest rate mortgage loan. It is commonly termed as an adjustable rate home loan, adjustable rate mortgage or an ARM. Learning the intricacies of adjustable rate mortgages will empower borrowers to make informed decisions that resonate with their financial goals.

Startup funding or seed capital is one of the most important driving factors in the start of a company's expansion. In India, with growing entrepreneurship, venture capital as well as angel investing can ultimately determine a startup’s failure or success. This guide discusses key issues of start up through the lenses of investment knowledge and with insights. Also find strategies that will help an entrepreneur understand the rocky terrain of investments.

Investing through real estate crowdfunding has become the most preferred choice for investors. Who also wants to explore different markets and create a percentage in crowded housing. As Fundrise Investment and other fundraising platforms get more popular, Indians opt to do this method of investment. They are ready to put their money on real estate projects not only in the country but even abroad.

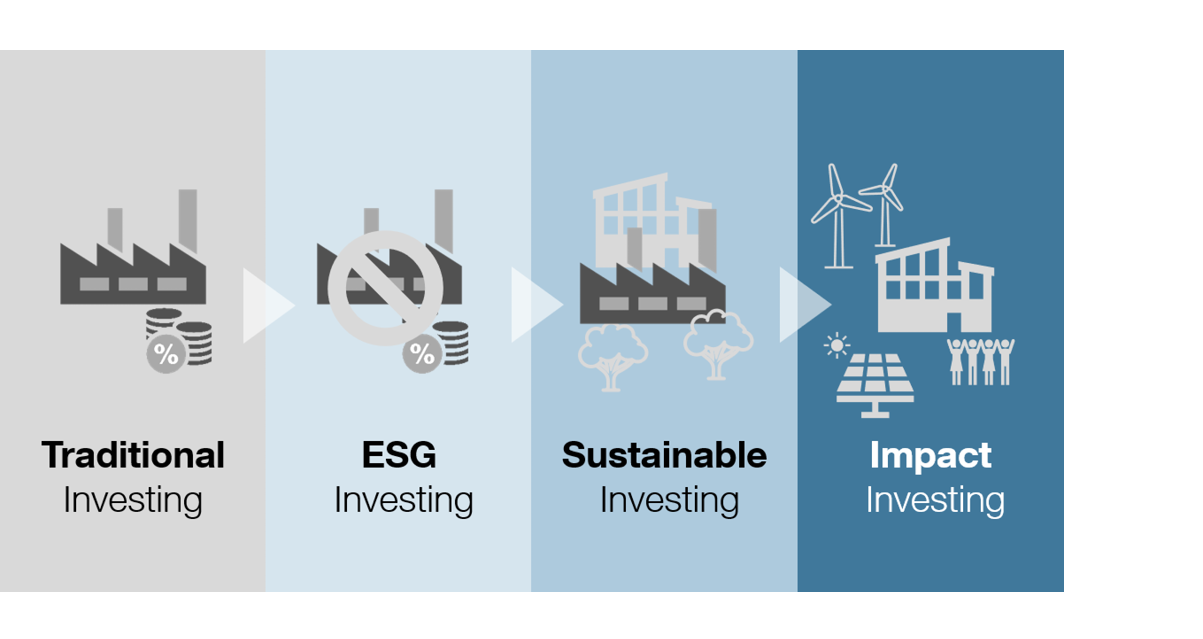

Social impact investment covers multiple methodologies. Including impact funds and social impact bonds intended for support of existing solutions. Also for the most urgent social and environmental issues that also offer investors the possibility of good returns.

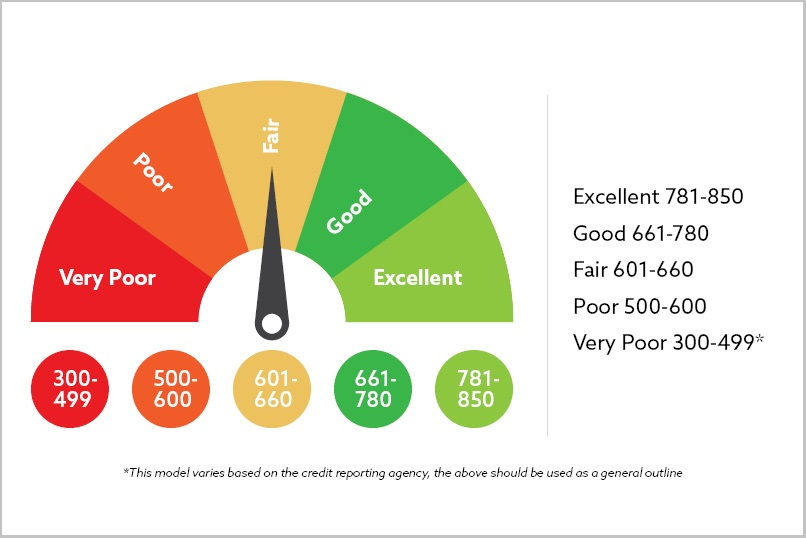

A credit score comes up as a significant factor in our financial life. They determine whether we get capital for our loans or credit cards and even whether we can get a rental house or not. The CIBIL score in India is one of the most prominent metrics for financial institution’s estimation of the borrower’s credit quality. This is what implies that to gain access to the profitable financial opportunities one should keep the most of the positive credit record possible. The ability to stay more steady financially can cause problems as well.

Do you have mixed feelings about the trend that everyone is talking about regarding cryptocurrency? Maybe you have questions relating to the ways to begin to explore the amazing but complex market of digital assets. Cryptocurrency investments, or crypto coins, can be exciting to do business. But it is equally important to tackle crypto space with a high level of caution and insight. This is to minimize the risks in store and increase your bottom line.

A Millennial who wishes to accumulate wealth and enhance wealth management should look at planning his budgets carefully. The focus of this article is to highlight the major strategies and the common tips that will go a long way in helping the millennials make sound financial decisions.

Mutual funds are one of the preferred investment avenues in India now. For the same reasons they are reputed across the globe for, that is the diverse underlying investment securities and the skilled management. Although you might be starting as an investing newcomer, you may be aiming to increase your present asset value. This calls for ample financial understanding, including understanding mutual funds. In this beginner's guide, we're gonna travel around the fundamental topics of mutual funds. So be confident and seize the moment - navigate the dynamic investment landscape!

Before jumping into the optimization tactics, it is essential to grasp what machinery financing is all about. Also know why businesses need such loans. The audience will acquire knowledge on machinery loans, that is, equipment loans or machinery finance. Designed for businesses to secure the funds to buy new machines or upgrade to newer models. Frequently, these credits having to compete favorably in interest rates and in which the repayment terms are flexible bring them out as a great option in financing the expansion of the business.

Today, a business environment requires rapid innovations and application of upgraded equipment to outrun the competition. Financing is a tough nut for many businesses, especially those reliant on machinery in manufacturing and construction. A machinery loan, however, can turn the table in business’ favor. Whatever your motivation may be; is it; move the line; expand operations or replace obsolete equipment; or enhance productivity, without having to understand the basics of machinery loans, you’re doomed for failure.

In the current world of interdependence, NRIs [Non-Resident Indians] have boundless options. To invest their money both in their home country and abroad which leads to improved financial security. The NRI loan happens to be the one of the most important tools that help NRIs to move towards achieving that. NRI loans can be of great assistance in financial planning and investments of NRIs. To the extent they are well versed with the intricacies and benefits associated with such loans.

The last couple of years have been a very interesting period for everybody involved in the gathering and issuing of digital assets. Experiencing a major evolution with the emergence of Non-Fungible Tokens (NFT). The outcome of this digital money has been a deep-rooted change in the thinking of whether digital art, collectibles, and even real estate are easily tradable. The conversation about NFTs as a game-changing technology won't end any time soon.

The business loans, especially those explicitly designed to promote the lending to the small and medium size enterprises. These can play the major role in the process that provides the money to increase capacity, buy the new technology, hire the skilled workers, and fight the crisis when it is needed. Through this post we will determine five manners by which business loans can skyrocket your entrepreneurial venture in India.

Today, people encountering some financial issues often turn to gold-secured loans. The loans that offer quick and easy access to the money. If you find some expansion you haven’t planned for, or if you want to test your business out of its comfort zone, displaying assets based on gold may be a good idea. In this blog, gold loan procedure in India will be discussed. This will enable readers to have the ability to become knowledgeable to make better choices while getting maximum benefits.

Newsletter

Subscribe to our newsletter for the latest loan market updates, offers and exclusive content. Stay informed and make informed decisions about your finances. Sign up now.

B

Balance Transfer

Balance transfer or refinance allows the borrower to transfer the remaining balance of the loan to a different lender or bank with lower interest rates and better deals at any given point of time during the continual loan period after a year of repayment history.

Binder Agreement

It is a temporary legal document provided by the insurer or an agent for the insurance provided as an agreement between both parties until a policy can be issued.

Bridge Loan

It is a short-term loan to access urgent cash requirements taken out for a period lasting from 2 weeks to 3 years.

Buy Down

A financing technique where the buyer, borrower, or the third party attempts to lower the interest rates for the first few years of the loan period by paying discount points(one-time fee) at closing.

Balloon Payment

A balloon payment is a lower monthly payment followed by a larger-than-usual final payment at maturity.

Bankruptcy

Bankruptcy as we know is zero balance in your credit when you have an outstanding balance amount that you cannot repay.

Bankruptcy Filing

Filing bankruptcy means discharge of debts encountered with serious legal proceedings and long-term impact on credit.

Base Value

The base price or value is the price of the vehicle without add-ons, taxes, and extra charges.

Borrower

The person, organization, or country borrowing the loan.

Buyout

Lease buyouts are when dealers allow buying your vehicle before the lease contract ends.

Buyout Amount

The buyout or payoff amount is the residual value of the vehicle stated in the agreement, total remaining payments, fees, and taxes added.

C

Collateral

Collateral is an asset or property owned by someone pledged as security to the lender to borrow a loan. When pledged, the lender becomes the owner of the property until the loan amount is retrieved in full.

Credit Score

A credit score or Cibil score is a three-digit number that determines the creditworthiness of a person or the ability to repay debt. The score is calculated based on the personal financial data of the cardholder.

Cash Reserve

A cash reserve is a short-term money preserved in hand by an individual or an organization to meet the unplanned costs or expenses of the business.

Condominium

A condominium or condo is defined as a building structure with several apartments or individual units, each owned separately.

Covenant

Covenant also known as a binding agreement is a mutual contract between two parties signing a lease, deed, or another legal contract.

Contingency Clause

A contingency clause or agreement is a legally binding document that when certain conditions or actions are met become valid. The clauses allow a way out for both parties to resign from the contract if one or more conditions are not met.

Curtailment

It is an act of reducing or limiting something. In terms of the loan, curtailment is reducing the loan burden by making part payments ahead of schedule.

Comparison Rate

Comparison rates are competitive pricing including interest rates, fees, and charges relating to the loan offered by different banks or lenders.

Credit Agreement

A credit or loan agreement is a contract or formal agreement between the lender and the investor stating the transfer and borrowal of money between both parties concerned.

Creditor

A creditor or lender is a person who issues money to the investor intended to be repaid in full in the future with interest.

Co-borrower

Co-borrower is a co-owner of the loan amount. One or two people who apply for the loan together with a primary borrower become equally responsible to pay the loan amount borrowed in due time.

CUV (Crossover Utility Vehicle)

A crossover utility vehicle or crossover SUV is a vehicle combining the features of a hatchback and an SUV with midsized unibody construction.

Coupe

A coupe is a four-wheeled closed carriage with sloping rear and a luggage compartment.

Cabriolet

Cabriolets are cars with a roof/hood(usually made of leather) that can fold down.

Credit Unions

A credit union is an NPO(nonprofit organization) existing to serve its members at lower interest rates from the funds they have saved within their group.

Co-signer

Co-signer or guarantor is a person (likely a family/friend/well-wisher) who will sign on a loan application jointly with the owner to vouch for their worthiness, hence pledges to repay the loan in case the applicant will fail to take responsibility due time.

Credit Report

Credit reports hold a record or history of your credit statements made by the credit bureaus based on your previous activity and current status. This may include everything from your outstanding debts, bankruptcies, or even any negative track record.

Credit Card

A credit card is a small piece of plastic or metal card issued by the bank on a credit basis to borrow limited funds to purchase goods and repay in the future by the issued due date.

Credit Insurance

It is a type of insurance to pay off one or more debts left unpaid by the financial shock in the events of death, unemployment, disability, or even loss of property.

Creditworthiness

Creditworthiness is how the lender or a financer knows if you are worthy of a loan or new credit. It is based on your credit history, credit score, repayment capabilities, employment stability, and sometimes even your relationship with the lender.

Conversion Fee

Borrowers who have already taken out a loan but wish to sell their property and purchase a new one can opt for a conversion loan by paying a fee to avail of the conversion.

D

Debt

Debt is the money owed by the investor to the lender or any outstanding payments on the borrowed sum from another person or a party.

Debt Consolidation

Debt consolidation is the act of combining multiple credit accounts or loans into a new loan to pay off the debts.

Defaults

Default is a failure to meet the required legal obligations of a loan by the investor or borrower unable to make the payments in due time.

Debt-To-Income Ratio

DTI determines the borrower’s debt capacity for monthly repayments. It is the ratio of the monthly gross income divided by monthly debt payments to determine the money earned per month and the money going into clearing debts.

Delinquency

It is an act or situation in which the amount borrowed as a loan is not returned as agreed.

Deficiency Balance

It is the outstanding amount to be paid to the creditor at the time when the vehicle is repossessed by the lender. The vehicle is thus sold at an auction to recoup the remaining principal balance that the borrower failed to repay.

Depreciation

Depreciation is the decrease in the value of the car from the time it is purchased to the present time. It is calculated over several other factors including age, resale value, mileage, and wear and tear of the car.

Diminishing ROI

In diminishing ROI, the interest rate will be charged on the outstanding amount (initial principal – paid principal amount), not on the initial amount.

Down Payment

It is the initial payment made at the time you purchase something in a percentage smaller than the total amount to be paid. It is also called a partial payment for something bought on credit.

Disposition Fee

A disposition fee or turn-in fee is a fee charged at the end of a lease contract, collected to prepare the vehicle for the next buyer.

E

Equity

Equity is the actual worth of the vehicle or the resale value minus the amount you owe on the auto loan.

Eligibility Criteria

Eligibility criteria are written in a set of conditions in which if the borrower or the investor fails to meet will be rejected of the loan on application.

Entitlement

Entitlement is a legal privilege or right to benefits or assets you own as an individual or a party.

Easement

A binding agreement or contract between both parties involved in granting access to land or property of another for a particular purpose without possessing it.

ECOA (Equal Credit Opportunity Act)

ECOA is civil law protecting discrimination against race, gender, age, wealth, or welfare status of the borrower by the creditor or lender with no regard to the set eligibility criteria by the organization.

EMI (Equated Monthly Installments)

An amount of money paid every month by the borrower to the lender for a predetermined period with interest to repay the loan borrowed.

Extended Warranty

It is a warranty contract extended over the initial manufacturer’s warranty on the vehicle at the time of purchasing a new car. Any repairs, defects, and even replacements are covered within the warranty over the mentioned span.

F

Fund

A fund is the sum of money allocated for a specific purpose.

Fair Market Value

It is the fair rate/price at which the vehicle is traded between two parties sharing common knowledge in the open market without being under pressure.

Finance

Finance is the procedure of managing a large sum of money, such as raising funds for borrowing, lending, or investing to purchase any asset.

Fixed ROI

Fixed Interest rates offer interest that does not change with the market value. Even with variable market conditions, the loan is set to remain the same throughout the loan tenure.

Flat ROI

Flat rate interest is a rate of interest charged on the initial principal amount instead of the outstanding payment.

FOIR (Fixed Obligation to Income Ratio)

FOIR allows you to consider your monthly income, requested loan amount, and current liabilities, to determine your repayment capacity and loan eligibility by financial institutions while lending loans.

Front End Ratio

Also known as mortgage to income ratio is a percentage indicator at which an individual’s income is calculated against the allocated mortgage.

Foreclosure

It is a process in which the lenders can legally recover the remaining borrowed sum from the borrower if he/she fails to repay their debts in due time by forcing the sale of the vehicle(asset) in case of an auto loan.

G

GST (Goods & Service Tax)

A tax stated by the Indian Govt. was imposed on the supply of goods and services.

Gross Income

It is the total amount earned by the individual without tax or other deductions included.

GAP Insurance (Guaranteed Automobile Protection)

It is a type of add-on coverage for automobile insurance to protect the owner from any loss if incurred.

Gift Funds

Free funds are assisted by some organizations or third-party services to assist with down payments.

Gift Letter

For a gift fund received by a family, friend, or a well-wisher the applicant needs to submit a gift letter stating the mutual agreement of both parties involved in an exchange of funds and thus agreeing to not receive any repayment in return for the fund. This will help the creditor to calculate the debt-to-income ratio of the applicant concerning the remaining balance amount.

GEM (Growing Equity Mortgage)

An escalating mortgage is a type of loan where payments increase over time with the extra money applied to the principle of the loan to pay it off faster.

GPM (Graduated Payment Mortgage)

GPM involves an increase in repayments over time with lower payments in the initial stages of the loan.

Grace Period

This is a grace period during which a borrower who has not paid the fee on or before the monthly due date will not be subject to penalties.

H

Hard Credit Check

A hard credit check or inquiry is when a lender or creditor checks your credit score before approving a loan or credit. This can lower your credit score by a few points, so it’s important to be careful when applying for credit.

Hatchback

A hatchback is a type of car with a rear door feature that opens upward where luggage or extra goods can be stored.

Hybrid Mortgage Loan

A hybrid loan is a type of home loan that combines features of both fixed-rate and adjustable-rate mortgages. Hybrid loans typically start with a fixed-rate period of three, five, or seven years, after which the interest rate adjusts annually.

Hypothecation

When a borrower takes out a loan using their vehicle as collateral, this is called a hypothecated loan. The lender becomes a lienholder on the vehicle instead of the borrower, which means they have a legal claim to the vehicle if the borrower fails to repay the loan.

I

Insurance

It is the protection coverage provided by a company to retrieve money in case of any loss on the commodity or asset purchased.

Insurance Premium

While the insurance covers any loss on the vehicle or any other asset obtained, a premium is what you pay monthly or annually to cover these losses in the future.

Indirect Financing

Indirect financing deals with an intermediary who is partnered with the lenders and will take care of your financial needs via a third party.

Invoice

A bill or statement that records the prices of the goods and services provided and the costs incurred for each is called a time-stamped bill.

Interest Rate

The interest rate is the percentage of the loan amount that the lender charges on top of the principal amount borrowed. Interest rates can vary depending on the lender, and are affected by several factors.

Installment

It is a total amount paid on a fixed basis equally distributed through an agreed period.

ITR (Income Tax Returns)

ITR is a form submitted by an individual or an organization to the income department declaring the income and taxes payable during the financial year.

J

Joint Loan

A joint loan or shared loan is taken by two people, a co-borrower and a primary borrower sharing the ownership of the loan and responsibility to repay the sum in due.

L

Liability

It is an obligation or responsibility of an individual over the possession of an article or asset.

Line Of Credit

A line of credit is an individual, public, or private credit facility that helps a customer get funds when they need them.

Late Fee

It is a charge or penalty that must be paid by the borrower or the consumer who fails to make their payment in due time.

Loan Deferment

The deferment period is a time during which a borrower does not have to pay interest or principal on a loan. This period is typically agreed upon when the loan is first taken out, as with a student loan.

Lifetime Cap

There is a limit to the amount of interest that a borrower may have to pay over the life of a loan, known as a lifetime cap or a maximum interest rate.

Lock-In Period

The lock-in period is the time frame during which an investment or the invested amount cannot be sold, redeemed, or withdrawn.

LTV (Loan-To-Value Ratio)

LTV is a creditor’s or lender’s measure to forecast/predict the net profit amount by calculating the loan borrowed by their customer against the actual value of the asset purchased.

Lease

A lease is a contract or agreement signed by two parties. One renting an asset, another lending the asset. It grants the new owner temporary possession over the asset until the loan is repaid in full.

Limited Warranty

Limited warranty restricts or limits the warranty issued to only specific parts under certain conditions.

Lien Holder

A lienholder is a lender, an individual, or a party that claims a hold on your property until the loan is repaid in full.

Loan

It is a sum borrowed by an individual from a person or a party promising to repay in the future with an interest rate.

Loan Contract

It is an agreement document signed by the parties involved in the loan process to fulfill the requirements.

Loan Maturity

It is the loan expiry date or due date at which the borrower is expected to pay the loan in full. Once fulfilled, the borrower is retired from the previous agreement and is known to have closed the loan successfully.

Legal Assessment Fee

The legal assessment fee is a fee charged by credit associations on the total of your monthly sales for each credit card brand owned by an individual to cover the costs or charges associated with processing the credit card transactions.

M

Mortgage

A mortgage is a loan product typically used by homebuyers to finance the purchase of a home, but can also be used to purchase other types of real estate.

Mortgage Margin

The mortgage margin is the percentage of the interest rate that is added to the index value to determine the interest rate for an adjustable-rate mortgage (ARM).

Memorandum

A memorandum is a brief or short written report that is specifically tailored for a person or group of people containing information regarding a specific matter.

Make & Model

Make is the brand of the car, and a model is a serial number or a name added to the series of vehicles. For example, Nissan Micra is a car where Nissan is the make and Micra is the model.

Marketplace

It is an open place where the experts in the industry come together to sell their products or services.

MCLR (Marginal cost of funds)

It is the base or minimum lending rate below which the banks are not permitted to grant loans. For banks in India, MCLR is 7%.

MCLR rate

MCLR rate is subject to change depending on financial market conditions.

Mileage

It is the number of miles or distance traveled.

MSRP (Manufacturer’s Suggested Retail Price)

The MSRP is the base value or retail price of a vehicle without any added charges, taxes, or features.

MUDRA

MUDRA (Micro-Units Development and Refinance Agency) or PMAY is an Indian govt initiated scheme to offer financial help for non-farming or non-corporate micro and small organizations.

MODT (Memorandum For Deposit Of Title Deed)

MODT is a loan agreement in which you pledge your property (title documents) as collateral or security for the loan with free will.

N

Notice Of Default

A notice of default is a formal legal notice filed with the state court that the borrower has failed to make mortgage repayments. This notice is the first step of the foreclosure process.

NBFCs

Non-banking Financial Companies or NBFCs are entities principally engaged in providing financial services without a government-acquired banking license. Aditya Birla, Bajaj Finserv, Mahindra & Mahindra, and Muthoot, are some of the many examples of NBFCs.

NOC Letter

No objection certificate (NOS) is a legal document offered by the bank or the financier upon closing a loan.

Negative Equity

Negative Equity is a drop in the value of the car you own compared with the remaining balance on your loan you still have left to pay to the bank.

Net Worth

The value of what a person or company owns, minus what they owe, is their net worth.

No Credit Check

The policy of no credit checks means that the lender does not take your credit score into account when deciding on your loan. This can be beneficial for those with poor credit scores, as they may still be able to get attractive deals on their loan. Usually, you can use your car as collateral against the loan amount, which can help to get lower interest rates and zero down payments.

O

Owner Financing

Owner financing is a direct transaction between a seller of the property and the individual or entity buying it, in which the purchase is financed either in whole or in part by the seller.

Origination Fee

An origination fee is a charge assessed by a lender for processing a new loan application. This fee compensates the lender for the work involved in evaluating and approving the loan.

OEM(Original Equipment Manufacturer)

OEM is a company or organization that produces goods like parts or components of the vehicle that are marketed by another company in their end product.

P

Penalty

Penalties are fines levied on the vehicle in cases of overspeeding or driving without proper documents needed at the time of the driver being questioned for the vehicle and individual proofs on the car. And the penalty on the loan is applied when the debts are not cleared in due time.

Part-Payment

If you are unable to pay the full amount owed to the lender, you may be able to arrange for a partial payment. Some companies will accept other goods or products instead of the remaining payment. Be sure to check with the lender’s terms and conditions before applying for a loan.

Part-Payment Charges

Varying from bank to bank, some banks may charge 2% of the total amount to be part prepaid and others zero charges.

Pre-Approved Loan

Pre-approved loans are typically pre-qualified loans sanctioned to a borrower even before he/she purchased the car upon the fulfillment of the eligibility criteria of the bank or the individual based on the buyer’s financial stability and credit report.

Principal Amount

The principal amount is the original loan borrowed from the lender without interest rates, taxes, or extra charges.

Private Mortgage Insurance (PMI)

PMI is insurance that a borrower is required to buy as a condition of a conventional mortgage loan.

Prime Loan

Prime refers to a classification of borrowers, rates, or holdings in the lending market regarded to have great quality that any financial institution can have.

Promissory Note

A promissory note is a signed, legal document that obligates the issuer to repay a specified amount of money to a payee at a predetermined date or on demand.

Property Tax

Tax levied on the property owned by an individual or an organization by the government.

Purchase & Sale Deed

It is a legal contract or document proof obtained when you buy or sell a property showing the transfer of title and ownership of the asset from the seller to the new buyer of the property/asset.

Processing Fee

Payment processing fees are fees charged to merchants by financial institutions for the acceptance of credit cards and electronic payments from customers.

Positive Equity

Positive equity is when the resale value of the vehicle exceeds the principal amount on the loan taken.

Prepayment

Prepayment is when the borrower decides to pay the loan amount before the due date.

Prepayment Charges

A prepayment fee is charged by the lender to the borrower if they pay the loan amount well before the due date since the lender cannot anticipate if the customer has paid or paid off with the variable interest rate that may go up or down at the time of the due date.

Preclosure

It is the repayment of the entire loan amount before the end of the term/tenure by the borrower under mutual terms and conditions agreed by both parties.

Preclosure Charges

Many banks or financiers charge a fee for the preclosure process since paying off the amount before the end of the term may result in repaying less depending on the variable interest rates. The fee could be anywhere above 4% depending on the bank.

Q

Qualifying Ratio

It is a method in which the lenders or creditors calculate whether the consumer or investor can repay his/her loan in due time.

Quote

The vehicle quote has the details on the vehicle including make, model, sticker price, offers, charges, add-ons, and the estimated total amount for what the owner is paying and where the money is going.

R

Rebate

Rebates or incentives are discounts made on the vehicle by the manufacturer to boost sales.

Refinance

Refinancing allows you to transfer the balance of the current loan to another lender or modify and replace the terms of the current agreement under better conditions.

RC Book

Registration Certificate/Card or RC book is a legal proof document issued by the Indian govt. to certify the registration of the vehicle with the RTO(Regional Transport Office)

Recourse Loan

A recourse loan gives special power to the creditor or lender if in case the borrower may fail to repay the loan. The special power exercises the ability to recoup the balance by seizing the buyer’s possessions or income.

Residual Value

It is the estimated value of the vehicle at the end of the lease

Retailer

Automobile retailers sell car parts or components to all parties alike. Consumers and private party repair owners can buy these accessories at the store or online.

Retail Price

The retail price or MSRP is the same. It is the sticker price on the vehicle recommended for selling the vehicle.

RTA Agent

Registrar and transfer agents are mediators between investors and financiers who help both parties to manage, maintain and transfer documents safely.

RTO

RTO or regional transport office is a government organization managing all transport-related activity in India. The RTO registration is however taken care of by the dealer or a third-party marketplace when you buy a car.

Rescission Agreement

It is an act of canceling the contract between two parties when performing a material breach to dissolve legal ties.

Residual Income

The leftover cash or income after all the debts have been paid or cleared by an individual or a company.

ROI (Rate Of Interest)

The interest rate or ROI is the percentage of the loan amount that the lender charges on top of the principal amount borrowed. Interest rates can vary depending on the lender, and are affected by several factors.

Repayment History

Repayment history or credit history is the history of recorded payments during the span of a specific period within which the borrower has successfully or unsuccessfully paid his debts.

S

Subprime Loan

Subprime auto loans are offered by lenders to investors with low credit scores and rough credit history; with interest rates higher than prime rates, depending on the agreement and relationship with the lender.

Stamp Duty

It is the tax levied by the government in the course of action when transferring assets or property to a new owner.

Secure Loan

A secure loan is a type of loan where the investor pledges the vehicle as collateral or security to the lender in return for the loan amount until paid in full.

Security Deposit

If a car is rented, the security deposit is the amount paid by the customer as a deposit to the rental company. To cover any liability, unexpected charges, or damage caused by the render during the possession, the lender may use this sum.

Sedan

Sedans or saloons are traditional car models and 4-door passenger vehicles with a roof extending down the trunk of the car.

Settlement Figure

The total amount of money to be repaid to clear the full loan borrowed with interest.

Simple Interest

A simple interest loan is only based on the principal amount, unlike compound interest where interest on the principal is added to any other interest that has been aggregated over time.

Sticker Price

Sticker price/MSRP/Retail price is the manufacturer’s recommended price on the vehicle.

SUV(Sport Utility Vehicle)

Sport utility vehicles or SUVs are less heavier and much more refined than trucks, designed to look like station wagons. They are highly capable of long journeys and more able in managing higher payloads on the vehicle.

Soft Credit Check

Soft pull or soft credit checks are inquiries made to review credit reports without hurting your credit score.

T

Truck

A truck is a type of vehicle used for the transportation of goods in large amounts.

Tenure

Tenure or term is the period in which the repayment of your loan should be cleared. It is usually 1 – 7 years on a new car and 1 – 5 for a pre-owned car.

Third-Party Marketplace

Third-party marketplaces are mediators or intermediaries bringing together the vendors and service providers from a particular industry onto a single platform.

Top-Up Loan

It is an extra loan option on your existing loan, whether home, auto, or personal.

Trade-In

Trade-in vehicles are the exchange vehicles that you bring to a dealer or an individual when purchasing a new car. You can get the new car at a reduced price in exchange for the old one. This you can use to either fill down payments or reduce the total price of the vehicle.

Trade-In Allowance

It is the amount reduced in the trade value of the new car in exchange for the old one.

Transfer Tax

Transfer tax is levied by the government upon the transfer of the title and the ownership of an asset or property to the new owner.

Title Deed

A legal deed or proof document showing the successful ownership of the property.

U

Unsecured Loan

An unsecured loan needs no security asset in return for the loan amount. As a result, the lender may increase interest rates and steer his requirements depending on the mutual relationship of both parties concerned.

Underwriting Fee

Underwriting fee, also known as commission, discounts, etc is a fee charged by the underwriters to determine the risk or price of a particular security in the market.

V

Variable Interest Loan

Variable loans or interest rates are the interest rates that are subject to change at any given time under market conditions.

Vehicle Identification Number (VIN)

VIN is a unique code or number assigned to your vehicle to make its identification faster and easier.

Vehicle Registration

This is the ownership of the car registered in the presence of a government official. When the vehicle is purchased, the owner should change the title of the car to his/her name and include the financier if required to show proof of possession.

VSI Insurance

The vendor’s single interest or VSI insurance is a lender’s protection against the lender if it may be damaged or destroyed under any given circumstances before the loan is cleared.

W

Warranty

A warranty on a car will ensure that the company or dealers may service, repair, or replace without any added charges to the vehicle owner if the vehicle fails prematurely before the end of this warranty period. You can also extend your warranty period at the time of purchase

Wholesale Value

It is the price at which manufacturers sell their vehicles to dealers. This price will go up when the dealer sells the vehicle again to the customer to bank the profits.

Working Capital

Net working capital or capital is the financial metric that measures the overall efficiency of the organization against its financial conditions and liquidity levels in terms of cash, inventory, etc. Simply put, it is an organization’s current liquidity/assets against the existing liabilities.

Y

YSP (Yield Spread Premium)

The yield spread premium (YSP) is a type of commission that a mortgage broker or a dealer receives from a lender for selling a loan to a borrower with an interest rate that is higher than the creditor’s par rate.

Z

Zero Balance Savings Account

A zero-balance account is a type of savings account where the account holder is not required to maintain a minimum balance. This type of account can be useful for individuals who want the flexibility to choose how much they save.

Zero Emission Vehicle

ZEVs are environment-friendly and do not release any pollutants into the air.